Lessons from Rakesh Jhunjhunwala for Retail Investors

Introduction

Rakesh Jhunjhunwala, often referred to as the “Big Bull” of Indian stock markets, is one of the most renowned and successful stock market investors in India. His journey from humble beginnings to becoming a billionaire through stock market investments is nothing short of inspiring. Retail investors, looking to navigate the complex world of stock markets, can learn valuable lessons from his experiences and investment strategies. In this article, we will explore ten key lessons from Rakesh Jhunjhunwala that can help retail investors make informed and profitable investment decisions.

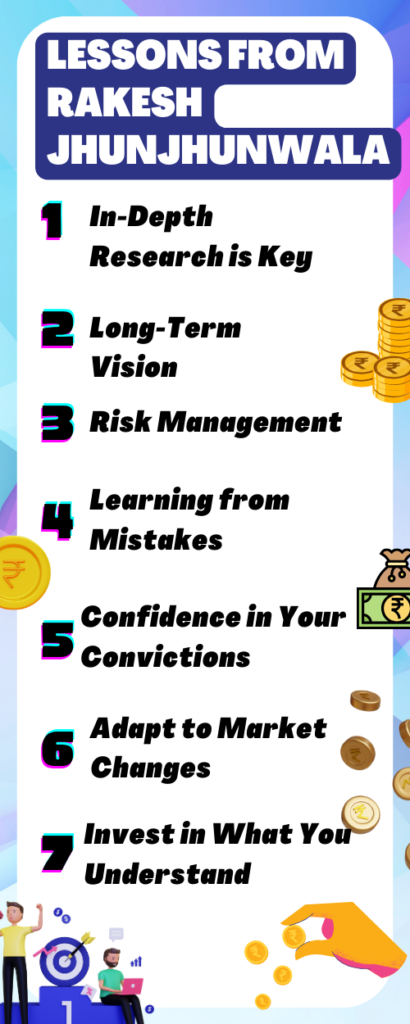

In-Depth Research is Key

Rakesh Jhunjhunwala’s success can be attributed to his unwavering commitment to research. He emphasizes the importance of thoroughly understanding the companies you invest in. Retail investors should follow suit by conducting comprehensive research, analyzing financial statements, and staying updated on industry trends before making investment decisions.

Long-Term Vision

Similar to Warren Buffett, Jhunjhunwala is a proponent of long-term investing. He has consistently held investments for years, allowing them to compound over time. Retail investors should adopt a patient and long-term vision, avoiding the temptation to constantly trade and churn their portfolios.

Risk Management

Jhunjhunwala acknowledges that risk is an inherent part of investing. He advises retail investors to manage their risk by diversifying their portfolios across various sectors and asset classes. Diversification can help mitigate losses during market downturns.

Learning from Mistakes

Even successful investors like Jhunjhunwala have made mistakes. He believes that learning from one’s mistakes is crucial for growth. Retail investors should not be discouraged by losses but should instead view them as valuable learning experiences.

Confidence in Your Convictions

Jhunjhunwala is known for his conviction in his investment choices. Once he believes in a stock, he holds onto it through market ups and downs. Retail investors can learn to have confidence in their own research and investment decisions, rather than being swayed by market sentiment.

Adapt to Market Changes

The stock market is dynamic, and Jhunjhunwala understands the importance of adapting to changing market conditions. Retail investors should remain flexible and open to adjusting their investment strategies as the market evolves.

Invest in What You Understand

Jhunjhunwala is a firm believer in investing in businesses and industries that one understands. Retail investors should stick to their circle of competence and avoid investments in sectors they have little knowledge of. Index Long Term Strategy is a investment which has a long term value also has compounding effect if you want to know about how the compounding effect works on your investment then you must know about Index Long Term Strategy.

Avoid Overtrading

Overtrading can erode profits due to high transaction costs and taxes. Jhunjhunwala advises against excessive trading and instead recommends patience in waiting for the right opportunities.

Stay Informed

Jhunjhunwala is known for staying well-informed about the macroeconomic factors that can impact the stock market. Retail investors should keep themselves updated on economic news and global events that can influence their investments.

Continuous Learning

Lastly, Jhunjhunwala emphasizes the importance of continuous learning. He believes that the stock market is a great teacher, and retail investors should be open to learning from their experiences and the experiences of others.

Conclusion

Rakesh Jhunjhunwala’s journey from a small-town trader to a billionaire investor is a testament to his commitment, knowledge, and discipline in the world of stock markets. While not every retail investor can replicate his success, there are invaluable lessons to be learned from his investment philosophy. In-depth research, a long-term vision, risk management, and confidence in one’s convictions are some of the key takeaways.

By embracing these principles and learning from Jhunjhunwala’s experiences, retail investors can navigate the complex world of investing with more confidence and poise. Whether you are a novice or experienced investor, there is always room for improvement, and Jhunjhunwala’s lessons can serve as a guiding light on your investment journey.

What is one important lesson from Rakesh Jhunjhunwala’s investment journey that retail investors can apply to their own portfolios? Comment Down Below

In conclusion, as you embark on your investment journey, remember the wisdom of Rakesh Jhunjhunwala and strive to apply these lessons in your own portfolio.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.

Nice advice.

Rakesh Sir’s success has been simply put in few points