Investment Advisors vs. DIY Investing: Pros and Cons

Introduction

When it comes to managing your hard-earned money and securing a prosperous financial future, the decision between using an investment advisor or pursuing a do-it-yourself (DIY) approach is a crucial one. Both avenues offer distinct advantages and drawbacks, and understanding these can help you make an informed choice that aligns with your financial goals, risk tolerance, and level of expertise. In this blog, we’ll delve into the pros and cons of investment advisors versus DIY investing to help you make the best decision for your financial journey.

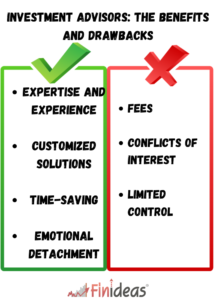

Investment Advisors: The Benefits and Drawbacks

Pros:

- Expertise and Experience: Investment advisors are trained professionals who possess in-depth knowledge of financial markets, investment strategies, and portfolio management. They have experience navigating various economic conditions, and their insights can help you make well-informed decisions that match your financial goals and risk profile. To get better advice on Index Long Term Strategy contact us.

- Customized Solutions: A skilled investment advisor tailors investment strategies to your individual circumstances. They take into account your financial objectives, risk tolerance, time horizon, and other factors to create a personalized plan designed to optimize your returns and manage your risk exposure.

- Time-Saving: Managing investments can be time-consuming, requiring thorough research, analysis, and monitoring. With an investment advisor, you can delegate these tasks to a professional, freeing up your time for other pursuits.

- Emotional Detachment: The world of investing is fraught with emotional highs and lows. Investment advisors provide an objective perspective, helping you stay rational and disciplined in the face of market fluctuations, which can lead to better long-term outcomes.

Cons:

- Fees: Investment advisors typically charge fees for their services, which can include a percentage of your assets under management (AUM) or flat fees. These costs can eat into your overall returns, especially in periods of lower market performance.

- Conflicts of Interest: Some investment advisors may be driven by commissions or incentives tied to specific financial products. This could potentially lead to recommendations that aren’t entirely aligned with your best interests.

- Limited Control: Entrusting your investments to an advisor means relinquishing a degree of control over your portfolio decisions. While this can be beneficial for some, others may prefer more hands-on involvement in their investment choices.

DIY Investing: The Advantages and Challenges

Pros:

- Cost Savings: DIY investing often comes with lower fees compared to hiring an investment advisor. With the rise of online brokerages and investment platforms, you can execute trades at a fraction of the cost of traditional advisory services.

- Control and Flexibility: Opting for a DIY approach gives you complete control over your investment decisions. You can choose investments that align with your personal values and preferences, and you have the flexibility to adjust your portfolio in real-time as market conditions change.

- Educational Opportunity: Managing your investments independently offers a valuable learning experience. It encourages you to educate yourself about different investment strategies, asset classes, and market dynamics, potentially enhancing your financial literacy.

Cons:

- Lack of Expertise: One of the most significant challenges of DIY investing is the potential lack of expertise. Without a deep understanding of financial markets, you might make suboptimal decisions that could negatively impact your returns and long-term financial goals.

- Emotional Biases: DIY investors might be more susceptible to emotional biases, such as fear and greed, which can lead to impulsive decisions during market volatility.

- Time and Effort: Successfully managing your investments requires substantial time and effort. From research and analysis to ongoing monitoring and rebalancing, the DIY route can be demanding, particularly for individuals with busy schedules.

Conclusion

Ultimately, the choice between investment advisors and DIY investing depends on your financial goals, risk tolerance, level of expertise, and willingness to commit time and effort. Investment advisors offer expertise, personalized solutions, and emotional detachment, but they come with fees and potential conflicts of interest. On the other hand, DIY investing offers cost savings, control, and educational opportunities, but it requires a solid understanding of financial markets and the ability to manage emotions.

A hybrid approach is also worth considering, where you strike a balance between using an investment advisor for strategic guidance and handling certain investment decisions yourself. Whichever path you choose, remember that investing is a long-term endeavor, and staying disciplined and informed is key to achieving your financial aspirations.

What do you prefer Investment Advisor or DIY Investing? Comment Down Below

Happy Investing!