FinNifty - The New Index Introduced By NSE

Today we are here to share a piece of exciting news with you.

As you might have heard already the National Stock Exchange of India Limited (NSE) is introducing a completely new index which will give us new opportunities for trading.

This index is called the Nifty Financial Services Index, or simply FinNifty. This index will represent the financial markets of India and its portfolio will consist of the shares of prominent financial services companies of India.

In this article, we will discuss FinNifty, what it is all about and how you can trade it.

Composition

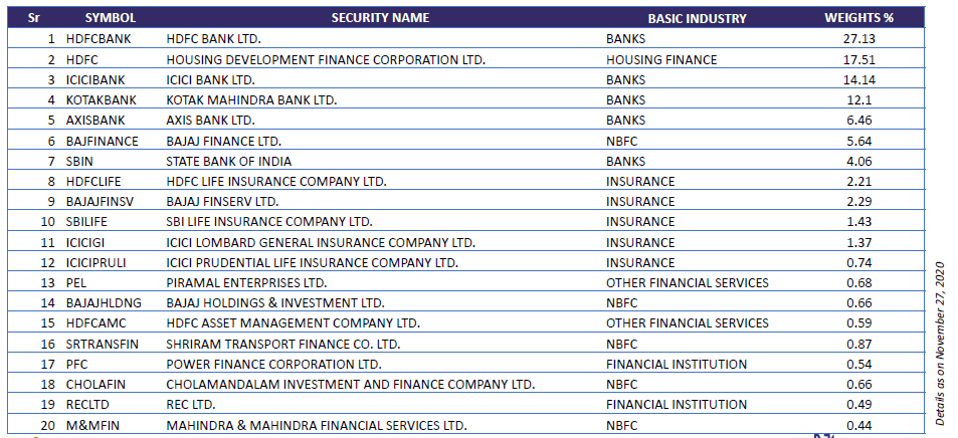

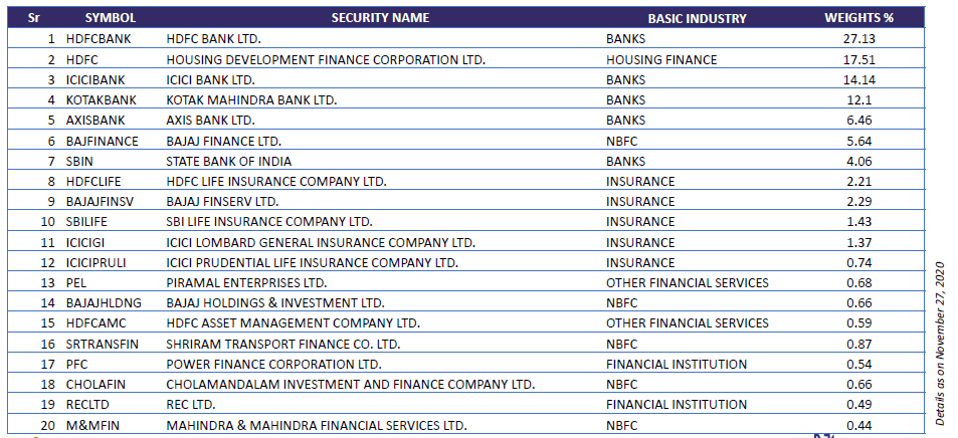

This Index constitutes of 20 stocks, which are categorized as under:

- Banking stocks

- Financial Institutes

- Housing Finance Companies

- Insurance Companies

- Financial Service Companies

Methodology

This index has been constructed with the Free Float Market Capitalization methodology, the same methodology with which the Nifty 50 index has been constructed.

However, there are some differences in the construction of FinNifty and Nifty 50.

In FinNifty,

- The maximum weightage for a single stock is 33%

- The maximum cumulative weightage of the top 3 stocks will be 62%

This means that no single stock can get more than 33% weightage and cumulative of 3 stocks cannot exceed 62% weightage.

This weightage will be rebalanced every 6 months, on 31st January and 31st July.

