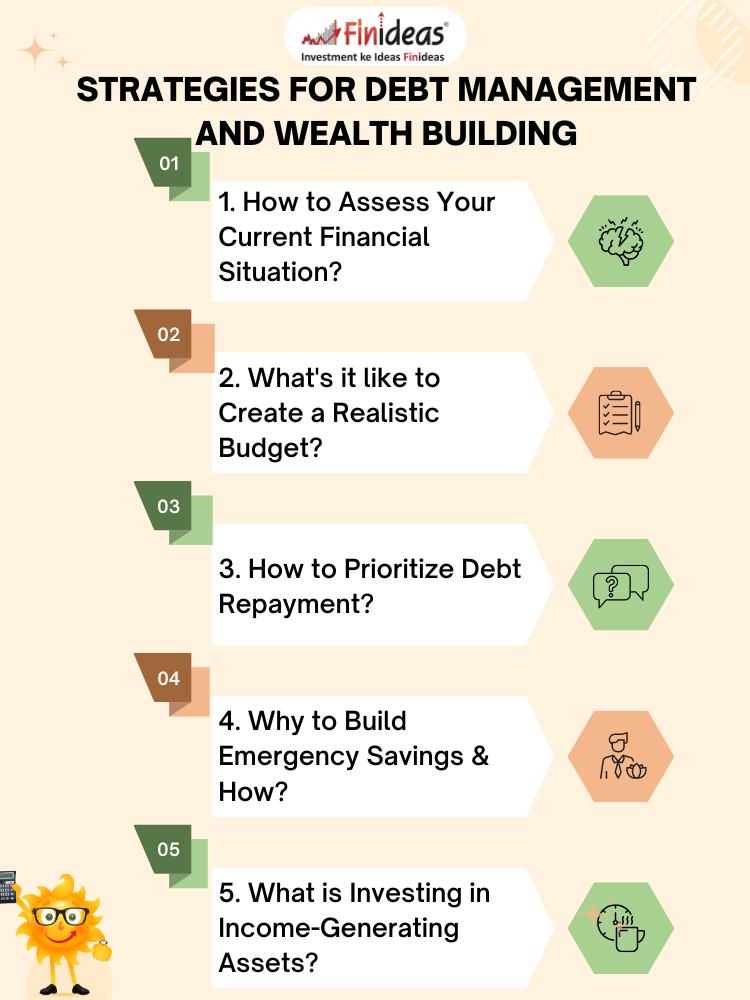

From Debt to Wealth Strategies for Debt Management and Wealth Building

Introduction:

In today’s financial landscape, managing debt and building wealth are two crucial components for achieving financial stability and success. Whether you’re burdened by debt or aiming to grow your wealth, implementing effective strategies is key. In this blog, we’ll explore practical tips and insights to navigate the journey from debt to wealth.

How to Assess Your Current Financial Situation?

Before diving into debt management and wealth building strategies, it’s essential to assess your current financial situation. Take stock of your debts, assets, income, and expenses. This step lays the foundation for creating a personalized plan to tackle debt and accelerate wealth accumulation.

What’s it like to Create a Realistic Budget?

A budget is a powerful tool for managing finances and prioritizing goals. Identify your essential expenses, such as housing, utilities, and groceries, and allocate a portion of your income towards debt repayment and savings. Strive for a balanced approach that allows you to make progress on both fronts without sacrificing essentials.

How to Prioritize Debt Repayment?

High-interest debt can be a significant obstacle on the path to wealth accumulation. Prioritize paying off debts with the highest interest rates first, such as credit card balances or payday loans. Consider debt consolidation or negotiation with creditors to lower interest rates and streamline repayment.

Why to Build Emergency Savings & How?

Unexpected expenses can derail your financial progress if you’re not prepared. Aim to build an emergency fund equivalent to three to six months’ worth of living expenses. This cushion provides a financial safety net and prevents you from relying on credit cards or loans during times of crisis.

What is Investing in Income-Generating Assets?

To build wealth over the long term, focus on investing in income-generating assets such as stocks, bonds, real estate, or business ventures. Diversify your investments to mitigate risk and capitalize on opportunities for growth. Consider seeking advice from a financial advisor to develop an investment strategy aligned with your goals and risk tolerance. If you are interested in income generating assets then you must know about Index Long Term Strategy.

Why to Continuously Educate Yourself?

Financial literacy is a lifelong journey. Stay informed about personal finance topics, investment opportunities, and economic trends. Attend workshops, read books, and follow reputable financial experts to expand your knowledge and make informed decisions about debt management and wealth building.

What strategies have you found most effective in managing debt and building wealth? Share your insights and experiences in the comments below!

By implementing these strategies and staying committed to your financial goals, you can transform your financial future from one burdened by debt to one defined by wealth and abundance. Remember, every step you take towards debt reduction and wealth accumulation brings you closer to financial freedom and peace of mind.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.