Decoding NIFTY 50 Performance Over the Last Decade

Introduction

The NIFTY 50 index serves as a barometer for the Indian stock market, encapsulating the performance of 50 prominent companies across various sectors. Over the past decade (2015-2024), the index has navigated through economic reforms, global challenges, and unprecedented events like the COVID-19 pandemic. This blog delves into the NIFTY 50’s performance during this period, explores strategies to leverage it for tax-saving investments, and highlights Finideas’ Index Long Term Strategy as a top investment approach.

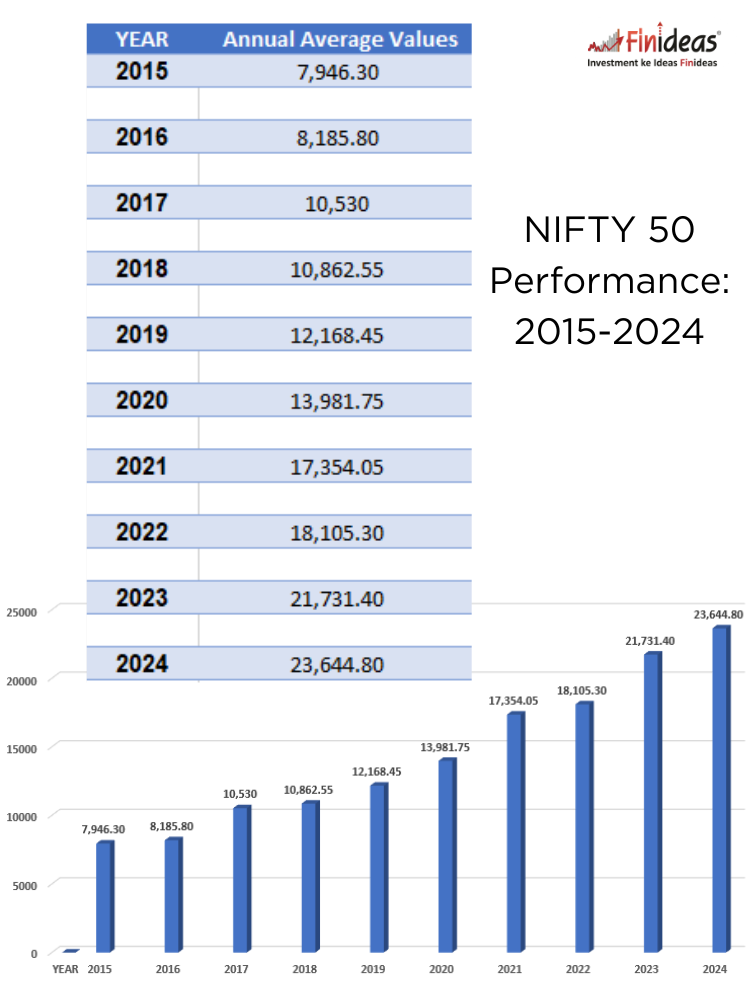

The NIFTY 50 index has demonstrated resilience and growth over the past decade. Here’s a snapshot of its annual average values:

- 2015: 7,946.3

- 2016: 8,185.8

- 2017: 10,530

- 2018: 10,862.55

- 2019: 12,168.45

- 2020: 13,981.75

- 2021: 17,354.05

- 2022: 18,105.3

- 2023: 21,731.4

- 2024: 23,644.8

These figures reflect the index’s upward trajectory, with notable growth in recent years. For instance, from 2022 to 2023, the NIFTY 50 saw an increase of approximately 20%, underscoring robust market confidence.

Leveraging NIFTY 50 for Tax-Saving Investments Before March 31

As the financial year draws to a close, investors seek avenues to optimize tax liabilities. One effective method is investing in Equity-Linked Savings Schemes (ELSS) that are linked to the NIFTY 50. Under Section 80C of the Income Tax Act, investments up to ₹1.5 lakh in ELSS are eligible for tax deductions. By channeling funds into NIFTY 50-based ELSS, investors not only avail tax benefits but also gain exposure to the top-performing companies in the Indian market.

Finideas’ Index Long Term Strategy: A Top Investment Approach

For those aiming for long-term wealth creation with minimized risk, Finideas offers the Index Long Term Strategy (ILTS). This strategy involves investing in the NIFTY 50 index, utilizing low-cost leverage through futures, and hedging with options. The ILTS has delivered a Compound Annual Growth Rate (CAGR) of 17.90% since 2002, with a maximum annual risk of 4%. Notably, an investment of ₹1 crore in 2002 would have grown to ₹31.72 crore by 2023 under this strategy.

Key Benefits of ILTS:

- Diversification: Exposure to the top 50 companies across various sectors.

- Risk Management: Hedging mechanisms to protect against market downturns.

- Leverage: Utilizing futures to enhance returns without significant capital outlay.

Conclusion

The NIFTY 50’s performance over the past decade reflects the dynamism of the Indian economy. By strategically investing in NIFTY 50-linked instruments, especially through avenues like ELSS for tax savings and adopting robust strategies like Finideas’ ILTS, investors can optimize returns while managing risks effectively.

What are your thoughts on leveraging the NIFTY 50 for long-term investments? Share your views in the comments below!

Note: Investments are subject to market risks. It’s advisable to consult with a financial advisor before making investment decisions.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.