How to Leverage NIFTY 50 for Tax-Saving Investments Before March 31

Why Should You Consider NIFTY 50 for Tax-Saving Investments?

As the financial year comes to an end on March 31, investors in India rush to find tax-saving options. But did you know that investing in NIFTY 50-based funds can help you save taxes while growing your wealth?

Under Section 80C of the Income Tax Act, 1961, investments up to ₹1.5 lakh in certain instruments are eligible for tax deductions. One of the best ways to leverage this benefit is by investing in NIFTY 50-linked tax-saving options like ELSS funds and Index Long Term Strategy (ILTS) by Finideas.

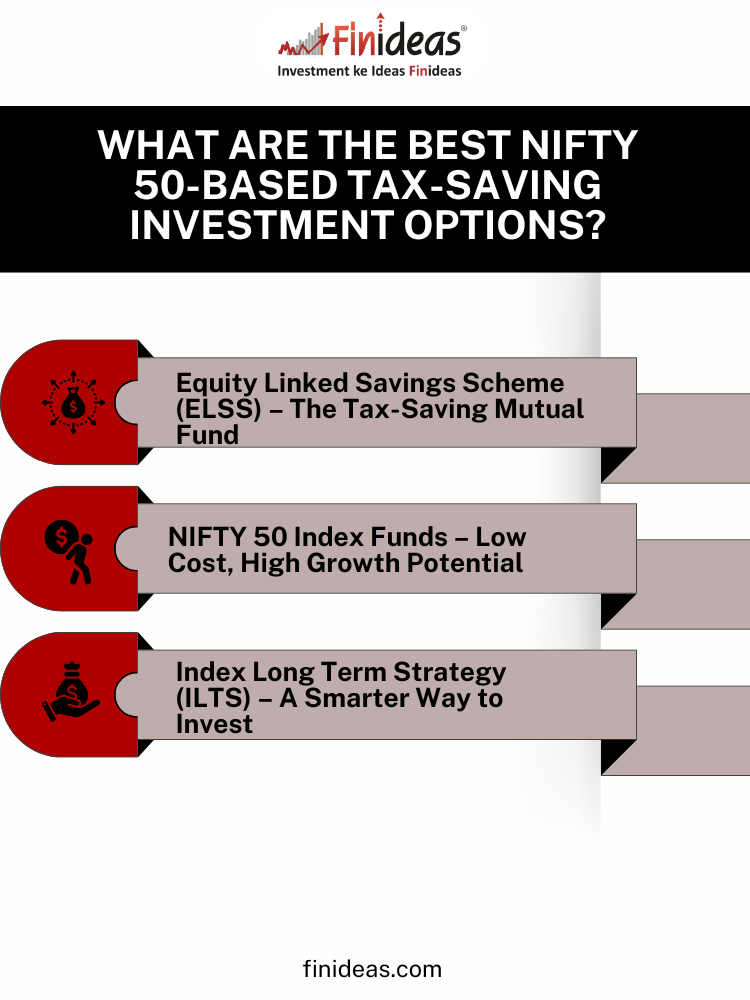

What Are the Best NIFTY 50-Based Tax-Saving Investment Options?

Equity Linked Savings Scheme (ELSS) – The Tax-Saving Mutual Fund

- ELSS funds are mutual funds that primarily invest in equity markets, including NIFTY 50 stocks.

- They offer tax deductions of up to ₹1.5 lakh under Section 80C.

- These funds have a lock-in period of only 3 years, the shortest among all tax-saving options.

- Example: If you invest ₹1.5 lakh in an ELSS fund tracking NIFTY 50, you can save up to ₹46,800 in taxes (assuming a 31.2% tax slab).

NIFTY 50 Index Funds – Low Cost, High Growth Potential

- These funds track the performance of the NIFTY 50 index and offer stable, long-term returns.

- Though not directly tax-saving, investing in NIFTY 50 index funds via ELSS gives dual benefits—tax savings and wealth creation.

- Example: If NIFTY 50 grows by 12% per year, a ₹1.5 lakh investment can grow to ₹2.1 lakh in 3 years.

Index Long Term Strategy (ILTS) – A Smarter Way to Invest

One of the best ways to leverage NIFTY 50 for tax-saving and long-term wealth creation is through the Index Long Term Strategy (ILTS) by Finideas.

✅ Minimizes market timing risks

✅ Maximizes compounding benefits

✅ Uses a systematic approach to invest in NIFTY 50

Why ILTS? Unlike traditional investments, ILTS helps investors capture the long-term growth of the market while also reducing volatility.

How Much Tax Can You Save by Investing Before March 31?

Here’s a quick breakdown:

Investment Type | Max Investment (₹) | Tax Deduction (₹) under 80C | Lock-in Period |

ELSS (NIFTY 50-linked funds) | ₹1,50,000 | Up to ₹46,800* | 3 Years |

NIFTY 50 Index Funds (ILTS Approach) | No limit | No direct deduction, but lower LTCG tax | Long-term |

*Assuming a 31.2% tax bracket

What Should You Do Before March 31 to Maximize Benefits?

✔ Invest in ELSS funds linked to NIFTY 50 to claim ₹1.5 lakh tax deduction under Section 80C.

✔ Start with an Index Long Term Strategy (ILTS) for long-term wealth creation while minimizing risk.

✔ Avoid waiting till the last moment – The earlier you invest, the better your returns and tax benefits.

Conclusion

Investing in NIFTY 50-based tax-saving options before March 31 is a smart financial decision. Whether through ELSS funds, index funds, or the ILTS strategy, you can save taxes while growing your wealth efficiently.

💬 What’s your preferred tax-saving investment strategy? Comment below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.