Exploring the Various Plans of the Index Long-Term Strategy (ILTS)

Investing wisely is key to achieving long-term financial goals, and the Index Long-Term Strategy (ILTS) offers a suite of tailored plans to suit different investor needs. These plans—Relax, Basic, Comfort, and Power Booster—each offer unique approaches to managing exposure, risk, and returns. Here’s a detailed look at what each plan entails and who might benefit from them.

What is a Relax Plan?

The Relax Plan is ideal for those nearing retirement, with a low risk appetite, or who need regular withdrawals. This plan requires a 100% initial investment of, for example, Rs. 1 Crore. Rs. 30 Lakhs is allocated to NiftyBees, which is then pledged to secure a margin in the Futures and Options (F&O) segment. Synthetic futures of Nifty50 are purchased for Rs. 70 Lakhs, and put options are acquired to match the combined position of NiftyBees and Nifty Futures. The remaining Rs. 70 Lakhs is invested in debt funds.

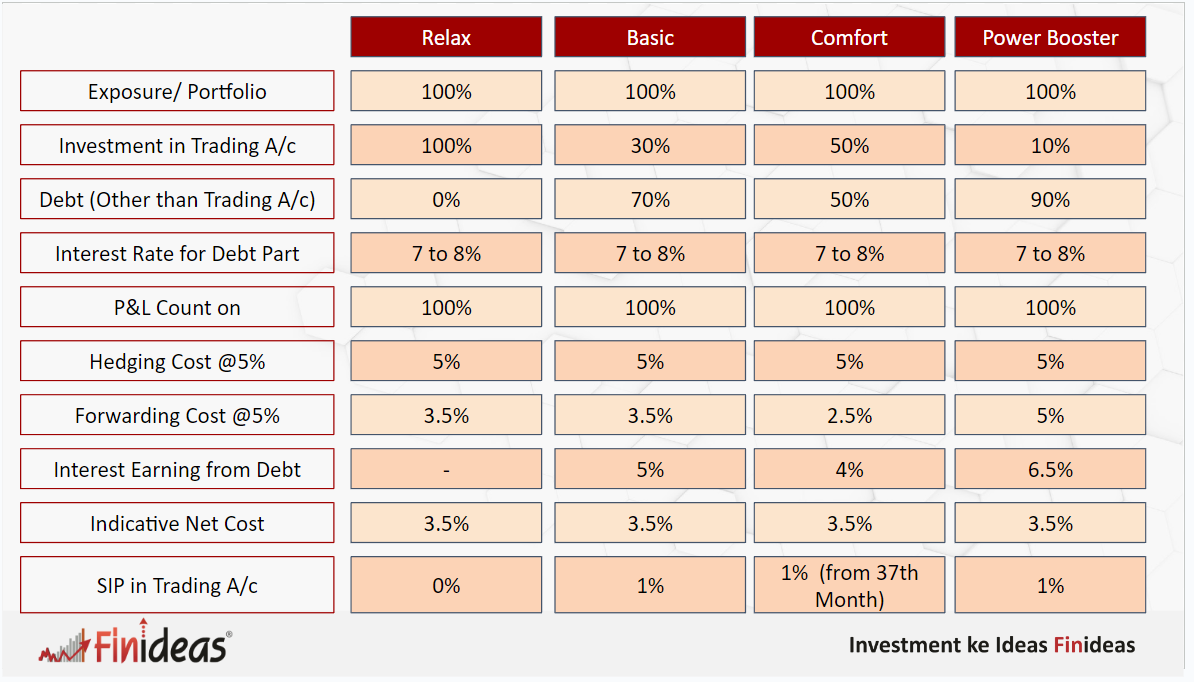

Cost management in the Relax Plan involves a hedging cost of 5% of the total exposure and a futures forwarding cost of 3.5%. With a gross cost of 8.5% and an interest earning of 7.15% from debt funds, the net cost boils down to 3.5%. This plan is perfect for those who prioritize capital preservation and require a steady income stream while maintaining low-risk exposure.