The current index composition along with the stock weightage is as follows:

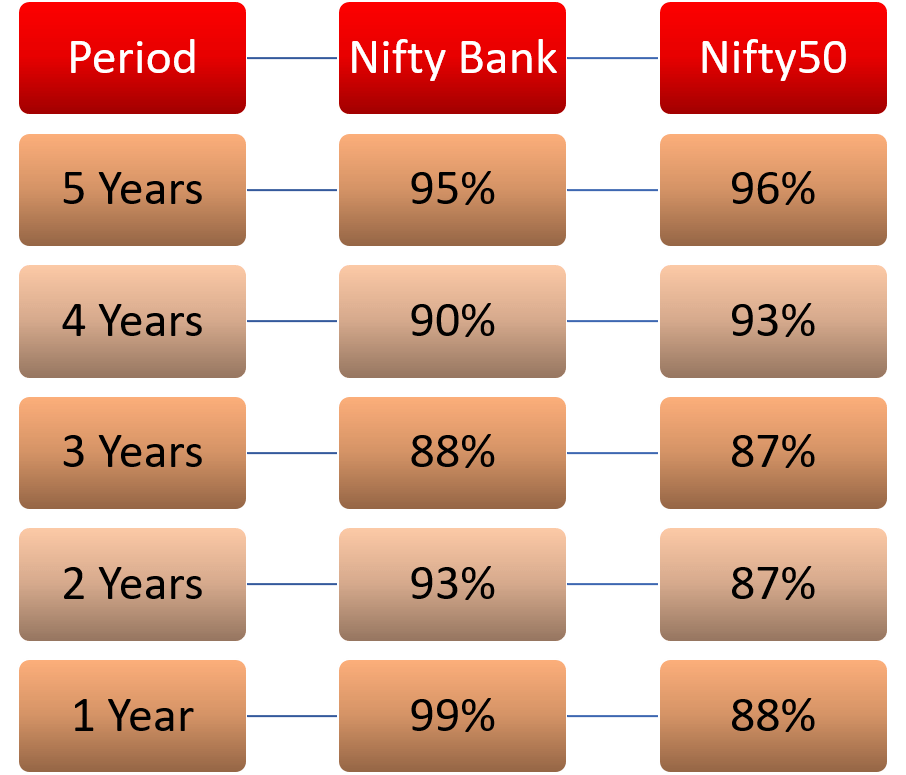

Correlation between FinNifty, BankNifty and Nifty50

FinNifty shares many attributes of BankNifty and Nifty50.

Between FinNifty and BankNifty:

- 5 stocks of FinNifty are present in BankNifty

- 63% weightage of FinNifty and 87% weightage of BankNifty are common.

- Beta: 0.93% in 1 year, and 0.94% in 5 years

Between FinNifty and Nifty:

- 10 stocks are common and

- About 93% weightage of FinNifty and 38% weightage of Nifty50 are same.

- Beta: 1.23% in 1 year, and 1.20% in 5 years

Now let us look at the correlation of FinNifty with Nifty50 and BankNifty:

