The Future of Investment Advisors & Their Potential Growth in the Investment Industry

Introduction

In the dynamic landscape of the Indian investment industry, the role of investment advisors is evolving rapidly. As technology continues to reshape the financial world, investment advisors find themselves at the forefront of change. In this blog post, we will explore the future of investment advisors in India, their potential for growth, and the key factors driving their evolution.

The Current State of Investment Advisory in India

Before we delve into the future, let’s take a moment to understand the current state of investment advisory in India. As of now, the industry is marked by a combination of traditional practices and digital innovations. Many investors still rely on human advisors for financial guidance, while others are increasingly turning to robo-advisors and online platforms.

- Traditional vs. Digital: While traditional investment advisory continues to be prevalent, the digital revolution has introduced new, tech-driven players into the market. The coexistence of these two approaches opens up diverse opportunities for growth.

- Regulatory Changes: The Securities and Exchange Board of India (SEBI) has introduced regulatory changes to enhance transparency and investor protection in the advisory space. These regulations have set the stage for a more professionalized and accountable advisory industry.

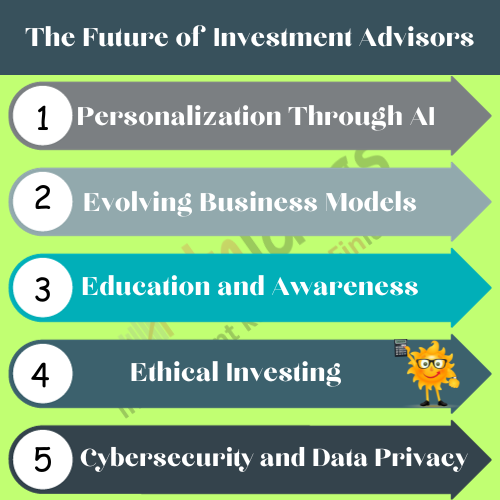

The Future of Investment Advisors

Now, let’s explore the exciting possibilities that lie ahead for investment advisors in India.

- Personalization Through AI: As artificial intelligence (AI) and machine learning algorithms continue to advance; investment advisors can leverage these technologies to provide highly personalized recommendations. Investors can expect tailored investment strategies that align perfectly with their financial goals and risk tolerance.

- Evolving Business Models: Investment advisors are diversifying their business models beyond traditional fee structures. This includes performance-based fees, subscription-based models, and hybrid approaches that combine human expertise with automated tools.

- Education and Awareness: The future of investment advisory will see a greater emphasis on investor education and financial literacy. Advisors will play a pivotal role in empowering investors with knowledge to make informed decisions.

- Ethical Investing: ESG (Environmental, Social, and Governance) investing is on the rise globally, and Indian investors are increasingly conscious of the ethical implications of their investments. Investment advisors who specialize in ethical investing can tap into this growing market.

How important is ethical investing to you, and what factors would influence your decision to choose an advisor who specializes in this area? Comment Down Below

- Cybersecurity and Data Privacy: With the increased use of digital platforms, safeguarding client data and ensuring cybersecurity will be a top priority for investment advisors.

Conclusion

The future of investment advisors in India is filled with promise. With the right blend of technology, regulatory support, and a commitment to client interests, investment advisors are well-positioned to unlock significant growth potential. As investors, it’s essential to stay informed about these developments and actively participate in shaping the future of investment advisory in India.

Also you must Know About Index Long Term Strategy if you are planning for long term investing.

Investment advisory in India is not just about numbers and financial markets; it’s about empowering individuals to achieve their financial aspirations. As the industry evolves, your input and engagement will be pivotal in ensuring that investment advisors continue to meet your needs and expectations effectively.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.