It is not easy to invest in the stock market but with a systematic investment plan you can easily build your wealth over time. SIP is widely accepted as a very investment strategic way of investing the world over millions of investors use it actively. In this article we will understand what SIP is, how it works and why you should use it seriously for long term wealth creation.

What is the systematic investment plan?

An SIP is a style of investing wherein instead of investing all your money in a lumpsum you invest it in regular and smaller instalments, usually every fortnight or every month.

For example, if you save ₹5000 every month then at the end of the year you will have 5000 * 12 equal to ₹60,000 with you. In the lump sum style of investment, you will invest the 60,000 at one go.

However, you can also invest the same ₹5000 every month instead of waiting for the year to end. In this way you will be able to average out the price at which you are buying these investments over a period of time.

The benefits of SIP

There are several benefits of SIP over lump sum investing. These are:

- Rupee cost averaging:

Remember that the share prices go up and down every day whenever the stock markets are open. Now since you will be investing a specific sum of money in shares every month via sip, instead of investing in a lump sum, you will be able to buy the assets are different prices.

This approach will therefore average out your cost of purchasing these shares and earn higher returns in the long term.

- Enjoy the power of compounding:

The benefit of investing regularly on staying invested for a long time will allow your returns to grow at a compound rate. This is the best way in which you can build your wealth. Not only will you earn interest on the amount that you have invested, but you will also get interest upon interest.

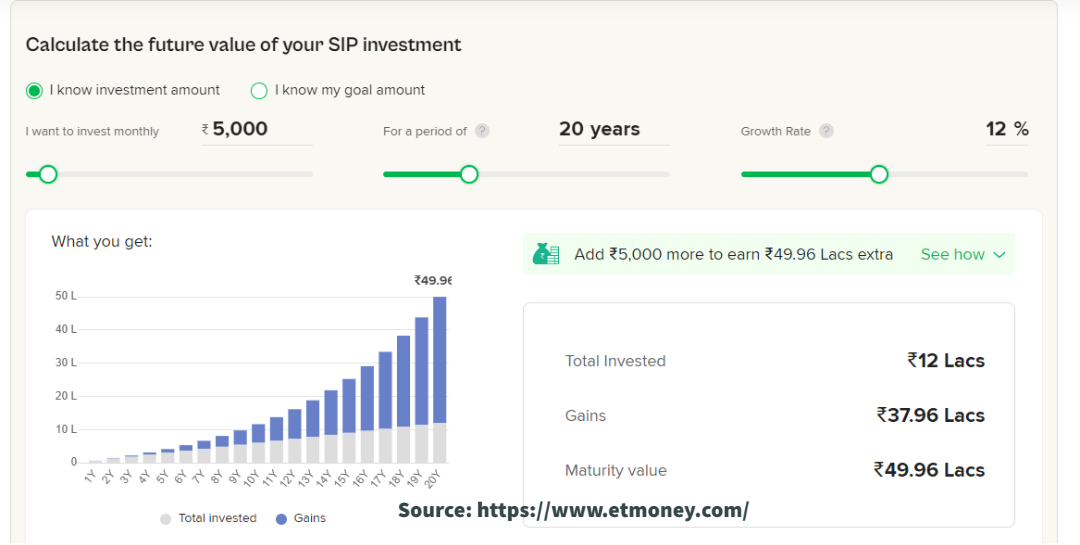

For an example, if you invest ₹5000 every month and continue to do so for 20 years, your investments will grow to almost ₹50,00,000, assuming an expected rate of return of 12%. This is simply fascinating considering the fact that the total amount that you will invest in these 20 years is just rupees (5000x12x20) = ₹12,00,000.

- Reduces your risk.

When you invest all your money in the lump sum you expose yourself to the risk of buying doshas at very high prices. If the share price falls after you have purchased, all your money will get stuck in the shares. By investing smaller amounts of money at regular intervals through sip you will be able to protect yourself from this risk.

Always remember that timing the markets is very difficult. By making our investments at regular intervals you will therefore reduce your chances of losing a large amount of money in a single investment.

- Convenient and affordable:

You can start a SIP with a very small budget, as low as ₹500 per month. Hence there is no need to wait for accumulating a large sum of money.

Also it is extremely easy to start and SIP. You just need to sign up SIP mandate with a mutual fund company, stockbroker or bank to get started. Now a days this can be done online so there is no need to even go to their offices to do this. All you need to do is sign up the sip mandate and ensure that there is adequate money in your bank account every month so that the SIP investment can go through.

- Diversification of portfolio

You can invest in a wide range of mutual funds and shares through sip. This will allow you to diversify your investments further. Mutual funds generally invest in basket of shares, thereby spreading your risk across different assets. Even if you are investing in shares ensure that you choose multiple shares instead of one.

This diversification will help you earn consistent returns from your investments over time.

- Easy tracking:

Nowadays every mutual fund company and stockbroker provides you with the facility to view your portfolio online by logging on to their website. This makes it extremely easy for you to track the performance of your portfolio and monitor the progress. You may also make further transactions in your account to ensure that you reach your financial goals steadfastly.

Where can you best through SIP?

Equity mutual funds: these our nation fund schemes that invest in the shares of different large cap mid cap or small cap companies. It is generally advisable to invest in large cap or mid cap mutual funds through IP as returns from small cap funds can be quite unstable. The large cap or mid cap funds can give you Higher returns in the long run and will be better for building wealth.

- Debt mutual funds: If you are looking for stable returns at a low risk than fixed income mutual funds will be better for you. These mutual funds invest in various fixed income instruments like bonds. A SIP in debt mutual funds is ideal for people who have low risk tolerance or are close to retirement.

- Hybrid mutual funds: These funds offer the best of both worlds by investing in both equity and debt. If you are looking for stable returns as well as growth, then go for hybrid mutual funds.

- Direct equity: If investing in mutual fund is not your thing then you can directly pick a stock or basket of stocks where you would like to invest your money through SIP.

Conclusion:

You have seen that is SIP can be a very important tool for you in your long term wealth creation journey. The benefits that it offers are highly compelling and perfect for providing stability and growth to your portfolio. So, make a smart choice today. Sign up for a SIP in the mutual funds stocks of your choice and watch your wealth grow steadily over time.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.