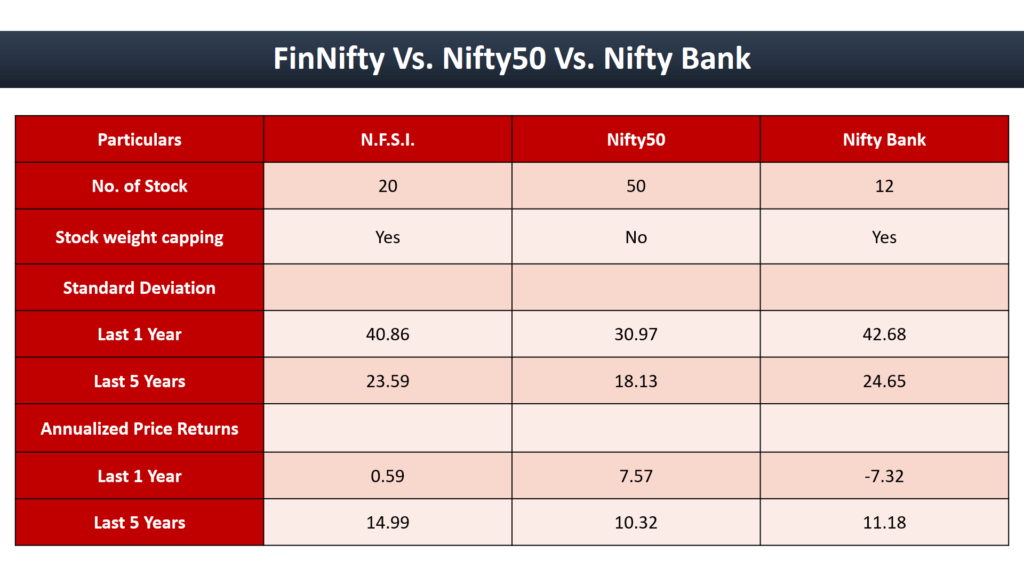

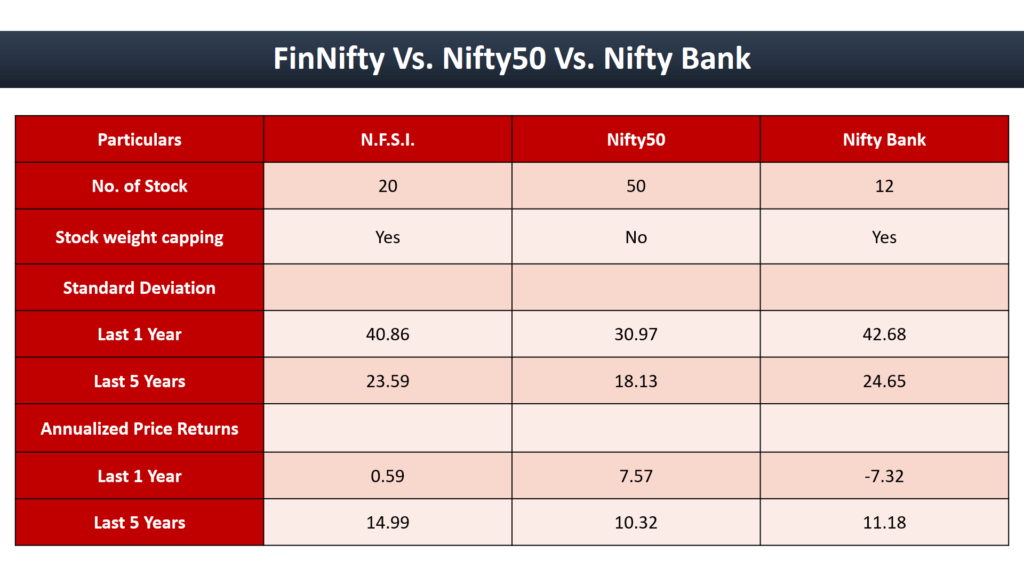

If you go through the whole mechanism of FinNifty, BankNifty and Nifty50, you will see that:

- FinNifty comprises of 20 stocks, Nifty50 consists of 50 stocks and BankNifty has 12 stocks.

- Stock Capping is only done in FinNifty and BankNifty.

- Standard Deviation, which tells us about the volatility of all Indexes, shows us that Nifty50 should be least volatile, FinNifty should be more volatile than Nifty50, and BankNifty’s volatility should be more than FinNifty.

