Instruments in Index Long Term Strategy

What Is an Index Long Term Strategy?

In finance, an index is a statistical measure that tracks the changes in a portfolio of stocks representing a portion of the overall market. For instance, the Nifty 50 Index tracks the performance of 50 large companies listed on the National Stock Exchange (NSE) in India.

What are the Key points about the Nifty 50 Index?

Composition:

The Nifty 50 includes companies from various sectors like banking, IT, pharmaceuticals, and energy.

Market Capitalization Weighted:

Companies with higher market capitalizations have a greater impact on the index’s value.

Benchmark:

The Nifty 50 is used as a benchmark for investors to evaluate the performance of their portfolios.

Nifty 50 Companies:

The list of companies can change over time based on factors like market capitalization and liquidity.

Investment Products:

Investors can use index funds and ETFs to invest in the Nifty 50.

Example: If the Nifty 50 index increases by 10% in a year, a portfolio that mirrors this index would also increase by approximately 10%, minus any fees or tracking errors.

How Do Index ETFs Work in Index Long Term Strategy?

Index ETFs, or exchange-traded funds, aim to replicate the performance of a specific market index. They offer broad market exposure and are a popular choice for diversified, low-cost investments.

If you want to choose Index funds then you must know about Index Long Term Strategy.

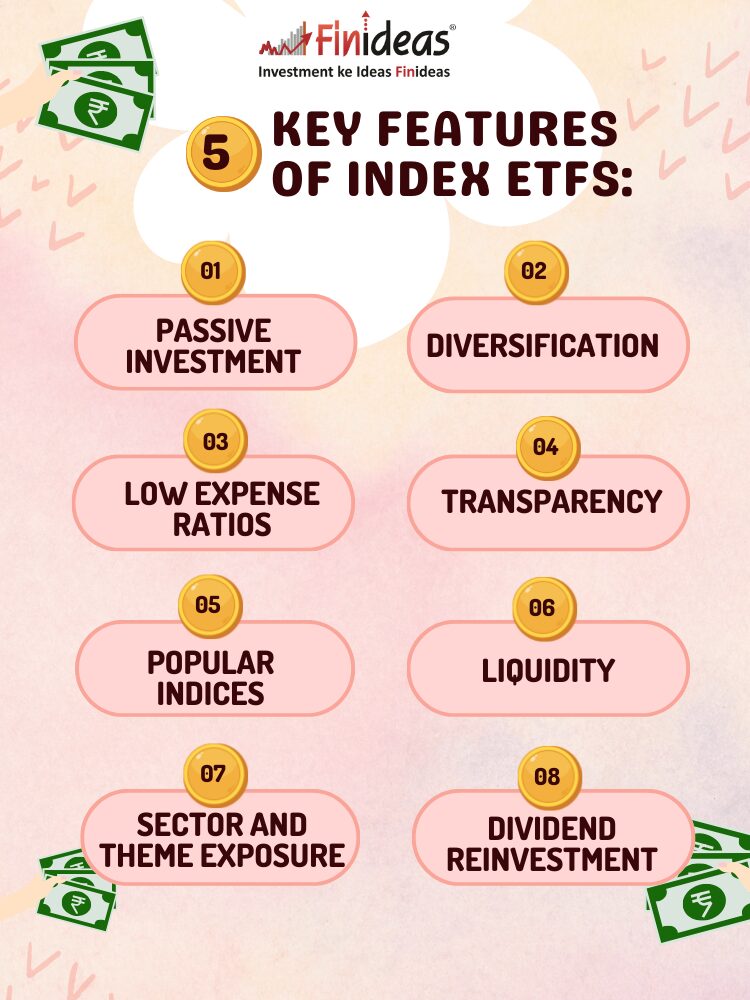

What are the Key features of Index ETFs?

Passive Investment:

Index ETFs aim to match the returns of a chosen index, not actively select individual securities.

Diversification:

These ETFs provide exposure to a diversified portfolio within a specific market segment.

Low Expense Ratios:

Passive investment strategies lead to lower associated costs.

Transparency:

Regular disclosure of holdings allows investors to see the components of the fund.

Popular Indices:

Examples include the Nifty , Sensex S&P 500, Dow Jones Industrial Average, and NASDAQ Composite.

Liquidity:

Index ETFs are traded on stock exchanges, providing flexibility for buying or selling shares.

Sector and Theme Exposure:

There are index ETFs focusing on specific sectors or themes, such as technology or healthcare.

Dividend Reinvestment:

Some index ETFs offer automatic reinvestment of dividends.

Why Choose Index Funds for Long Term Strategy?

Index funds are mutual funds that track a specific index. They are favored for long-term investment strategies due to their simplicity, diversification, and cost-effectiveness.

What are the Benefits of Index Funds?

Consistency:

Index funds aim to replicate the performance of their respective indices consistently.

Lower Costs:

The passive management of index funds generally leads to lower fees compared to actively managed funds.

Diversification:

By investing in an index fund, investors gain exposure to all the securities in the index, spreading risk.

Ease of Investment:

Index funds are simple to understand and manage, making them suitable for new investors.

Historical Performance:

Over the long term, index funds often perform well, mirroring the growth of the overall market.

What Are the Risks of Using Index Instruments in Long Term Strategy?

While index instruments are generally considered lower risk compared to individual stocks, they still carry certain risks:

Market Risk:

The value of index funds and ETFs can decline due to market downturns.

Tracking Error:

There may be slight deviations between the index’s performance and the fund’s returns.

Lack of Flexibility:

Index funds and ETFs strictly follow their indices, missing out on potentially high-performing individual stocks.

Sector Risk:

Index funds tied to specific sectors may be more volatile if that sector experiences downturns.

What index instruments have you found most effective in your long-term investment strategy? Share your thoughts and experiences in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..