Introduction:

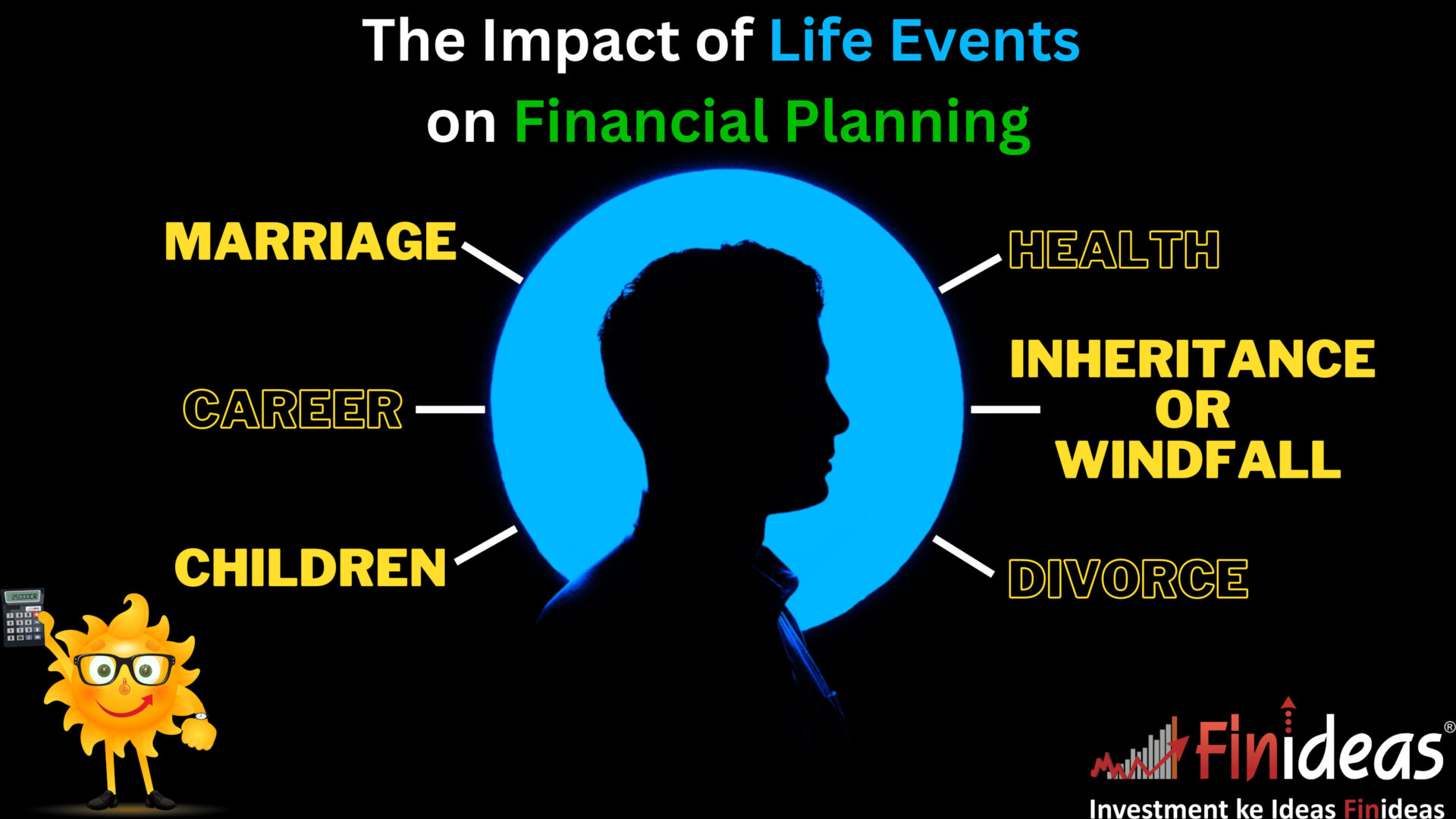

Life events such as marriage, divorce, or the birth of a child can have a profound impact on our lives. These events bring joy, change, and new responsibilities. However, they also significantly impact our financial landscape, requiring us to adapt our financial plans accordingly. In this blog post, we will explore the effects of significant life events on financial planning in the Indian context, offering valuable insights and real-life examples to help individuals navigate these transitions effectively.

