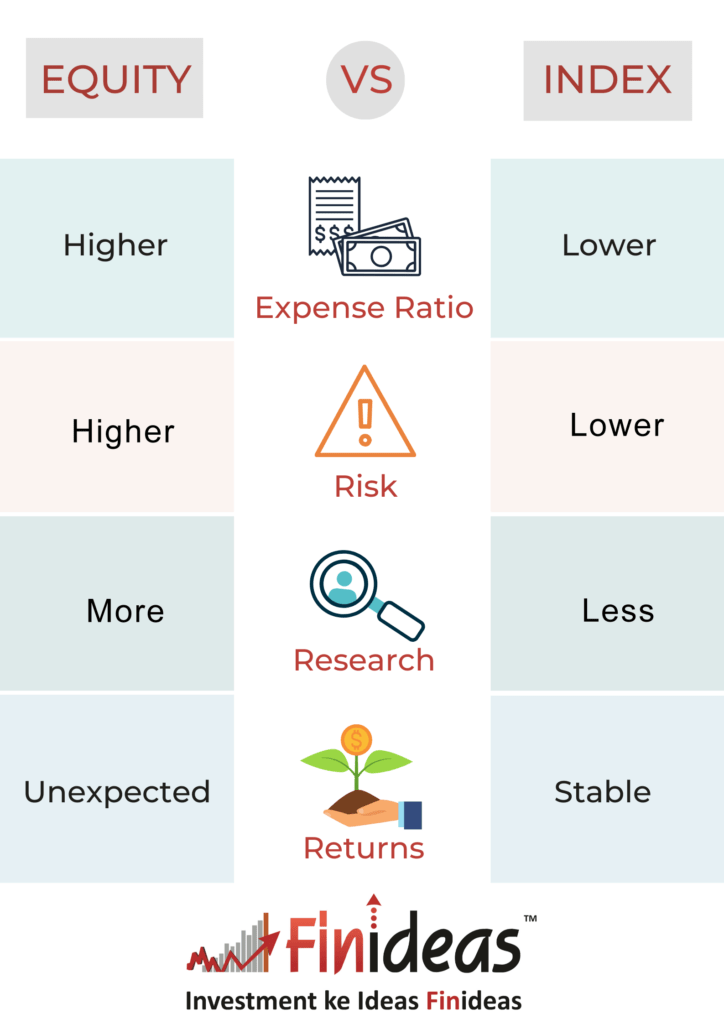

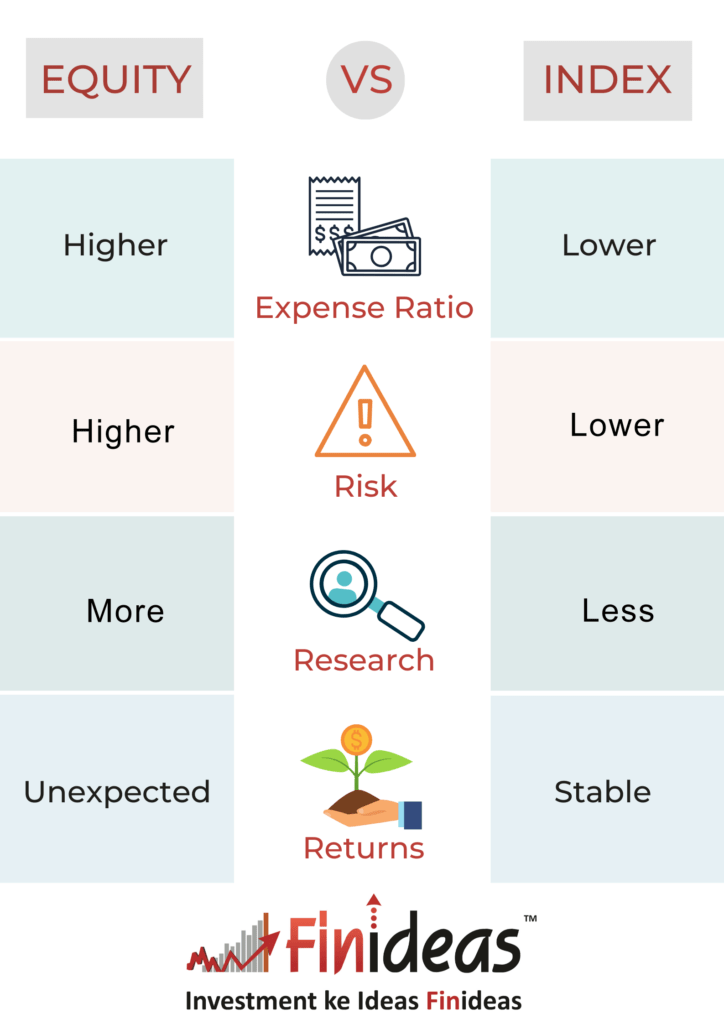

Equity Vs. Index

One common question that we always get asked in our Seminar & Webinar is “what is the difference between equity and index?” Let us try to answer this question today in a simple way.

Equity

Equity refers to the shares issued by individual companies. These can be purchased in the stock exchanges by individuals, trusts, HUFs, firms and corporate investors.

Index

An index, on the other hand, is generally issued by a stock exchange, not by any company. An index can be a broad market index, like Nifty 50, S&P BSE Sensex, or a sectoral index like Nifty Bank Index, Nifty IT Index, S&P BSE Auto and S&P BSE Capital Goods.

Every index consists of a Portfolio of stocks chosen in a very careful way. For example, the Nifty50 consists of the top 50 companies of NSE according to their size (free-float market capitalization) and the S&P Sensex consists of the top 30 companies listed in BSE.

Now that you have understood the basic concept of equity and index, let us look at some differences between the two.

Expense Ratio

If you invest in Mutual Funds, then you will see that the expense ratio of equity mutual funds are more than that of the index funds. The reason is that in case of an equity mutual fund the fund manager must constantly monitor and optimize the portfolio by buying and selling shares. This involves various costs like brokerage, exchange fees and taxes, which make the expense ratio higher.

However, the composition of the Indices mostly remains fixed. That is why Index funds do not require regular transaction in shares. Hence, the expenses associated with them are much lower than those of equity funds.

Risk

Investing in equities requires more research

Since the performance of your equity investments depends on the performance of the companies whose shares you buy, you will have to be incredibly careful while choosing them. You must look deep into various factors like their quality of the management, past performance, outlook for the future, order book position etc. for this

Investing in an index requires a lot less research because the return that you will earn will be in line with the market segment that the index represents.

Expected returns are different

Since investing in equity is risky, the returns that you can expect from them is high. On the other hand, indices are much safer, so they offer much lesser expected returns.

We hope that by now you have clearly understood the difference between equity and index.

In Index Long Term Strategy, we invest in index with protection against market falls. It secures our capital if the market falls and gives us good returns while the market rises.