Top 3 Mistakes Investors Make When Investing in Index Funds

Index funds are one of the simplest and most effective ways to invest in the stock market. They offer diversification, lower costs, and a hassle-free investing experience. However, many investors, especially beginners, make common mistakes that can hurt their long-term returns.

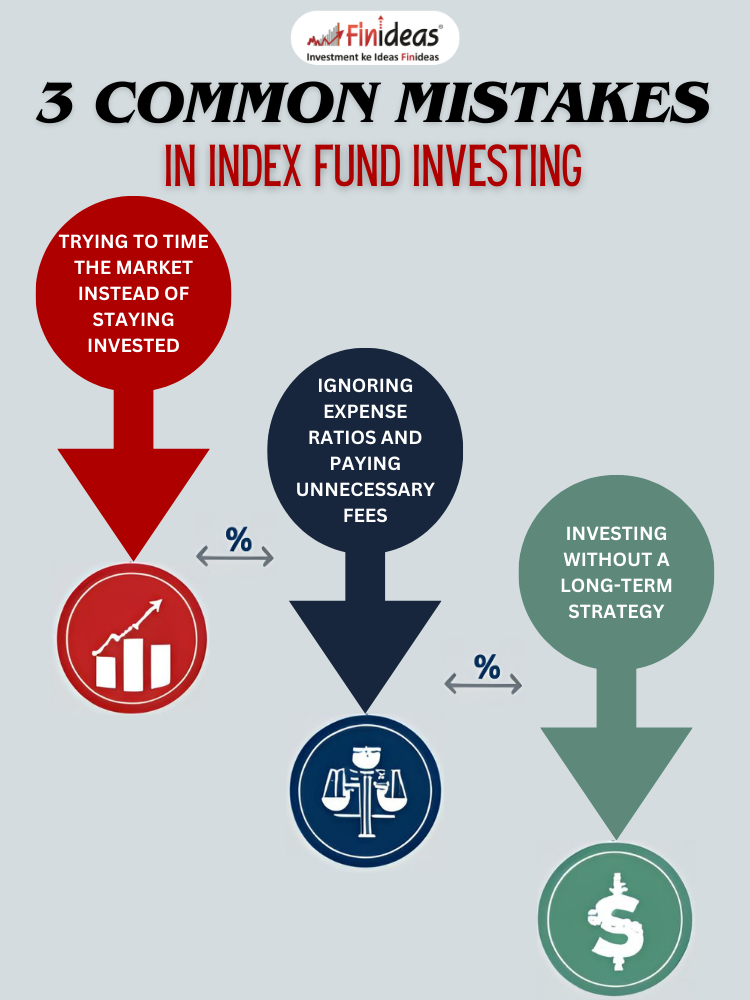

In this blog, we will discuss the top 3 mistakes investors make when investing in index funds and how to avoid them.

Are You Timing the Market Instead of Staying Invested?

One of the biggest mistakes investors make is trying to time the market. Many people wait for a “perfect” time to invest, hoping to buy at the lowest point and sell at the highest. However, the market is unpredictable, and timing it perfectly is nearly impossible.

🔹 Example: Suppose you waited to invest in the NIFTY 50 index in March 2020, hoping for a further drop. The index was around 7,500 then, but it quickly recovered, reaching 18,000+ by the end of 2021. Those who stayed invested saw their wealth grow, while market timers often missed the rally.

📌 What Should You Do?

Instead of timing the market, adopt a Systematic Investment Plan (SIP). By investing a fixed amount regularly, you benefit from rupee-cost averaging and avoid emotional investing mistakes.

Are You Ignoring Expense Ratios and Hidden Costs?

Index funds are known for their low costs, but that doesn’t mean all funds are the same. Some investors choose a fund without checking the expense ratio—the fee charged for managing the fund. A higher expense ratio can reduce your returns over time.

🔹 Example:

A fund with an expense ratio of 1% will cost ₹10,000 per year on a ₹10 lakh investment.

A fund with an expense ratio of 0.2% will only cost ₹2,000 per year.

Over 20 years, this small difference can cost you lakhs of rupees!

📌 What Should You Do?

Always compare expense ratios before investing. Lower expense ratios mean more of your money stays invested, helping you maximize long-term growth.

Are You Investing Without a Long-Term Strategy?

Many investors enter index funds without a clear strategy. They invest for a short-term gain and exit during market volatility. However, index funds work best over the long term.

🔹 Example: The NIFTY 50 index has grown from 1,000 in 1995 to over 22,000 in 2024. This means ₹1 lakh invested in 1995 would be worth more than ₹22 lakh today!

📌 What Should You Do?

One of the best long-term strategies is Index Long Term Strategy (ILTS) by Finideas. This strategy focuses on:

✔️ Consistent wealth creation

✔️ Managing risks effectively

✔️ Beating inflation with stable returns

By following a long-term disciplined approach, you can grow your wealth steadily and avoid panic-driven decisions.

The 3 Common Mistakes in Index Fund Investing

Index funds are a powerful tool for wealth creation, but avoiding common mistakes is crucial. Stick to long-term investing, low-cost funds, and a disciplined strategy like ILTS to maximize your returns.

💡 What’s your biggest challenge when investing in index funds? Comment below and let’s discuss!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.