How to Use Index Funds to Build a Retirement Corpus

Planning for retirement is crucial, and one of the best ways to build a solid retirement corpus in India is by investing in index funds. These funds offer a low-cost, passive investing approach, making them ideal for long-term wealth creation. In this guide, we will take you through a step-by-step process on how to use index funds to build your retirement corpus efficiently.

What Are Index Funds and How Do They Work?

Index funds are mutual funds that track a specific stock market index, such as the NIFTY 50 or Sensex. Instead of actively picking stocks, they replicate the performance of the index by holding the same stocks in the same proportion. This ensures steady growth, lower costs, and minimal risk.

For example, if the NIFTY 50 grows at an average annual rate of 12%, an index fund tracking it will offer nearly the same return, minus a small expense ratio.

Why Are Index Funds a Good Choice for Retirement?

- Low Cost: Since they follow an index, index funds have lower expense ratios (0.1%–0.5%), unlike actively managed funds with fees of 1.5%–2%.

- Compounding Benefits: Over 20-30 years, small investments can grow significantly due to compound interest.

- Market-Beating Consistency: Over the long term, index funds often outperform actively managed funds.

- Diversification: Index funds automatically diversify your investment across multiple stocks.

Step-by-Step Guide to Using Index Funds for Retirement

Step 1: Define Your Retirement Goal

Calculate how much you need for retirement. Suppose you need ₹5 crores by retirement and have 30 years to invest. If you earn 12% CAGR from index funds, you need to invest ₹10,000 per month in an SIP to reach your goal.

Step 2: Choose the Right Index Fund

- NIFTY 50 Index Fund: Best for steady growth.

- NIFTY Next 50 Index Fund: For slightly higher risk and returns.

- Sensex Index Fund: Another reliable choice tracking India’s top 30 companies.

Step 3: Start a Systematic Investment Plan (SIP)

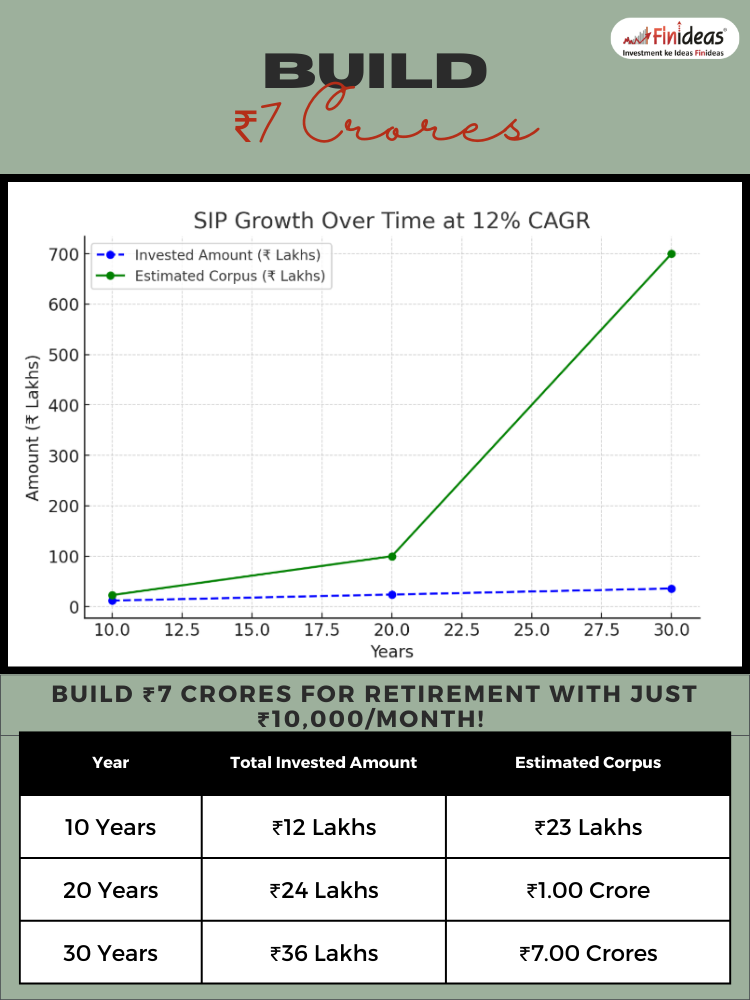

SIPs allow you to invest a fixed amount monthly. Example:

- ₹5,000/month for 30 years at 12% CAGR = ₹3.5 crores

- ₹10,000/month for 30 years at 12% CAGR = ₹7 crores

Step 4: Increase SIP Contribution Over Time

To combat inflation, increase your SIP by 5%-10% every year. This ensures your investment grows in line with rising costs.

Step 5: Stay Invested for the Long Term

Avoid panic selling during market downturns. Over time, the market recovers and continues to grow.

Step 6: Use the Index Long Term Strategy (ILTS) of Finideas

One of the best ways to optimize returns in index funds is through the Index Long Term Strategy (ILTS) of Finideas. This strategy focuses on systematic long-term investments in index funds while managing risk efficiently. Finideas’ ILTS helps maximize wealth creation while keeping the process simple and disciplined.

Step 7: Shift to Conservative Funds Closer to Retirement

Around 5 years before retirement, start shifting investments to debt funds or fixed deposits to reduce risk and secure gains.

Conclusion

Building a retirement corpus through index funds is a smart, low-cost, and effective strategy. By following a disciplined approach with SIPs, increasing investments over time, and leveraging strategies like Finideas’ Index Long Term Strategy, you can secure a financially stable retirement.

What’s Your Retirement Investment Plan?

Comment below and let us know how you are planning for your retirement corpus!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.