Inflation and Investing: Opportunities and Risks

Introduction:

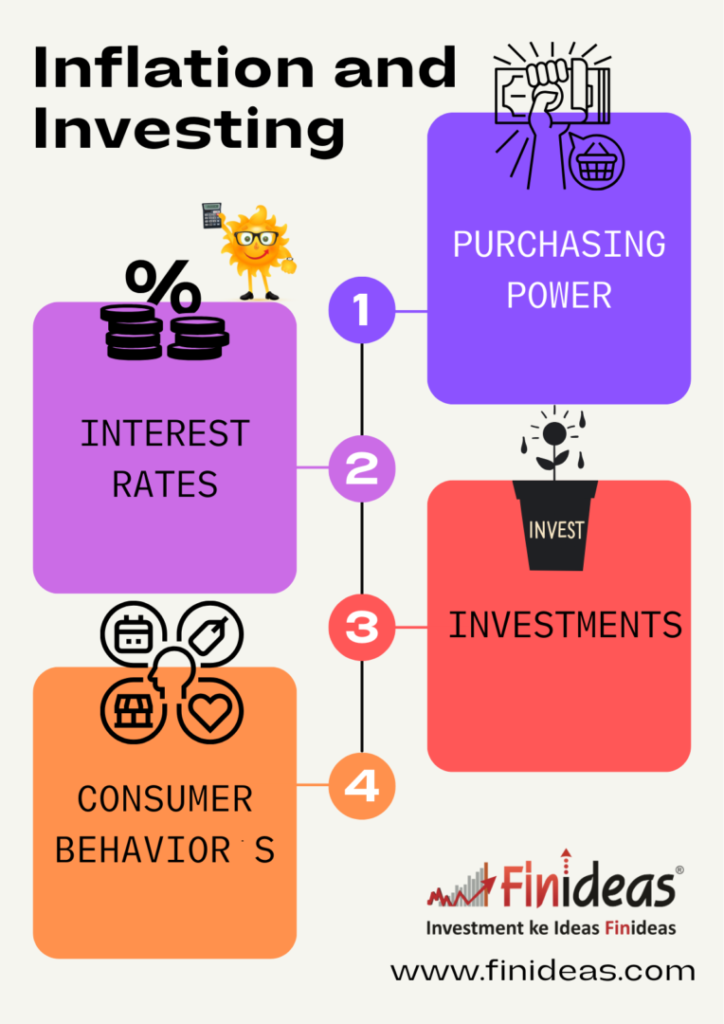

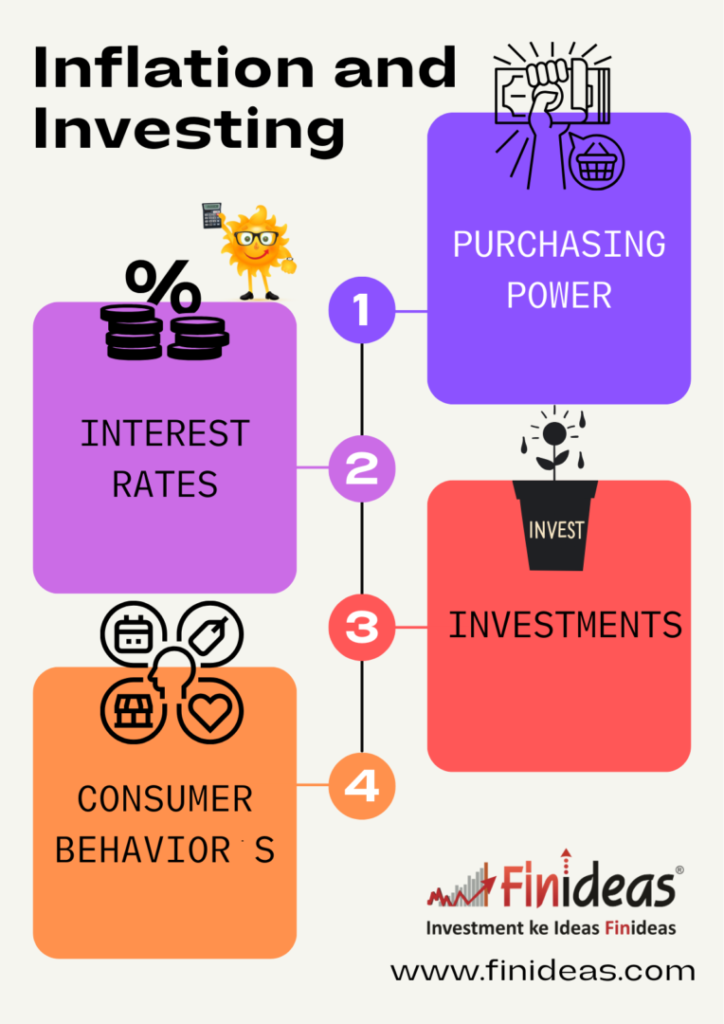

Inflation is the persistent increase in the general price level of goods and services in an economy over time. It’s measured as an annual percentage, reflecting the declining purchasing power of a currency. Inflation is significant in the economy as it affects various aspects:

- Purchasing Power: Inflation reduces the real value of money, meaning individuals can buy fewer goods and services with the same amount of currency, eroding their purchasing power.

- Interest Rates: Inflation influences central banks’ decisions on interest rates, impacting borrowing costs, investments, and overall economic growth.

- Investments: It affects the performance of assets like bonds, stocks, and real estate, making it a critical consideration for investors.

- Consumer Behavior’s: Inflation can influence consumer spending patterns and impact the overall economic stability and growth.

Understanding Inflation:

Moderate inflation and hyperinflation differ primarily in their magnitude and impact on an economy.

Moderate inflation is characterized by a gradual and controlled increase in the general price level, typically ranging from 2% to 10% annually. It can be manageable and even beneficial, as it encourages spending and investments while preventing deflation.

In contrast, hyperinflation is an extreme form of inflation, involving an uncontrollable and rapid surge in prices, often exceeding 50% per month. It results from various factors like excessive money supply growth, loss of confidence in a currency, or economic crises. Hyperinflation disrupts economic stability, destroys savings, and requires immediate and drastic measures to restore monetary order.

Investment Opportunities in an Inflationary Environment:

During periods of inflation, certain asset classes tend to perform relatively well due to their ability to preserve or increase in value in response to rising prices. Here are some asset classes that investors often consider during inflation:

