Future Vs. Options : Which is better for trading?

General people think that there are only two views in Market… (1) Bullish View & (2) Bearish View

But they do not know about two more views… (3) Volatile View & (4) Range bound view

Now answer for title question…

If you are trading in Cash Equities, You are not allow to bring short position to the Next day. And if you do so you have to be ready for auction penalty. That means you can trade only & only with bullish view.

Equity Futures allow you to take short position to the next day. That means It allow you to trade in either bullish view or in bearish view.

But what if you know that particular stock or index will be / wont in some range during this month but you don’t know where it will go today. Here you have to trade in Range bound or Volatile view. Volatile view trading help you to earn money in volatile day like budget and election result etc. while Range bound view is good for trading on a normal day.

Options helps you to execute trades for volatile and range bound view. There is a wide range of strategies in Options for trading on various market views like bullish, slightly bullish, heavily bullish, bearish, slightly bearish, heavily bearish, Range bound for intraday / short term/ long term and a Volatile view for intraday /Short term or long term. It also help you to earn time money as options premium are effected by time also.

If you are trading in Futures or Equity, You do not have option to change your strategy if market goes against your view. But in Options you can change your strategy in such a way that changes in market direction could not effect your risk return profile as well as your portfolio also continue earning in such scenario.

Secondly options are less risky & Cost effective then futures. Here you can earn good returns in with lower investment.

One more thing….

Do you know? Options can help you to trade future without headache of M2M loss.

Confused? We called it Synthetic Future.

Formula: Synthetic Future = Call Buy + Put Sell

Rules:

- Both Call & Put must having same strike

- Both Call & Put must having Same Expiry

E.g.

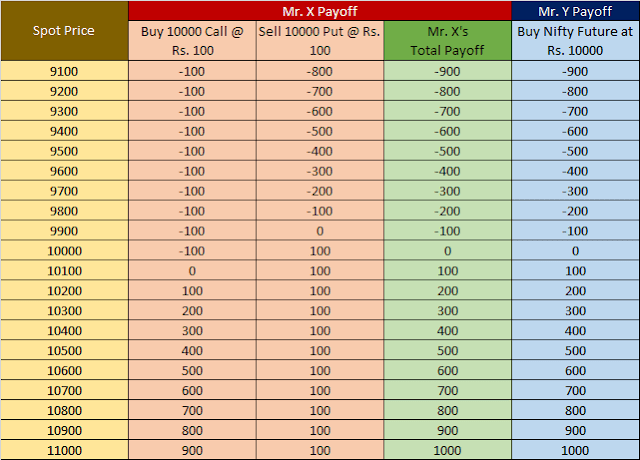

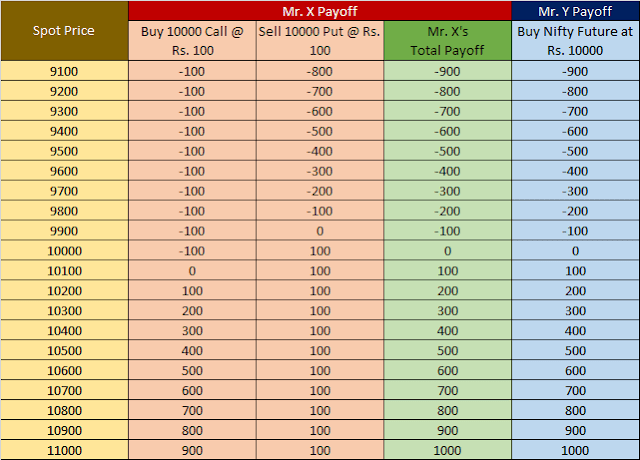

- Mr. X bought Nifty 10,000 Call Option at Rs. 100 & Sold Nifty 10,000 Put Option at Rs. 100

- Mr. Y Bought Nifty Future at Rs. 10,000

Now let’s check Payoff of both Mr. X & Mr. Y on Different Different Spot Price…. Here it is….

In above table you can see that the Total payoff of Mr. X & the payoff of Mr. Y are same at every level of market.

Why 2 trades instead of 1 Trade?

If both pay off are same then why Mr. X did two trades instead of 1 trade? Here are reasons for the same.

- MTM Loss: Futures’ Mark to Market (M2M) P&L is getting settled on daily basis. While Options MTM is getting settled directly on expiry day. So Mr. X has not to worry about MTM loss occur in his account.

- Long Term Future: Now imagine if you have a bullish view on nifty in long term (6,9,12 months) but you have only 3 months Futures available for trading. Here, using Options, you can trade in Long Term Synthetic Futures. Yes. I know that you can invest in NiftyBEES but it requires a lot more investment then Futures / Synthetic Futures. Hence, now you have 5 years long Futures available for Nifty.

- Risk Management: As Futures is having only 1 Greek i.e. Delta, you can’t manage Risk easily. While if you purchased it through Options you can manage its risk easily as there are other Greeks like Delta, Gamma, Vega, Theta, Rho, Volga, Vanna etc. available for Options..

There are other lots of benefits available for Synthetic Future & Synthetic Options. They also help you for Fund Management & Risk Management in your portfolio. The person who knows option pricing know the best benefits of Options Trading.

If you don’t know about Options Trading, Pricing, Greeks & Strategies then I suggest yo visit www.finideas.com as they are providing online and corporate training for Options. They also develop some system for trading Option in Intraday, medium term or long term.

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.