Navigating the Waves of Time: A Gentle Guide to Retirement Planning in Your 30s, 40s, and 50s

Introduction:

In the symphony of life, the tune of retirement may seem distant when you’re in your 30s. However, just as a wise sailor charts a course early, crafting a harmonious retirement melody begins with the first notes of your career. In this gentle guide, we’ll embark on a journey through the decades—30s, 40s, and 50s—unraveling the threads of retirement planning, all while dancing to the rhythm of a long-term index strategy.

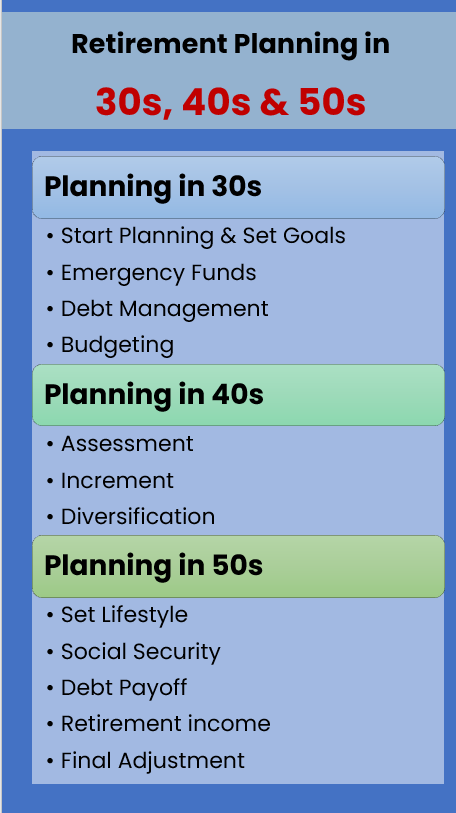

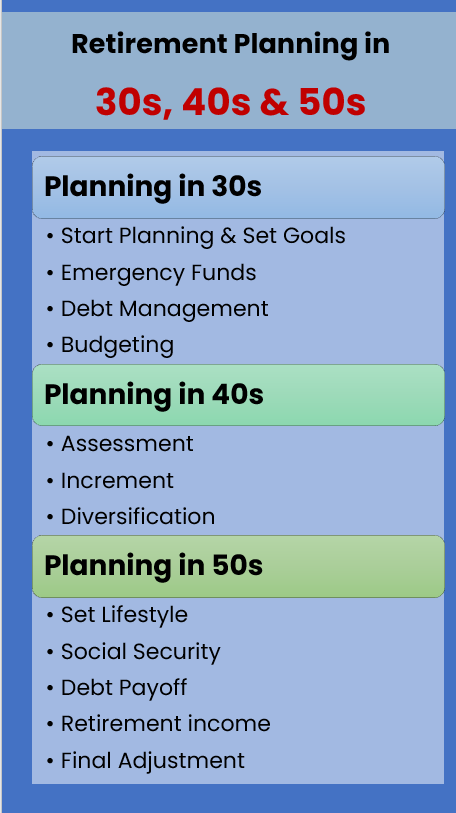

Retirement Planning in Your 30s: Laying the Foundation

1. Introduction to Retirement Planning:

As you stand at the gateway of your career, retirement might appear as a faraway utopia. Yet, it’s precisely in these early years that the seeds of your retirement garden are sown. Picture retirement not as a finish line, but as a beautiful tapestry, woven with each paycheck.

2. Understanding Financial Goals:

Start by identifying your financial goals—a mix of short-term desires and the long-term dream of retirement. This clarity will be your compass, steering you toward balanced financial decisions.

3. Emergency Fund:

A storm can brew at any moment. That’s why, in your 30s, building an emergency fund is akin to fortifying your ship. This fund, like an anchor, provides stability and ensures your financial vessel weathers unexpected waves.

4. Employer-sponsored Retirement Accounts:

Enter the realm of employer-sponsored retirement accounts. Maximize your contributions to the 401(k) or its equivalent. It’s a long-term investment in your future, a vessel gathering momentum as it sails towards a prosperous retirement.

5. Debt Management:

Tame the debt dragon. High-interest debts are lurking monsters, and defeating them in your 30s is a heroic feat. This is your chance to ensure your ship remains unburdened and nimble.

6. Investment Basics:

Think of investments as the wind in your sails—dynamic and powerful. Introduce yourself to the art of diversified, long-term investments. The index strategy, like a reliable North Star, guides your ship steadily toward retirement goals.

7. Healthcare Planning:

Consider healthcare not as a potential storm but as a planned pitstop. Secure health insurance, and calculate potential healthcare costs. After all, a sturdy ship needs a healthy crew.