- Equities (Stocks): Historically, stocks have shown resilience during moderate inflation. Companies can often pass on increased production costs to consumers, which can boost revenues and profits. Additionally, equities can act as a hedge against inflation, as the real value of future corporate earnings may grow.

- Real Assets (Real Estate and Commodities): Real assets have intrinsic value and can serve as effective hedges against inflation. Real estate investments, such as residential or commercial properties, tend to appreciate in value as the cost of living and construction materials rise. Commodities like gold, silver, oil, and agricultural products often see increased demand during inflationary periods, as they have tangible value and can protect against currency devaluation.

- Inflation-Indexed Bonds (TIPS): These bonds are specifically designed to protect against inflation. Their principal value adjusts with inflation, ensuring that the investor receives a real return. TIPS can be a safe option for investors looking to preserve their purchasing power.

- Stocks in Inflation-Resistant Sectors: Some sectors, like utilities, consumer staples (e.g., food and beverages), and healthcare, are considered defensive against inflation. These companies provide essential goods and services that remain in demand regardless of economic conditions.

- Foreign Currencies and Assets: Investing in assets denominated in foreign currencies or holding foreign currencies themselves can be a strategy to diversify against domestic currency depreciation caused by inflation.

It’s essential to note that the performance of these asset classes during inflation can vary based on the severity and duration of inflation, as well as broader economic conditions. Diversifying across different inflation-resistant assets can help mitigate risks and enhance a portfolio’s resilience in an inflationary environment. However, investors should carefully assess their risk tolerance and financial goals when making investment decisions. Consulting with a financial advisor is advisable for personalized guidance.

Do you Think your investment will beat Inflation ? Comment Down Below

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.