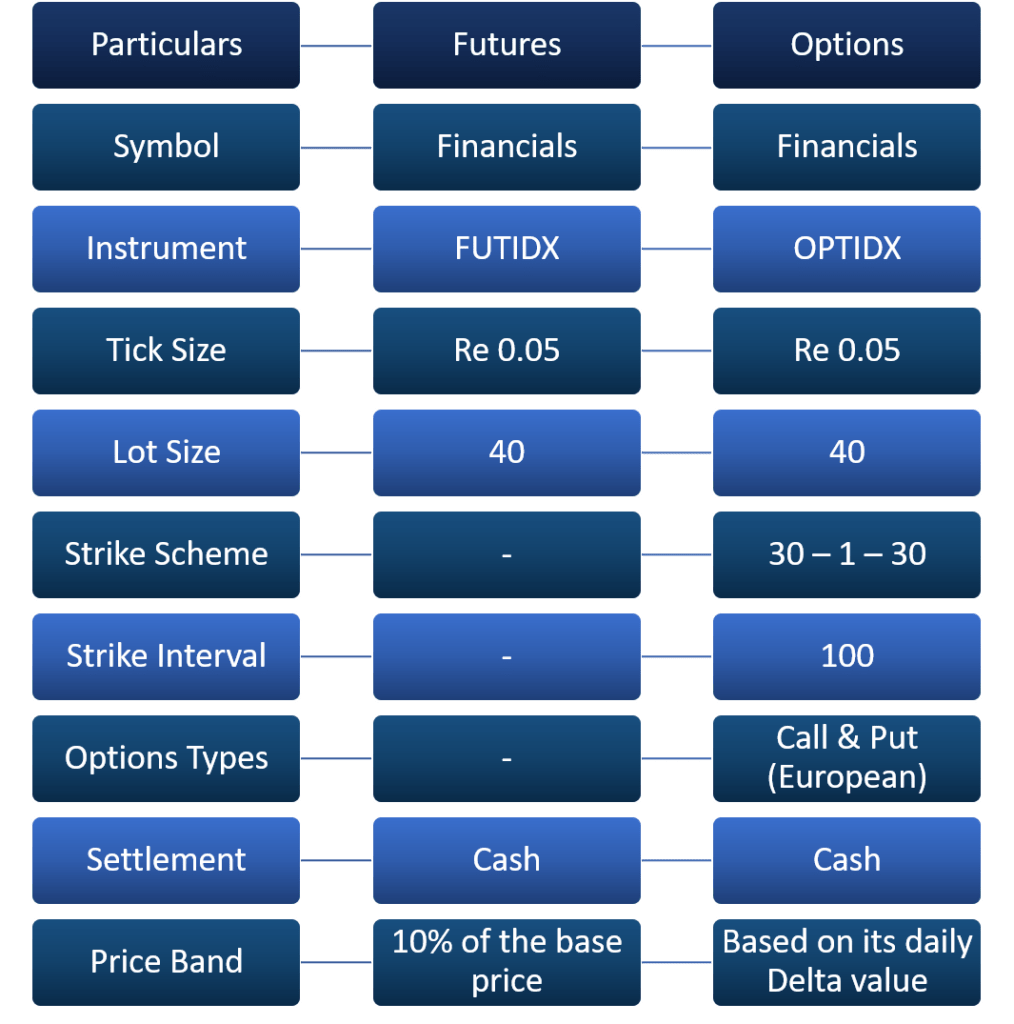

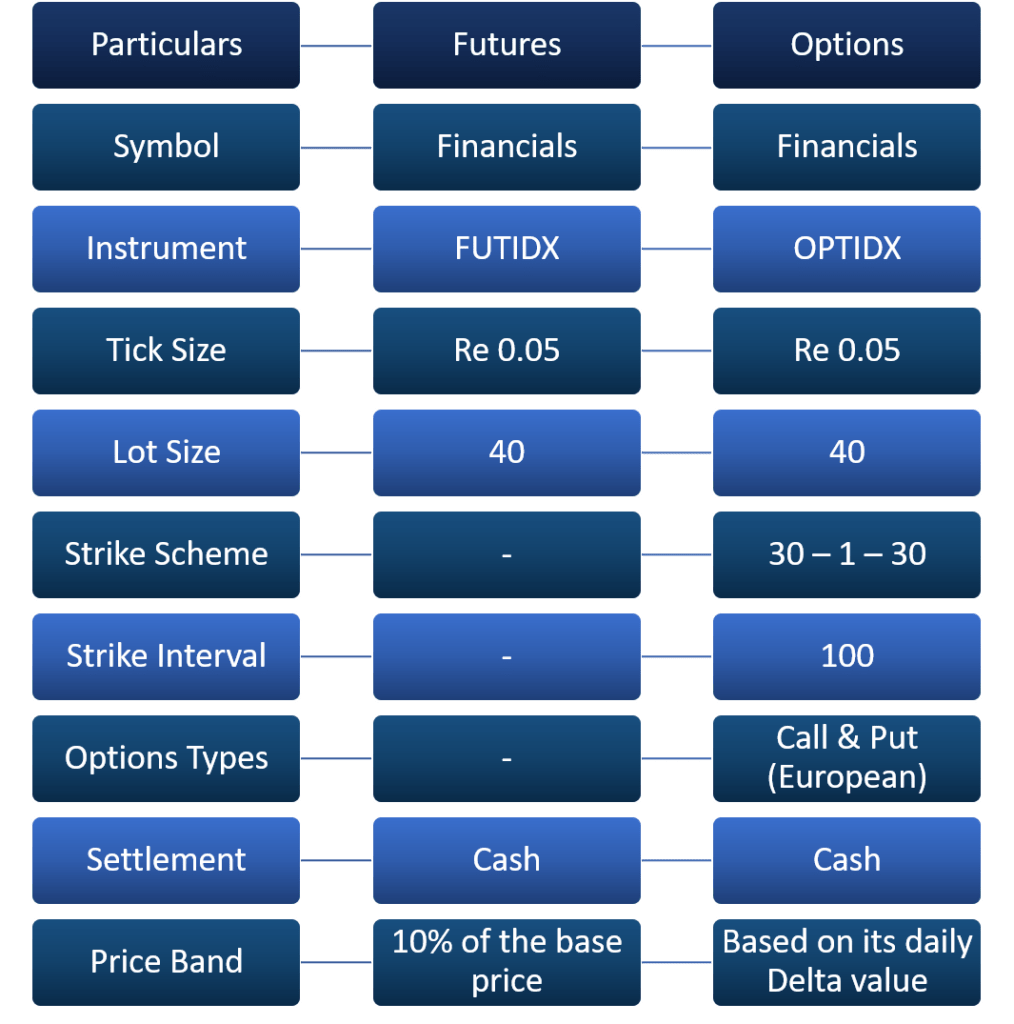

Contract Specifications:

The most interesting thing that you will notice about the current contract specifications of FinNifty is that options and futures of seven weeks will be available. This means that can now trade in weekly Futures also.