What is a Basic Plan ?

The Basic Plan caters to investors capable of generating secured and higher returns from other assets and who can commit to regular investments. It begins with Rs. 1 Crore, allocating Rs. 30 Lakhs to NiftyBees, which is pledged for F&O margin to purchase Rs. 70 Lakhs worth of synthetic Nifty50 futures. The rest of the capital (70%) can be flexibly invested in alternative assets, business ventures, or used for loan repayments, aiming for a return of 7.15% or higher.

The costs involve a 5% hedging cost and 3.5% forwarding cost, resulting in an 8.5% gross cost, offset by 7.15% interest from debt investments. Managing annual costs requires strategic use of interest earnings to cover expenses related to the ILTS. This plan demands disciplined SIPs to ensure continuous investment and is ideal for investors who are comfortable with structured and systematic investment approaches.

What is a Comfort Plan?

For those preferring a balanced approach, the Comfort Plan offers a hybrid strategy with a 50% initial investment. In this plan, Rs. 30 Lakhs is invested in NiftyBees, Rs. 70 Lakhs in synthetic Nifty50 futures, and Rs. 20 Lakhs in debt funds. The remaining 50% of the capital is invested flexibly in other assets, aiming for returns above 7.15%.

The plan’s costs include a 5% hedging cost and a 3.5% forwarding cost, with interest earnings from debt funds covering part of these expenses. Regular SIPs start from the 37th month, ensuring cost management and long-term growth. This plan suits investors who have diversified portfolios and prefer a gradual transition to structured investments, avoiding monthly commitments while ensuring sustained growth.

What is a Power Booster Plan?

The Power Booster Plan is designed for individuals with substantial portfolios and the capability for monthly SIPs. With Rs. 1 Crore for investment and an additional Rs. 30 Lakhs portfolio for pledging, the plan involves buying synthetic Nifty50 futures for Rs. 1 Crore and acquiring matching put options. It excludes NiftyBees and allocates the remaining 90% of the investment freely in various assets aiming for a 7.15% return or more.

Costs involve a 10% gross cost from hedging and forwarding, partially offset by interest earnings, resulting in a net cost of 3.5%. This plan requires maintaining the portfolio value at 30% of total exposure and a disciplined SIP from the first month. It’s suitable for investors with strong financial standings, capable of optimizing debt returns, and committed to regular investments for maximizing long-term growth.

What are Key Differences Between the Plans?

The ILTS plans differ primarily in terms of risk exposure, investment flexibility, and investor profiles. Here’s a comparative summary of the key differences:

What is Risk Exposure ?

- Relax Plan: Low risk with high emphasis on capital preservation and regular income.

- Basic Plan: Moderate risk suitable for those comfortable with systematic investments.

- Comfort Plan: Balanced risk, combining structured investments with flexible asset allocation.

- Power Booster Plan: High risk aimed at maximizing growth with significant exposure and active portfolio management.

What is Investment Flexibility ?

- Relax Plan: Limited flexibility, focusing on NiftyBees and debt funds.

- Basic Plan: Higher flexibility with 70% of capital available for other investments.

- Comfort Plan: Moderate flexibility, with 50% of capital for alternative investments.

- Power Booster Plan: Maximum flexibility, using 90% of capital for various assets.

What is Investor Profile ?

- Relax Plan: Ideal for retirees or those needing regular withdrawals and low risk.

- Basic Plan: Suitable for disciplined investors who can commit to regular SIPs.

- Comfort Plan: Best for those with diversified portfolios preferring a balanced approach.

- Power Booster Plan: Designed for financially strong individuals ready for aggressive growth and active management.

Conclusion Comparison Table:

What do you think of these plans , which will be suitable for you? Comment Down Below

By understanding these differences, investors can choose the plan that best aligns with their financial goals, risk tolerance, and investment capabilities. The ILTS offers a comprehensive framework to help investors navigate their long-term financial journey effectively.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..