How Regular Withdrawals Work in Index Long Term Strategy

What Is Regular Withdrawal in Index Long Term Strategy?

In India, where many investors seek both long-term growth and regular income, the Index Long Term Strategy offers a unique feature under its Relax Plan called Systematic Withdrawal. This feature is specially designed for individuals—especially retirees—who want a monthly income while keeping their capital invested for long-term growth.

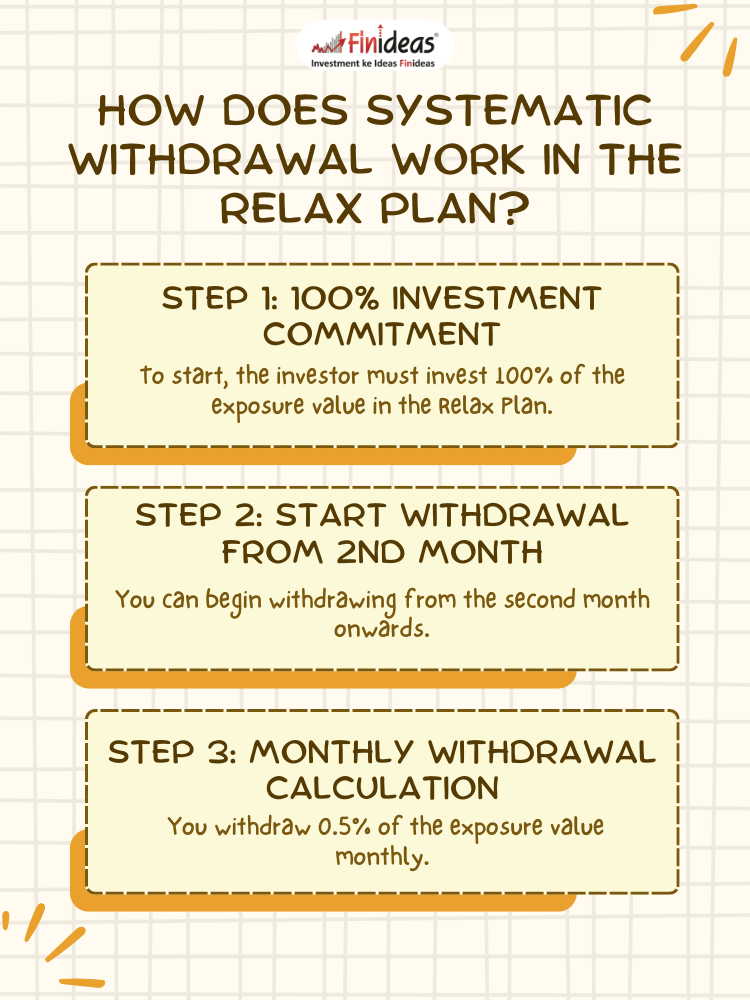

How Does Systematic Withdrawal Work in the Relax Plan?

Let’s break it down step-by-step with a simple example:

- Step 1: 100% Investment Commitment

To start, the investor must invest 100% of the exposure value in the Relax Plan.

✅ Example: If your exposure value is Rs. 1 Crore, you invest the full amount. - Step 2: Start Withdrawal from 2nd Month

You can begin withdrawing from the second month onwards. - Step 3: Monthly Withdrawal Calculation

You withdraw 0.5% of the exposure value monthly.

✅ In this case: You receive Rs. 50,000 every month (0.5% of Rs. 1 Crore).

How Are Your Funds Allocated Within the Relax Plan?

- 30% of your capital (i.e., Rs. 30 Lakhs) is invested in Index Long Term Strategy for equity exposure.

- 70% (i.e., Rs. 70 Lakhs) is invested in debt funds to generate stable interest income.

- Every month, Rs. 50,000 is redeemed from the debt funds for your payout, while your equity investment continues to grow.

What Happens to Your Investment Over the Long Term?

This strategy gives dual benefits:

- Regular income every month.

- Capital appreciation through long-term equity growth.