A. Trading Cycle

At any point of time, 7 Weekly Contracts and 3 Monthly Contracts will be available for trading. Thus, you will be able to choose from 10 contracts at a time and trade with ample flexibility.

B. Expiry

• The weekly contracts will expire on every Thursday and

• The Monthly contracts will expire on the last Thursday of the month

C. Spread Contracts

The following Spread Contracts will be available:

• M1-M2, M1-M3, M2-M3

• W1-W2 W1-W3 W1-W4

• W2-W3 W2-W4 W2-W5

• W3-W4 W3-W5 W3-W6

Here are some of the other salient points of the contract specifications:

* Initially, we will get to trade in 61 option strikes at intervals of 100 each as follows:

• 30 In The Money (ITM)

• 30 Out of The Money (OTM) and

• 1 At The money (ATM)

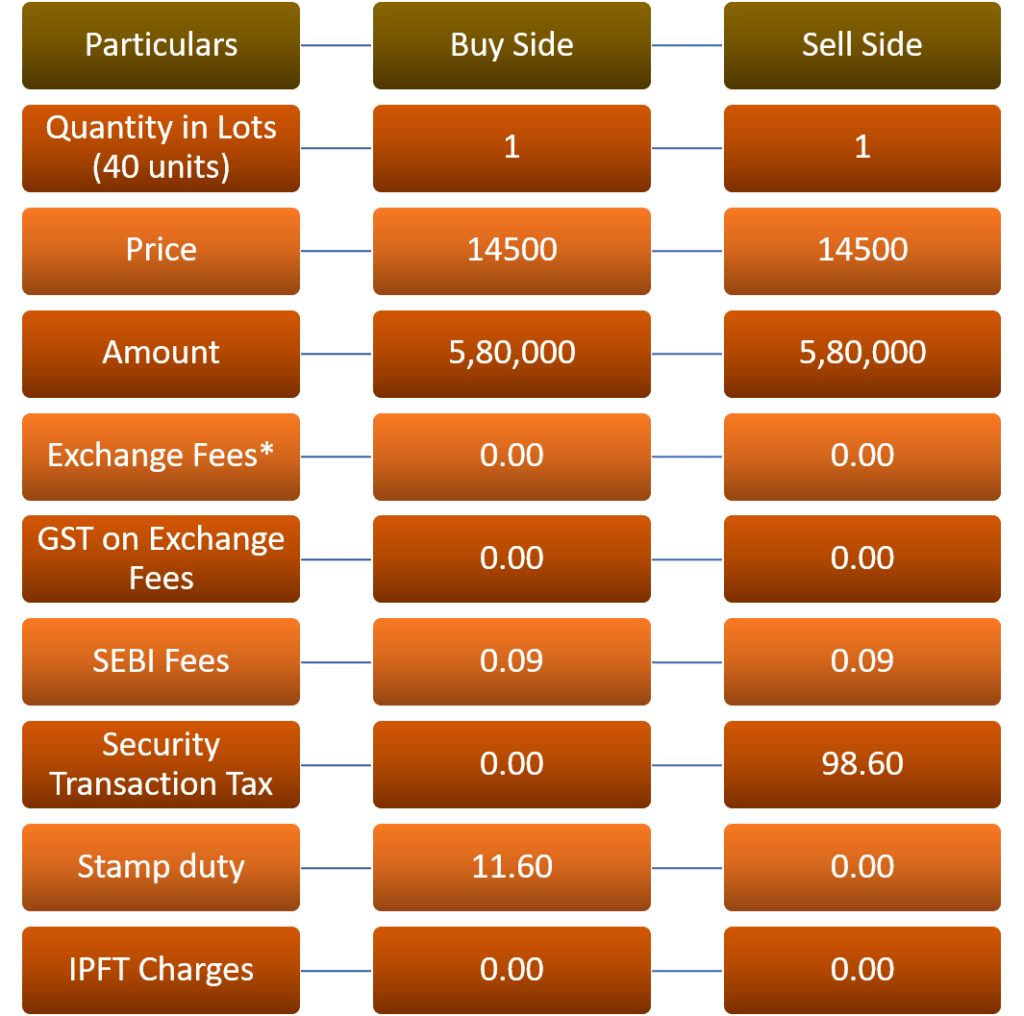

Cost of trading:

Currently, the Exchanges have exempted their fees for the next 6 months.

