NIFTY 50 vs Bank NIFTY: Which Index Should You Bet On?

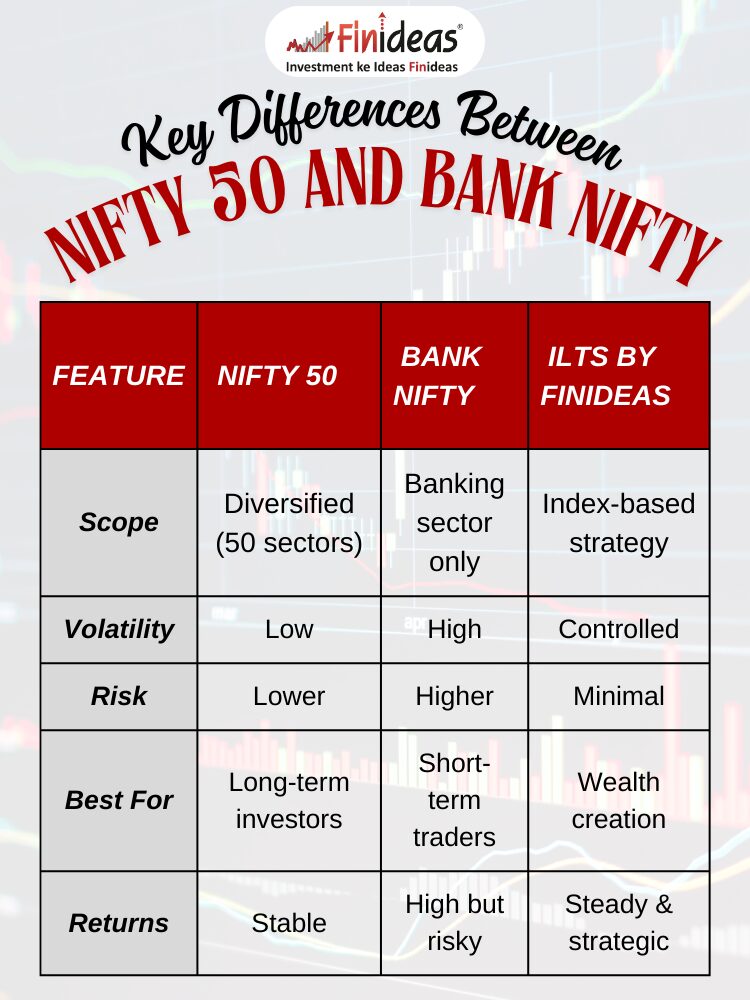

Investors in India often face a common dilemma: Should they invest in NIFTY 50 or Bank NIFTY? Both indices have their advantages, but the right choice depends on your investment goals, risk appetite, and market outlook. In this blog, we will break down the key differences, compare their past performances, and discuss the best strategy for long-term investing.

What is NIFTY 50?

NIFTY 50 is India’s leading stock market index, comprising the top 50 companies from various sectors listed on the National Stock Exchange (NSE). It represents the broader economy, including IT, finance, energy, FMCG, and more.

Key Features:

✔ Diversified Portfolio – Covers multiple sectors, reducing sector-specific risks.

✔ Stable Growth – Less volatile compared to sectoral indices.

✔ Ideal for Long-Term Investing – Offers steady returns over time.

Performance Example:

- As of recent data, NIFTY 50 has delivered an average annual return of around 12-15% over the last 10 years.

- If you had invested ₹1 lakh in NIFTY 50 a decade ago, your investment would have grown to approximately ₹3.1 lakh today (assuming a 12% CAGR).

2. What is Bank NIFTY?

Bank NIFTY is a sectoral index that includes the 12 largest banking stocks in India. Since banking is a crucial part of the economy, Bank NIFTY often sees higher volatility than NIFTY 50.

Key Features:

✔ Higher Volatility – Moves sharply based on interest rates, credit growth, and economic policies.

✔ Short-Term Trading Opportunities – Preferred by traders due to high liquidity and price swings.

✔ Highly Correlated with RBI Policies – Interest rate decisions impact Bank NIFTY significantly.

Performance Example:

- Bank NIFTY has delivered an average annual return of around 15-18% over the last decade, outperforming NIFTY 50 in bullish periods.

- If you had invested ₹1 lakh in Bank NIFTY 10 years ago, it could have grown to ₹4.2 lakh today (assuming a 15% CAGR).

3.Which One is Better for Long-Term Investment?

For long-term wealth creation, NIFTY 50 is a better option due to its diversified nature and lower volatility. While Bank NIFTY can offer higher returns in bullish phases, it is more prone to sharp corrections during economic downturns.

Best Strategy: Index Long-Term Strategy (ILTS) of Finideas

A disciplined investment approach is crucial for long-term wealth creation. The Index Long-Term Strategy (ILTS) by Finideas is designed to help investors systematically grow their money with minimal risk. By investing in index-based funds like NIFTY 50, investors can leverage market growth while avoiding excessive risk from individual stocks or sectors.

Why Does ILTS Work?

✔ Invests in diversified indices for steady growth.

✔ Reduces market timing risks.

✔ Ensures wealth compounding over time.

4. Final Verdict: Where Should You Invest?

- If you are a long-term investor looking for steady returns, go with NIFTY 50.

- If you are a short-term trader who can handle risk, then Bank NIFTY might be a better choice.

However, for those looking to create massive wealth with a safe approach, the Index Long-Term Strategy (ILTS) of Finideas is one of the best investment strategies.

What’s Your Take?

Which index do you prefer: NIFTY 50 or Bank NIFTY? Comment below and share your thoughts! 🚀👇

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.