-

- Marriage: Combining Finances and Shared Goals Marriage marks the union of two individuals and their finances. It necessitates careful financial planning to ensure a smooth transition and the achievement of shared goals. Key considerations include merging bank accounts, creating a joint budget, reviewing insurance coverage, and discussing long-term financial objectives.

Example: After getting married, Priya and Ravi sit down to discuss their financial goals. They consolidate their bank accounts, allocate funds for household expenses, and decide to start a joint investment portfolio for their future goals, such as buying a house and planning for retirement. - Divorce: Financial Independence and Restructuring Divorce is a challenging life event that often requires significant adjustments in financial planning. Individuals need to reassess their income, expenses, and assets, and create a new financial strategy that supports their independent lives. This involves addressing property division, revising insurance policies, updating beneficiary designations, and reevaluating retirement plans.

Example: After a divorce, Neha consults a financial advisor to help her create a revised financial plan. She updates her insurance policies, transfers ownership of shared assets, and adjusts her retirement savings to align with her new circumstances and long-term goals. - Birth of a Child: Expanding Financial Responsibilities The arrival of a child brings immense joy and newfound financial responsibilities. Parents must plan for medical expenses, education costs, and long-term financial security. This includes investing in child-specific financial instruments, such as education funds and insurance policies, while ensuring the family budget accommodates the additional expenses.

Example: Upon the birth of their child, Ankit and Meera start a systematic investment plan (SIP) in a mutual fund specifically designed for children’s education. They also purchase a child insurance policy that provides both financial protection and a savings component for their child’s future. - Career Transitions: Managing Income Variability Career transitions, such as job changes, starting a business, or taking a sabbatical, can significantly impact financial planning. These events often involve income variability, and individuals need to prepare for potential fluctuations in cash flow. It is essential to create an emergency fund, reassess budgeting, and explore income diversification options.

Example: When Rajiv decides to start his own business, he builds an emergency fund that covers at least six months of living expenses. He also revises his budget, reduces discretionary spending, and explores alternative income streams to ensure financial stability during the initial stages of entrepreneurship. - Inheritance or Windfall: Strategic Wealth Management Receiving an inheritance or a significant windfall requires careful financial management. Individuals should consider tax implications, pay off high-interest debt, diversify investments, and consult with professionals to create a comprehensive wealth management plan that aligns with their goals and risk tolerance.

Example: After inheriting a substantial amount of money, Deepika seeks advice from a financial planner to guide her through the process. They work together to create a customized investment portfolio, prioritize debt repayment, and establish a structured plan for long-term wealth preservation. - Health-related Events: Ensuring Adequate Coverage Health-related events, such as medical emergencies or chronic illnesses, can have a significant impact on financial planning. It is crucial to have adequate health insurance coverage, an emergency fund, and critical illness policies to protect against unexpected medical expenses.

Example: When Arjun’s father is diagnosed with a critical illness, Arjun realizes the importance of having comprehensive health insurance coverage. He researches and selects a family health insurance policy that provides extensive coverage and includes critical illness benefits.

- Marriage: Combining Finances and Shared Goals Marriage marks the union of two individuals and their finances. It necessitates careful financial planning to ensure a smooth transition and the achievement of shared goals. Key considerations include merging bank accounts, creating a joint budget, reviewing insurance coverage, and discussing long-term financial objectives.

Conclusion:

Life events have a profound impact on our financial planning, and it is essential to anticipate and adapt to these changes proactively. Whether it’s marriage, divorce, the birth of a child, career transitions, inheritances, or health-related events, understanding the financial implications and taking appropriate measures can help individuals navigate these transitions effectively. By revisiting and adjusting our financial plans, we can ensure financial stability, protect our loved ones, and work towards achieving our long-term goals in the Indian context.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.

Great Post. Thanks For Sharing.