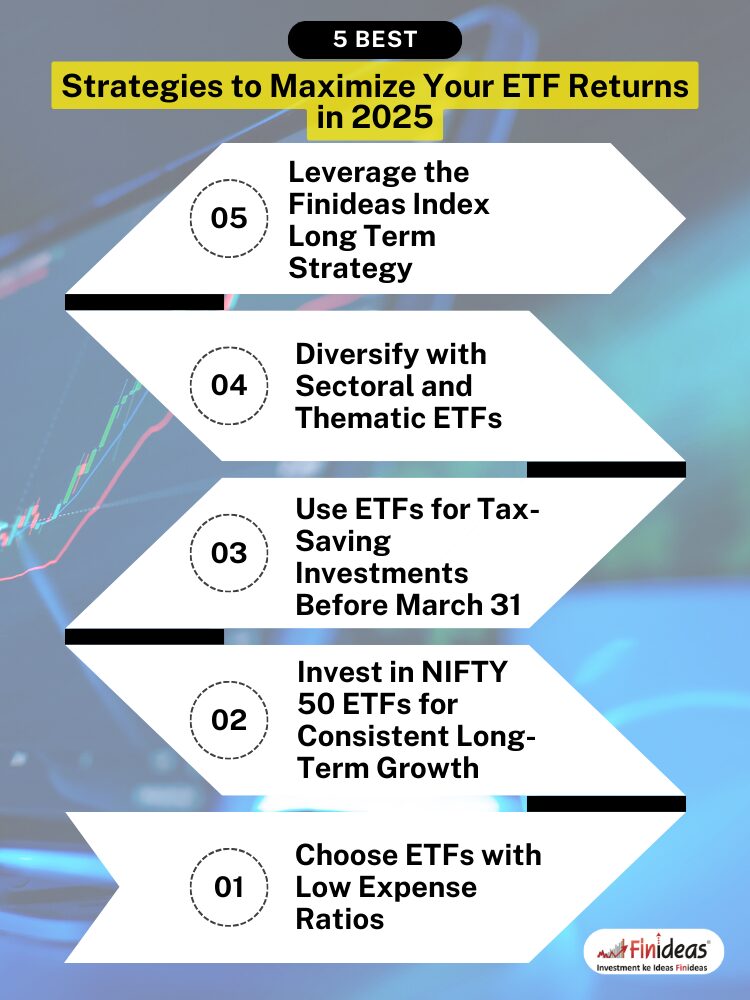

5 Best Strategies to Maximize Your ETF Returns in 2025

What Are ETFs, and Why Should You Invest in Them in 2025?

Exchange-Traded Funds (ETFs) are one of the smartest investment options for Indian investors looking for low-cost, high-growth, and tax-efficient investments. They track an index like NIFTY 50, Sensex, or sectoral indices while providing:

✅ Low expense ratios (as low as 0.05%)

✅ Diversified market exposure

✅ Better liquidity compared to mutual funds

In 2025, ETFs continue to dominate as one of the best ways to maximize returns while beating inflation. Here’s how you can make the most of them!

Choose ETFs with Low Expense Ratios

Why Is Cost Important?

Every rupee you save on costs adds to your returns. ETFs are already cheaper than mutual funds, but choosing the lowest expense ratio ETF can significantly boost your wealth.

🔹 Example:

If you invest ₹5 lakh in an ETF with a 0.1% expense ratio, you pay just ₹500 per year. In contrast, a mutual fund with a 1.5% fee would cost ₹7,500 per year!

🔹 Best Low-Cost ETFs in India for 2025:

- NIFTY 50 ETFs (Expense Ratio: 0.05% – 0.2%)

- Sensex ETFs (Expense Ratio: 0.1% – 0.3%)

Invest in NIFTY 50 ETFs for Consistent Long-Term Growth

NIFTY 50 ETFs track India’s top 50 companies, making them an ideal long-term investment. Over the past decade, NIFTY 50 has delivered an average return of 12-15% annually.

📊 Historical Growth of NIFTY 50:

- 2015: 7,500 points

- 2020: 12,500 points

- 2025 (Projected): 22,000+ points

💰 Example:

A ₹1 lakh investment in NIFTY 50 ETFs in 2015 would be worth ₹3.5 lakh today!

🚀 Pro Tip: Start a SIP in ETFs instead of lump sum investments to benefit from rupee cost averaging.

Use ETFs for Tax-Saving Investments Before March 31

Did you know that ETFs can help you save taxes?

✅ Equity ETFs held for over 1 year attract just 10% Long-Term Capital Gains (LTCG) tax on profits above ₹1 lakh.

✅ Investing in ELSS ETFs before March 31 can provide tax benefits under Section 80C (up to ₹1.5 lakh deduction).

💡 Example:

- Investing ₹1.5 lakh in an ELSS ETF before March 31 can save up to ₹46,800 in taxes (if in the 30% tax bracket).

🔹 Best Tax-Saving ETFs in India:

Diversify with Sectoral and Thematic ETFs

Investing in a mix of ETFs across different sectors can reduce risk and enhance returns. In 2025, some of the best-performing sectors in India include:

📌 Banking ETFs – HDFC, ICICI, SBI ETFs (Strong growth in financial services)

📌 IT ETFs – Infosys, TCS ETFs (Leveraging global tech demand)

📌 Gold ETFs – A hedge against inflation and market volatility

Why Diversification Matters?

If one sector underperforms, your investment in another can balance the losses.

Leverage the Finideas Index Long Term Strategy

The Finideas Index Long Term Strategy (ILTS) is a powerful approach to growing wealth with ETFs.

✔ Invests in NIFTY 50 ETFs for stable, long-term growth

✔ Minimizes risks while maximizing compounding benefits

✔ Beats inflation with consistent returns over time

💰 Example:

If you start investing ₹50,000 per month in a NIFTY 50 ETF using the ILTS strategy, you could accumulate ₹6.4 crore in 20 years!

Final Thoughts: Why ETFs Are the Best Investment in 2025

📌 Low cost ✅

📌 High liquidity ✅

📌 Long-term wealth creation ✅

📌 Tax efficiency ✅

By following these 5 proven ETF investment strategies, you can maximize your returns while minimizing risks.

💬 What’s your favorite ETF strategy for 2025? Comment below! 🚀

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.