The absence of Nifty December 18500 Puts, 19500 Calls, and 19500 Puts for trading can be attributed to circular number 44683, which was issued by the Exchange on June 17, 2020. This circular provides the explanation for their unavailability.

Nifty Options contracts have a maturity period of 5 years and are referred to as Long Term Options. Over the past decade, there has been a notable increase in participation in long-term options trading.

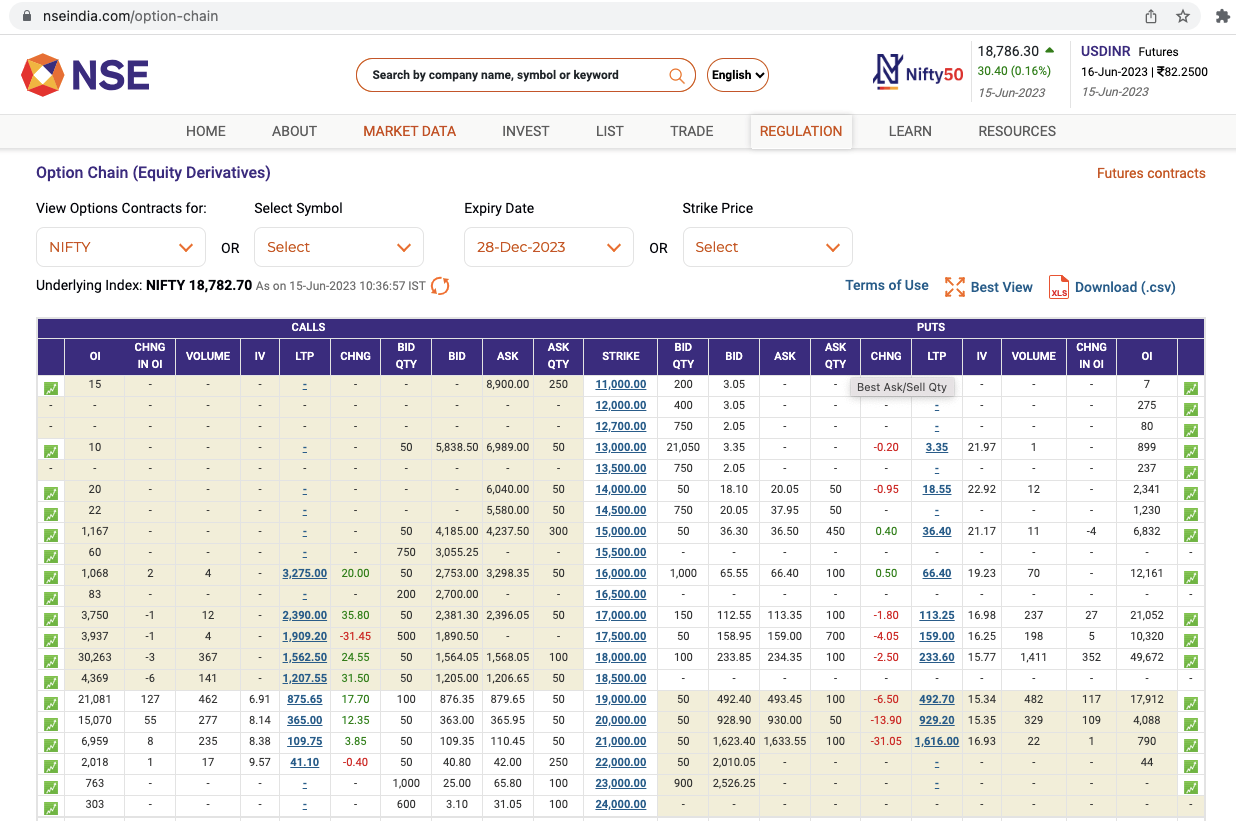

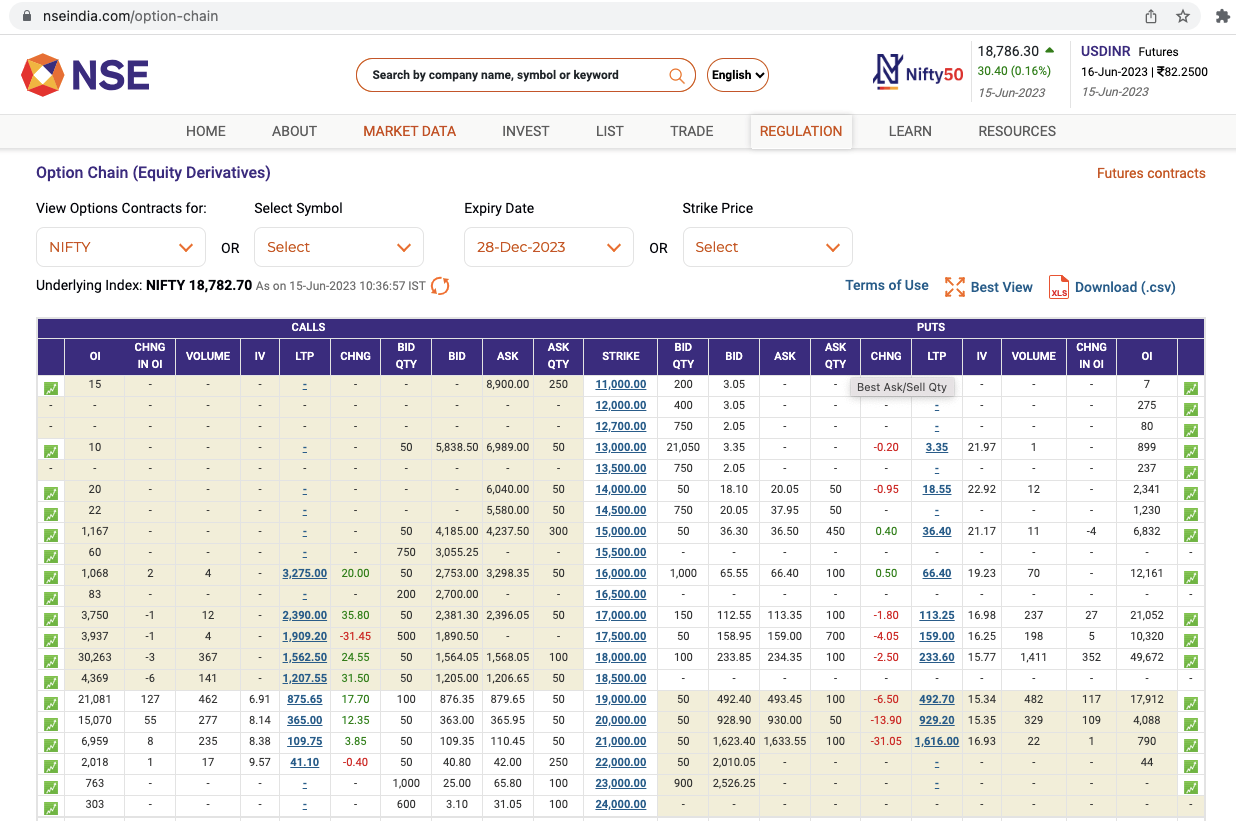

However, during the current observation of the Options Chain, a unique pattern emerged. It was discovered that while 18500 Calls were available for trading in December 2023 maturity, the corresponding 18500 Puts were not accessible. Similarly, strikes such as 19500, 20500, and 21500 were also absent from the trading options.

The reason for these options’ unavailability can be traced back to circular number 44683 issued by the Exchange on June 17, 2020. This circular provides further details and clarification on the specific factors influencing their discontinuation or exclusion from trading.

Source: https://www.nseindia.com/option-chain

It has been stated that when the Index is above 15000, the strike interval will be Rs. 1000.

In addition, the Exchanges, in consultation with SEBI, have decided to implement a semi-annual review to discontinue NIFTY 50 Long Term Index Option contracts with zero open interest that are not part of the revised strike scheme. The criteria for the revised strike scheme are as follows:

-

- 1. All long-term index option contracts eligible under the revised strike scheme will remain available, regardless of open interest.

- 2. All long-term index option contracts not eligible under the revised strike scheme but with open interest will continue to be available.

- 3. All long-term index option contracts not eligible under the revised strike scheme and with zero open interest will be discontinued.

We can have less transaction cost on Long Term Options