ETFs vs. Mutual Funds: Which Is Right for Your Financial Goals?

When it comes to investing in the stock market, two popular options for Indian investors are Exchange-Traded Funds (ETFs) and Mutual Funds. But which one should you choose? This guide will break down the differences, benefits, and drawbacks of both to help you decide the best option for your financial goals.

What Are ETFs and Mutual Funds?

ETFs (Exchange-Traded Funds)

An ETF is a basket of securities (stocks, bonds, commodities) that trades on the stock exchange, just like individual stocks. They aim to track a particular index like the NIFTY 50 or Sensex.

- Example: If you invest in a NIFTY 50 ETF, your money is spread across all 50 companies in the index, mirroring its performance.

Mutual Funds

A Mutual Fund pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. It is actively managed by a fund manager who makes investment decisions.

- Example: An actively managed Large-Cap Mutual Fund may invest in top Indian companies like TCS, Infosys, HDFC Bank, but fund managers decide on stock selection and rebalancing.

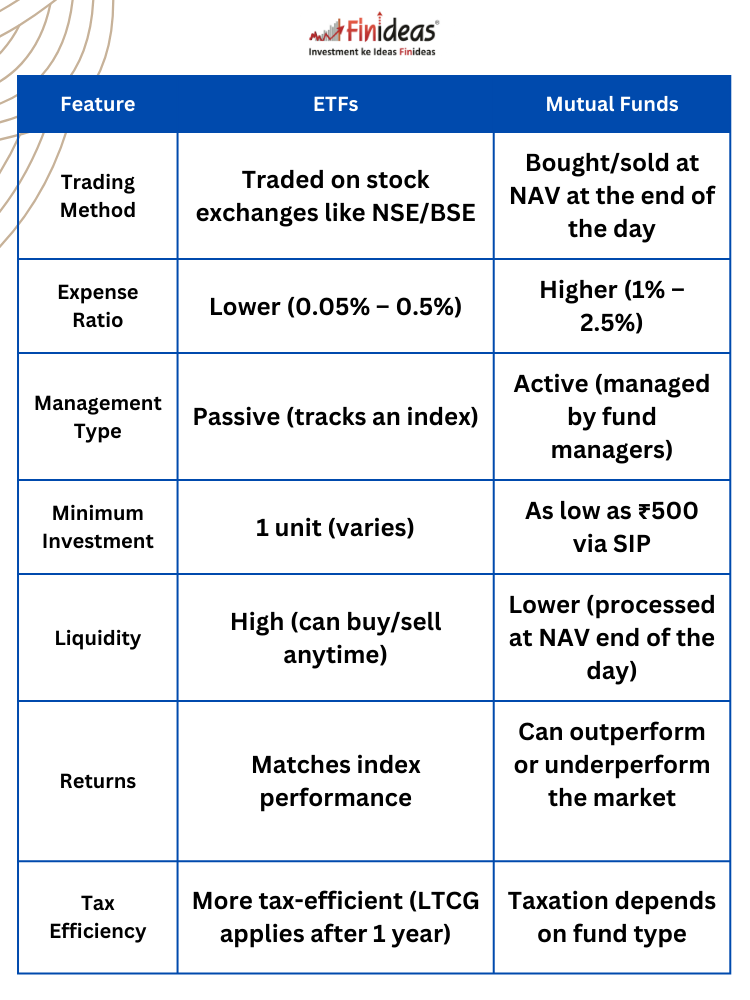

What Are the Key Differences Between ETFs and Mutual Funds?

Which One Offers Better Returns?

- ETFs generally match the performance of the underlying index.

- Actively managed Mutual Funds may generate higher returns if fund managers outperform the market.

- However, 80-85% of active funds fail to beat index funds in the long term due to higher fees and human errors.

🔹 Example:

- A NIFTY 50 ETF grew from ₹10,000 in 2013 to ₹30,000+ in 2023, following market growth.

- A Mutual Fund investing in similar stocks could have given higher or lower returns based on the fund manager’s skill.

Cost Comparison: Which One Is Cheaper?

- ETFs have an expense ratio of 0.05% – 0.5%, making them more cost-effective.

- Mutual Funds charge 1% – 2.5%, significantly reducing net returns over time.

📌 Example:

If you invest ₹10 lakh in an ETF with a 0.1% expense ratio, the cost is just ₹1,000 per year.

For a Mutual Fund with a 2% expense ratio, you pay ₹20,000 per year—20 times more!

Which One Is Better for Your Financial Goals?

- If you want lower costs, transparency, and flexibility → Go for ETFs.

- If you prefer professional management and don’t want to manage trades → Choose Mutual Funds.

- For long-term wealth creation → Consider index-based ETFs or Mutual Funds like NIFTY 50 Index Funds.

Why Is Index Long-Term Strategy of Finideas a Top Choice?

At Finideas, we recommend Index Long-Term Strategy (ILTS) as a powerful way to create wealth in the Indian stock market.

✅ Invest in ETFs or Index Mutual Funds that track NIFTY 50.

✅ Stay invested for 10-15 years to benefit from market growth.

✅ Avoid frequent buying/selling—let compounding work!

💡 Example:

- If you invest ₹1 lakh per year in NIFTY 50 ETF, assuming a 12% CAGR, in 20 years, your corpus will be ₹1 crore+!

- ILTS is a proven method that reduces risk and enhances long-term returns.

Conclusion: ETFs or Mutual Funds—Which One Should You Pick?

🔹 If you want lower costs, index-based investing, and flexibility, ETFs are a great choice.

🔹 If you prefer professional fund management, go for Mutual Funds.

🔹 For long-term investing, consider Index Long-Term Strategy (ILTS) with NIFTY 50 ETFs or Index Funds.

👉 Which one do you prefer—ETFs or Mutual Funds? Comment below and share your thoughts!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.