So, if we trade in FinNifty Futures,

• Total cost: Rs 110.38

• Break-even in ticks: 55.19

• The Breakeven cost for one round trip trade will be Rs 2.75

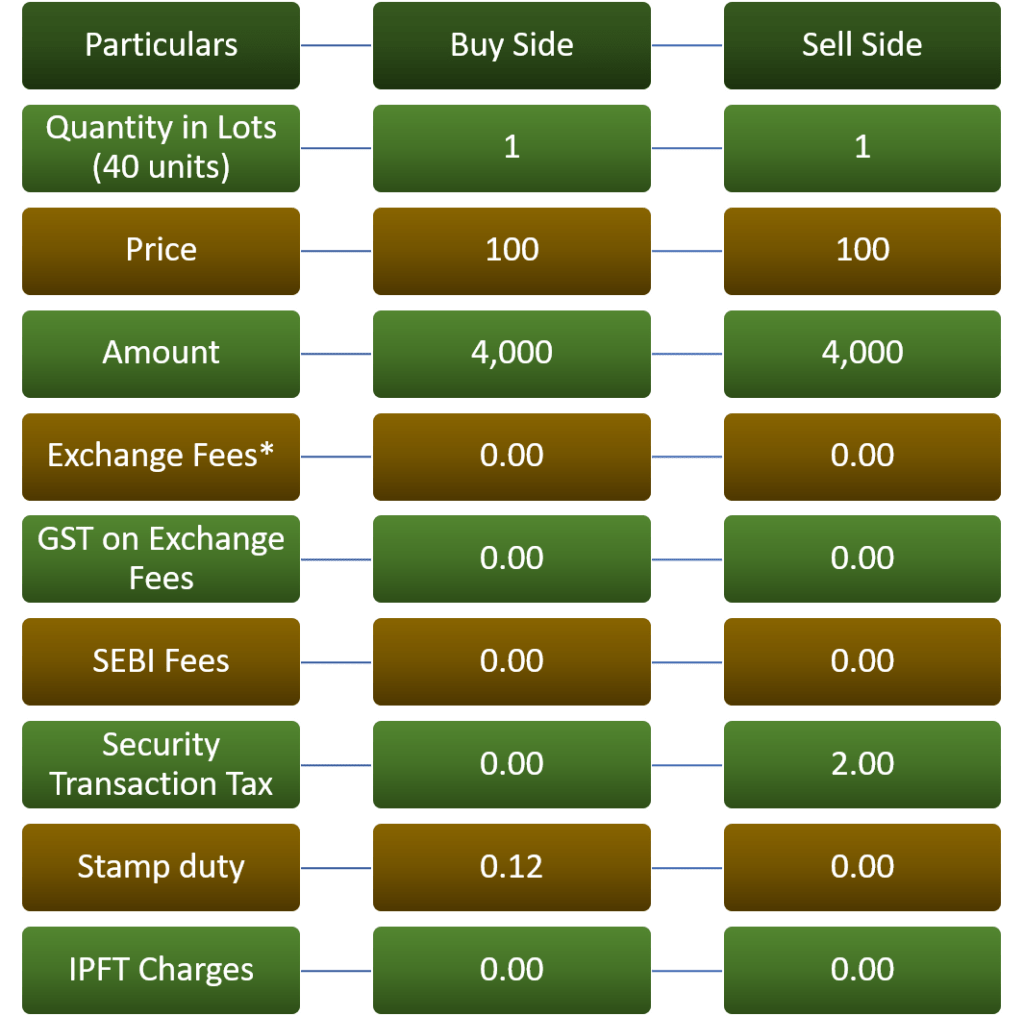

On the other hand, if we trade in Options at a premium of Rs 100,

• Total cost: Rs 2.12.

• Break-even in ticks: 1.06

• The Breakeven cost for one round trip trade will be: Rs 0.05

We hope that by now you have understood the entire concept of FinNifty and its contract specifications. We feel that this new index representing India’s financial market can become great opportunity for all of us.

Understand the Index well, trade responsibly and work your way towards profits.