Market Down but Portfolio Safe? Here's How Smart Investors Stay Relaxed

What is Market Volatility?

The Indian stock market has recently experienced significant volatility, with the NIFTY 50 index witnessing fluctuations that have left many investors anxious. On April 9, 2025, the NIFTY 50 declined by 0.72% to 22,372.7, reflecting the market’s sensitivity to global trade tensions and domestic economic policies. Despite these downturns, savvy investors maintain their composure by employing strategic investment approaches designed to safeguard their portfolios.

Market volatility refers to the rapid and significant price movements in financial markets. Factors such as geopolitical events, economic data releases, and policy changes can contribute to this instability. For instance, recent escalations in global trade tensions, including increased tariffs, have impacted investor sentiment worldwide.

Strategies to Protect Your Portfolio

To navigate market volatility effectively, consider the following strategies:

- Diversification: Spread investments across various asset classes to mitigate risk.

- Long-Term Focus: Maintain a long-term perspective to ride out short-term market fluctuations.

- Hedging: Use financial instruments like options to protect against potential losses.

- Systematic Investment Plans (SIPs): Invest regularly to average out purchase costs over time.

Index Long Term Strategy (ILTS) by Finideas

One effective approach to managing market volatility is the Index Long Term Strategy (ILTS) offered by Finideas. This strategy combines investments in the NIFTY 50 index with protective measures to ensure both growth and safety.

Features of ILTS:

- Investment in NIFTY 50: Focuses on India’s top 50 companies, providing a diversified equity portfolio.

- Leverage Through Futures: Utilizes low-cost leverage to enhance potential returns.

- Hedging with Options: Implements options to protect investments from significant market downturns.

- Consistent Growth: Aims for wealth accumulation in line with market growth while securing against losses.

Historically, ILTS has delivered a Compound Annual Growth Rate (CAGR) of 17.90% since 2002, with a maximum annual risk of 4%. For example, an investment of ₹1 crore in 2002 would have grown to approximately ₹31.72 crore by 2023.

Leveraging NIFTY 50 for Tax-Saving Investments

As the financial year approaches its end on March 31, investors can consider tax-saving instruments linked to the NIFTY 50, such as Equity Linked Savings Schemes (ELSS). ELSS funds offer tax deductions under Section 80C of the Income Tax Act and have a lock-in period of three years. Investing in ELSS not only provides tax benefits but also exposes your portfolio to the growth potential of the equity market.

Example:

Investing ₹1.5 lakh in an ELSS fund before March 31 can yield tax savings of up to ₹46,800, assuming a tax slab of 31.2%.

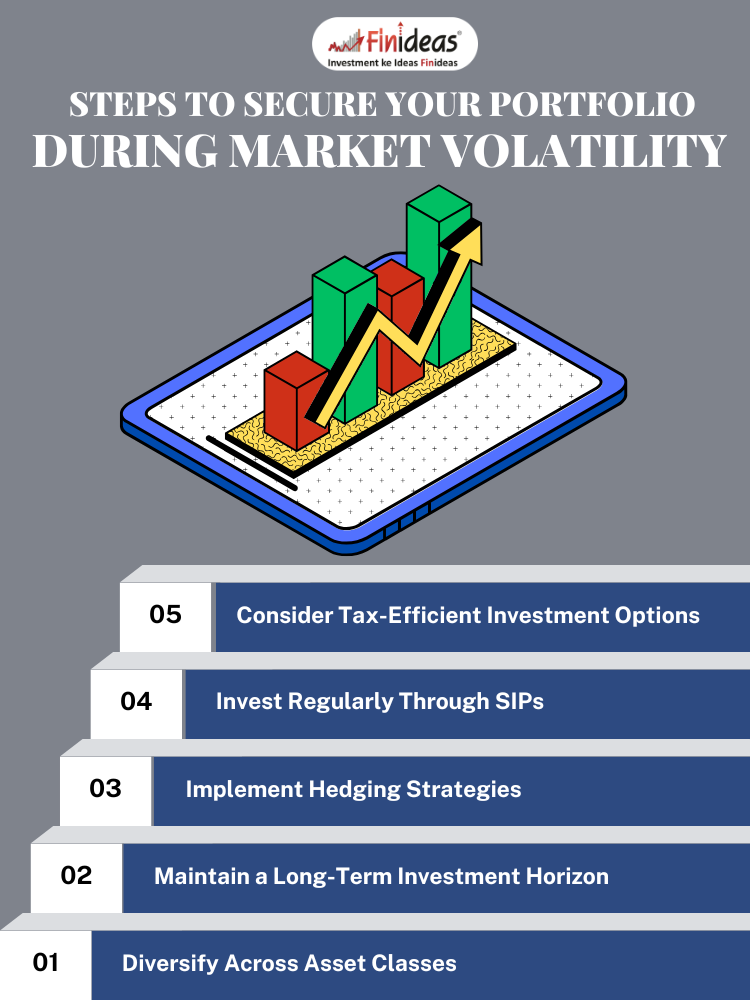

Steps to Secure Your Portfolio During Market Volatility

- Diversify Across Asset Classes

- Maintain a Long-Term Investment Horizon

- Implement Hedging Strategies

- Invest Regularly Through SIPs

- Consider Tax-Efficient Investment Options

Conclusion

Market volatility is an inherent aspect of investing, but with strategic planning and informed decisions, you can safeguard your portfolio and achieve long-term financial goals. Strategies like the Index Long Term Strategy by Finideas offer a structured approach to navigating market fluctuations effectively.

What strategies have you found effective in protecting your investments during market downturns? Share your experiences in the comments below!

Happy Investing!

This article is for informational purposes only. Please consult with a financial advisor before making any investment decisions.