Building a Bulletproof Emergency Fund: Your Safety Net in Times of Crisis

In today’s uncertain world, having a financial safety net is crucial. An emergency fund acts as that safety net, protecting you during unexpected financial crises. But how do you build a bulletproof emergency fund that can withstand any storm? Let’s dive into the essential steps and strategies.

What is an Emergency Fund and Why is it Important?

An emergency fund is a dedicated savings account meant to cover unexpected expenses such as medical emergencies, job loss, or major repairs. This fund is crucial because it provides financial security and peace of mind, allowing you to navigate tough times without resorting to high-interest debt or dipping into your long-term investments.

How Much Should You Save in Your Emergency Fund?

The amount you should save in your emergency fund varies depending on your personal circumstances. A common rule of thumb is to save at least 3 to 6 months’ worth of living expenses. For example, if your monthly expenses are ₹50,000, you should aim to have between ₹1,50,000 and ₹3,00,000 in your emergency fund.

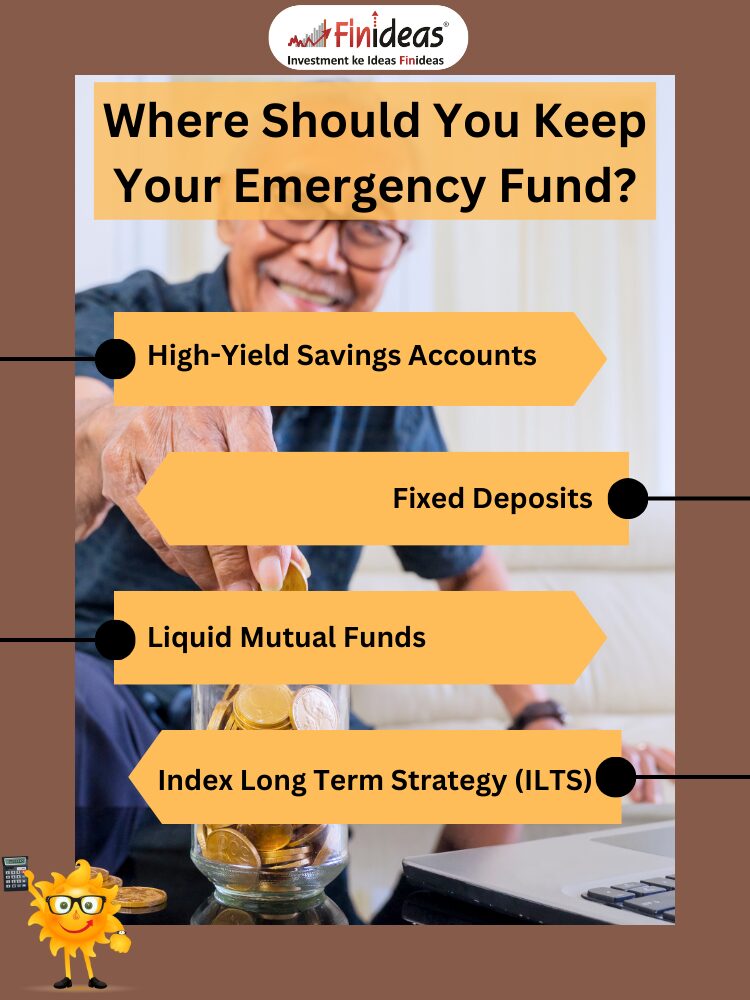

Where Should You Keep Your Emergency Fund?

The ideal place for your emergency fund is in a liquid, easily accessible account. But where exactly should you keep it? Consider the following options:

- High-Yield Savings Accounts: These accounts offer better interest rates than regular savings accounts while keeping your money accessible.

- Fixed Deposits: While less liquid, fixed deposits can offer higher interest rates and can still be broken in case of emergencies.

- Liquid Mutual Funds: These funds allow quick access to your money, typically within 24 hours, and offer better returns than savings accounts.

- Index Long Term Strategy (ILTS): While primarily a long-term wealth-building strategy, the Index Long Term Strategy from Finideas can also serve a dual purpose. By investing in ILTS, you not only grow your wealth over time but also maintain a portion of your investments in a relatively stable and liquid form. This strategy can provide additional security, giving you a flexible option to access funds in case of emergencies without heavily compromising your long-term financial goals.

How Can You Build an Emergency Fund Quickly?

Building an emergency fund might seem daunting, especially if you’re starting from scratch. But how can you build it quickly?

- Set a Budget: Allocate a specific portion of your monthly income towards your emergency fund.

- Automate Savings: Set up automatic transfers to your emergency fund account to ensure consistent contributions.

- Cut Unnecessary Expenses: Identify and reduce non-essential expenses to free up more money for your emergency fund.

What Role Does the Index Long Term Strategy (ILTS) of Finideas Play in Your Financial Planning?

While an emergency fund is your immediate safety net, what role does Finideas’ Index Long Term Strategy (ILTS) play in your overall financial planning? The ILTS is a strategic approach designed to help you build long-term wealth by investing in index funds. By following ILTS, you ensure that your long-term financial goals are met, while your emergency fund covers short-term crises. Together, they create a robust financial plan, protecting you in both the short and long term.

Why Should You Reevaluate Your Emergency Fund Regularly?

Life changes—so should your emergency fund. Why is it important to reevaluate your emergency fund regularly? Major life events like marriage, childbirth, or purchasing a home can significantly impact your financial needs. Regularly reviewing and adjusting your emergency fund ensures it remains adequate for your current situation.

Conclusion: Are You Ready to Build Your Bulletproof Emergency Fund?

Building a bulletproof emergency fund is essential for financial stability in times of crisis. By following these steps and incorporating strategies like Finideas’ Index Long Term Strategy, you can create a financial safety net that keeps you secure no matter what life throws your way.

How are you currently preparing for unexpected financial emergencies, and what strategies have worked best for you? Share your thoughts in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..