How to Start Investing in Index Funds

Are you wondering “How to Start Investing in Index Funds?” If you’re new to the world of investing, index funds can be a great way to build wealth with minimal hassle. Let’s break down the process with easy steps and some numerical examples to guide you along the way.

What Are Index Funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific index, such as the NIFTY 50 or the Sensex. They are passively managed, which means they aim to match the index’s returns rather than beating them.

Why Invest in Index Funds?

- Diversification: By investing in an index fund, you gain exposure to a broad range of stocks, reducing risk.

- Lower Costs: Index funds typically have lower management fees compared to actively managed funds.

- Ease of Investment: They are straightforward to invest in, making them ideal for beginners.

How Do I Start Investing in Index Funds?

Starting is simpler than you might think. Here’s a step-by-step guide:

Step 1: Understand Your Financial Goals

How Do I Define My Financial Goals?

Think about what you want to achieve with your investments. Are you saving for retirement, a house, or just building wealth? Your goals will determine your investment strategy.

Step 2: Choose the Right Index Fund

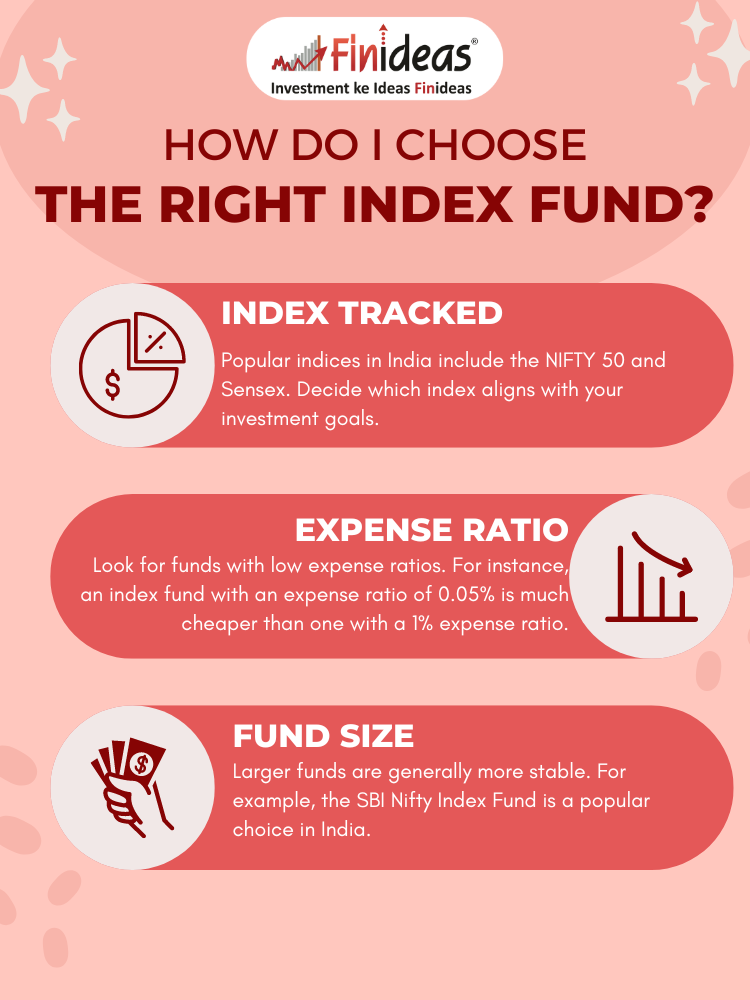

How Do I Choose the Right Index Fund?

Consider these factors:

- Index Tracked: Popular indices in India include the NIFTY 50 and Sensex. Decide which index aligns with your investment goals.

- Expense Ratio: Look for funds with low expense ratios. For instance, an index fund with an expense ratio of 0.05% is much cheaper than one with a 1% expense ratio.

- Fund Size: Larger funds are generally more stable. For example, the SBI Nifty Index Fund is a popular choice in India.

Step 3: Open a Brokerage Account

How Do I Open a Brokerage Account for Index Funds?

Choose a reputable brokerage. Here’s how:

- Research Brokerages: Research brokerages that offer low fees and excellent customer service. Consider factors such as transaction costs, account maintenance fees, and the quality of customer support to ensure a positive experience. Look for platforms with user-friendly interfaces, educational resources, and strong reputations in the financial community.

- Complete the Application: This usually involves providing some personal information and funding your account.

Step 4: Make Your First Investment

How Do I Buy Index Funds?

- Decide the Amount: Start with an amount you are comfortable with. For example, you might start with ₹5,000.

- Place Your Order: Go to your brokerage’s platform, search for the index fund you chose, and place an order to buy shares.

How Much Should I Invest in Index Funds?

A common rule is to invest at least 10-15% of your income into investment accounts. For example, if you earn ₹5,00,000 annually, you could aim to invest ₹50,000 to ₹75,000 per year.

What Are the Benefits of Investing in Index Funds?

Investing in index funds offers several advantages. Historically, they have provided average annual returns of around 7-10% over the long term, making them a solid choice for long-term growth. Additionally, index funds are known for their simplicity and low costs, requiring less effort and expense compared to actively managed funds.

What Are the Risks of Investing in Index Funds?

Investing in index funds does come with risks. One significant risk is market risk, as index funds are subject to market fluctuations. For instance, during the 2008 financial crisis, the S&P 500 dropped by nearly 57%. Another risk is the lack of flexibility; since index funds are passively managed, they do not offer the same flexibility that active management might provide.

How Should I Monitor My Index Fund Investments?

To effectively monitor your index fund investments, it’s important to conduct regular reviews, checking your investment performance annually. Utilize the tools provided by your brokerage to track returns and fees. Additionally, staying informed about market trends and news is crucial, as it helps you make well-informed decisions about your investments.

Conclusion: Ready to Start Your Journey?

Investing in index funds is a straightforward way to build wealth over time. Remember to start with clear goals, choose the right fund, and invest consistently. Have you considered starting your index fund investment journey? If yes, then you must visit and read about Index Long Term Strategy.

What’s the biggest challenge you face when thinking about investing in index funds?

Feel free to share your thoughts or ask any questions you have!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..