Index Strategy Performance Table (2002–2023)

| Date | Nifty | Investment (Rs.) | Value (Rs.) | P&L (Rs.) | Nifty Return | Strategy Return |

|---|---|---|---|---|---|---|

| 12/31/2002 | 1100 | -1,00,00,000 | 1,00,00,000 | – | – | – |

| 12/31/2003 | 1880 | 6,00,000 | 1,61,33,056 | 67,33,056 | 71% | 67% |

| 12/31/2004 | 2081 | 6,00,000 | 1,66,21,332 | 10,88,276 | 11% | 7% |

| 12/30/2005 | 2837 | 6,00,000 | 2,14,07,058 | 53,85,726 | 36% | 32% |

| 12/29/2006 | 3966 | 6,00,000 | 2,85,23,043 | 77,15,985 | 40% | 36% |

| 12/31/2007 | 6139 | 6,00,000 | 4,24,98,565 | 1,45,75,522 | 55% | 51% |

| 12/31/2008 | 2959 | 6,00,000 | 4,03,94,292 | -15,04,274 | -52% | -4% |

| 12/31/2009 | 5201 | 6,00,000 | 6,92,55,696 | 2,94,61,404 | 76% | 73% |

| 12/31/2010 | 6135 | 6,00,000 | 7,87,06,705 | 1,00,51,009 | 18% | 15% |

| 12/30/2011 | 4624 | 6,00,000 | 7,54,02,973 | -27,03,732 | -25% | -3% |

| 12/31/2012 | 5905 | 6,00,000 | 9,33,51,081 | 1,85,48,107 | 28% | 25% |

| 12/31/2013 | 6304 | 6,00,000 | 9,58,76,182 | 31,25,101 | 7% | 3% |

| 12/31/2014 | 8283 | 6,00,000 | 12,20,94,987 | 2,68,18,805 | 31% | 28% |

| 12/31/2015 | 7946 | 6,00,000 | 11,73,63,500 | -41,31,486 | 4% | 3% |

| 12/30/2016 | 8186 | 6,00,000 | 11,63,78,814 | -3,84,686 | 3% | 0% |

| 12/29/2017 | 10531 | 6,00,000 | 14,51,62,825 | 2,93,84,011 | 29% | 25% |

| 12/31/2018 | 10780 | 6,00,000 | 14,31,03,275 | -14,59,550 | 2% | -1% |

| 12/31/2019 | 12168 | 6,00,000 | 15,60,98,854 | 1,35,95,579 | 13% | 10% |

| 12/31/2020 | 13982 | 6,00,000 | 17,34,97,987 | 1,79,99,133 | 15% | 12% |

| 12/31/2021 | 17354 | 6,00,000 | 20,89,08,277 | 3,60,10,290 | 24% | 21% |

| 12/31/2022 | 18191 | 6,00,000 | 21,13,85,462 | 24,77,185 | 5% | 1% |

| 12/31/2023 | 21731 | 6,00,000 | 24,48,30,761 | 3,34,45,299 | 19% | 16% |

✅ Summary:

- Total Withdrawn (2003–2024): ₹1.32 Crores

- Final Investment Value in 2024: ₹12.15 Crores

This clearly demonstrates how long-term investing in an index with regular withdrawals can still lead to significant wealth creation, thanks to the power of compounding.

Who Should Consider Regular Withdrawal?

This is ideal for:

- Retired individuals who want a steady monthly income.

- Conservative investors looking to fund regular expenses without exiting the equity market.

Why Is It Only Available in the Relax Plan?

The Relax Plan supports systematic withdrawal because:

- It requires 100% exposure investment, making income generation reliable.

- The other plans like Basic, Comfort, and Power Booster don’t support full investment, as they are designed for flexibility and diversification, not for regular income.

How Does Finideas Make It Even Better?

The Index Long Term Strategy by Finideas uses advanced quantitative models to take 100% exposure using only 30% capital. The remaining capital is placed in secure debt instruments, generating income and reducing risk.

This model has proven its performance for over two decades, even while generating regular withdrawals for clients. It’s one of the top strategies to invest in India for both growth and income.

Infographic-Ready Point 🖼️

📌 Get Rs. 50,000/month from Rs. 1 Crore invested – while your capital grows!

(0.5% monthly withdrawal in Finideas’ Relax Plan with long-term growth potential)

Final Thoughts: Can You Really Have the Best of Both Worlds?

Yes. With the Systematic Withdrawal under Finideas’ Relax Plan, you get regular income and long-term capital growth. It’s a smart, balanced way to invest—especially for retirees and conservative investors.

❓What’s Your Take?

Would you prefer getting monthly income from your investments or letting them grow untouched for 10+ years?

💬 Comment down below and share your strategy!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.