8. Budgeting for Retirement:

Craft a budget that accommodates your current needs and paves the way for future savings. A well-structured budget is the map that ensures your ship navigates the financial seas with grace.

Transition: As the years unfold, let’s delve into the 40s—a period of refinement and adjustment.

Retirement Planning in Your 40s: Refining the Course

1. Assessing Progress:

In your 40s, pause to reflect on the journey. Assess your retirement savings and, if necessary, recalibrate your course. Flexibility is key; after all, a seasoned captain adjusts the sails as the wind shifts.

2. Increasing Contributions:

As your career climbs higher, let your contributions soar too. Take advantage of catch-up contribution limits. Your ship gains momentum with each additional drop in the retirement fund ocean.

3. Diversifying Investments:

Like a seasoned chef perfecting a recipe, now is the time to diversify your investments. A mix of stocks, bonds, and other assets creates a resilient portfolio, weathering the financial seasons.

4. Education Funding:

Balancing the needs of your ship’s crew—both present and future—is an art. Save for your children’s education, but ensure it doesn’t capsize your retirement plans. It’s a delicate dance on the financial seas.

5. Insurance Review:

As your ship matures, so does your need for protection. Review life and disability insurance. It’s the sturdy hull that shields your ship from unexpected tempests.

6. Estate Planning:

Craft a will, explore trusts—a legacy isn’t just a lighthouse on the shore; it’s the mark of a captain who navigated life with purpose.

7. Mid-career Job Changes:

A mid-career change is a change of winds. Assess its impact on your retirement savings. Sometimes, it’s a daring leap into uncharted waters; ensure your ship is ready for the challenge.

8. Long-term Care Considerations:

Acknowledge the potential storms of health issues. Understanding long-term care options and costs prepares your ship for the possibility of calmer waters.

Transition: The golden years beckon. Let’s sail into the 50s, where preparation meets anticipation.

Retirement Planning in Your 50s: Anticipating the Horizon

1. Catch-up Contributions:

In your 50s, the wind may slow, but your ship can still gather momentum. Catch-up contributions become your secret weapon, propelling you toward the retirement harbor.

2. Retirement Lifestyle:

Define your retirement vision. It’s more than a financial harbor; it’s the destination of a life well-lived. Your ship is not just about reaching a place; it’s about how you want to experience it.

3. Social Security Planning:

Social Security benefits are the gentle currents supporting your ship. Understand their nuances and time your sail to catch the most favorable winds.

4. Healthcare in Retirement:

Healthcare becomes a more pressing consideration. Navigate these waters wisely, securing a robust healthcare plan for your retirement voyage.

5. Paying off Mortgage:

As retirement nears, consider paying off the mortgage. A ship free from debt can sail into the sunset with unparalleled freedom.

6. Fine-tuning Investment Strategy:

Adjust your investment strategy to a more conservative approach. Like a captain navigating the final stretch, prioritize preservation while seeking modest gains.

7. Retirement Income Streams:

Diversify your income streams. Pensions, part-time work, and other sources ensure a steady flow, transforming your ship into a self-sufficient vessel.

8. Last-minute Financial Adjustments:

Fine-tune your financial instruments. Ensure your ship is well-equipped for the final leg of the journey.

Companion in Financial Planning: The Index Long-Term Strategy

The Index Long-Term Strategy serves as a companion throughout your entire financial planning journey. This strategy comprises two key factors that assist you in generating extraordinary wealth for a prosperous retirement:

1. Wealth Creation in Rising Markets: The strategy excels in creating wealth when the market is on an upward trajectory. As the market rises, this approach ensures that your financial assets grow, contributing to your overall wealth accumulation.

2. Protection of Funds in Falling Markets: In times of market downturns, the Index Long-Term Strategy acts as a safeguard for your funds. It shields your investments from the impact of a declining market, providing a protective layer during challenging financial conditions.

This dual capability not only outperforms index returns in the long run but also establishes the Index Long-Term Strategy as a reliable companion on your journey toward intelligent wealth creation.

As you embark on this journey through the waves of time and retirement planning, what aspect of financial preparation or investment strategy resonates with you the most, and what steps do you plan to take in your current life stage to enhance your retirement readiness?

Conclusion:

In the grand tapestry of life, retirement planning is a gentle art—a rhythmic dance across the seas of time. The index long-term strategy serves as your faithful companion, a compass pointing toward the financial North Star. As you traverse the decades, may your ship sail smoothly, guided by the wisdom of long-term planning and the gentle winds of preparation. Bon voyage into the golden years!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.