Comparing Index Funds NIFTY 50 vs. Sensex and More

What Are Index Funds and Why Should You Consider Them?

Index funds are mutual funds or exchange-traded funds (ETFs) that track a specific index, such as the NIFTY 50 or the Sensex. These funds are designed to replicate the performance of the index by holding all or a representative sample of the securities in that index. Investing in index funds offers diversification, lower costs, and a passive investment strategy, making them an attractive option for many investors.

How Do NIFTY 50 and Sensex Compare?

What Is the NIFTY 50 Index Fund?

The NIFTY 50 is an index representing the top 50 companies listed on the National Stock Exchange (NSE) of India. It covers various sectors like IT, finance, energy, and consumer goods, providing a broad market exposure.

What Is an Example of NIFTY 50 Performance?

For example, if you had invested ₹1,00,000 in a NIFTY 50 index fund five years ago, and assuming an average annual return of 12%, your investment would have grown to approximately ₹1,76,234.

What Is the Sensex Index Fund?

Sensex, or the S&P BSE Sensex, is another popular index, consisting of 30 prominent companies listed on the Bombay Stock Exchange (BSE). The Sensex represents a broader economic perspective but with fewer companies compared to NIFTY 50.

How Does Sensex Performance Compare?

If you had invested the same ₹1,00,000 in a Sensex index fund five years ago with an average annual return of 10%, your investment would have grown to about ₹1,61,051.

What Are Other Index Funds Worth Considering?

Are There Other Popular Index Funds in India?

Yes, apart from NIFTY 50 and Sensex, other notable index funds include the NIFTY Next 50, which covers companies ranked 51 to 100 on the NSE, and the NIFTY Midcap 100, which tracks the performance of 100 mid-sized companies.

How Do These Other Index Funds Perform?

For instance, the NIFTY Next 50 has shown strong growth potential with higher risk, while the NIFTY Midcap 100 offers a mix of growth and stability.

Which Index Fund Is Right for You?

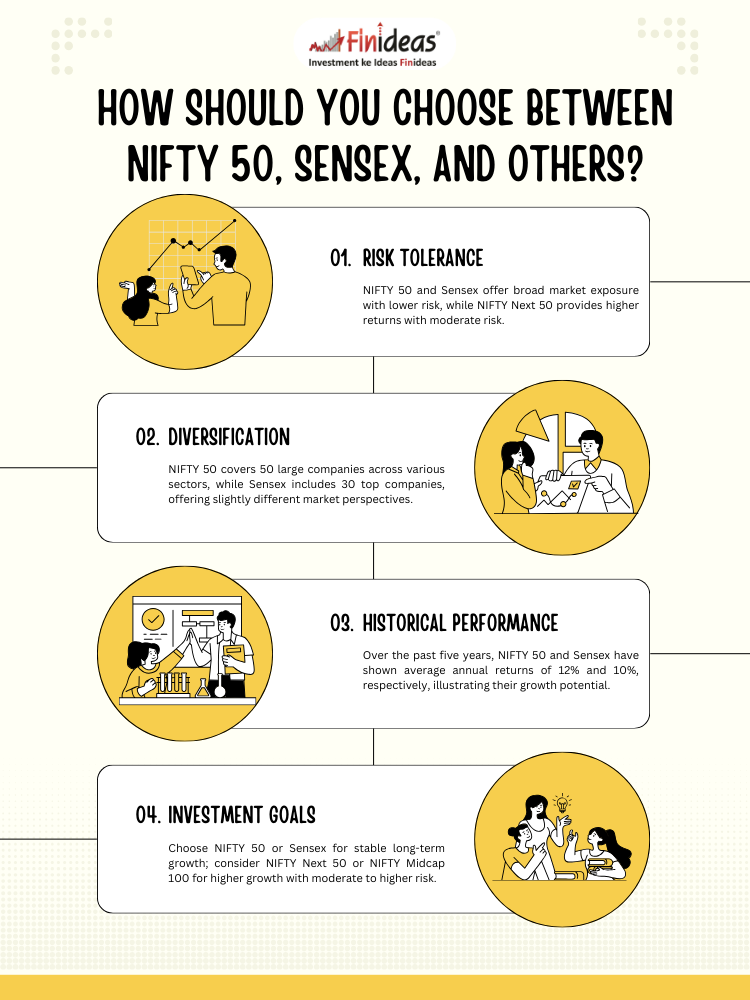

How Should You Choose Between NIFTY 50, Sensex, and Others?

Your choice between these index funds depends on your risk tolerance, investment goals, and time horizon. If you seek broad market exposure with relatively lower risk, NIFTY 50 or Sensex might be suitable. For higher returns with moderate risk, NIFTY Next 50 could be a better option.

Risk Tolerance:

NIFTY 50 and Sensex offer broad market exposure with lower risk, while NIFTY Next 50 provides higher returns with moderate risk.Diversification:

NIFTY 50 covers 50 large companies across various sectors, while Sensex includes 30 top companies, offering slightly different market perspectives.Historical Performance:

Over the past five years, NIFTY 50 and Sensex have shown average annual returns of 12% and 10%, respectively, illustrating their growth potential.Investment Goals:

Choose NIFTY 50 or Sensex for stable long-term growth; consider NIFTY Next 50 or NIFTY Midcap 100 for higher growth with moderate to higher risk.

What Is the Index Long Term Strategy of Finideas?

Finideas offers an Index Long Term Strategy (ILTS) that focuses on creating substantial wealth over time by systematically investing in index funds like NIFTY 50. This strategy emphasizes the power of compounding and disciplined investing to build a robust financial future.

What Are Your Thoughts on Index Fund Investing?

Which index fund do you prefer for long-term investment, and why? Share your thoughts and experiences in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..