Preparing for a Financial Windfall

Introduction:

In the journey of life, unexpected blessings occasionally grace our path in the form of financial windfalls. Whether it’s an inheritance, a lottery win, or an unexpected bonus, these moments bring with them the promise of a brighter financial future. However, such windfalls also come with responsibilities and challenges that require thoughtful consideration and planning. In this gentle guide, we’ll explore the various aspects of preparing for a financial windfall, ensuring that this influx of prosperity becomes a catalyst for long-term financial well-being.

Creating a Financial Plan:

One of the first steps in preparing for a financial windfall is to create a comprehensive financial plan. Take the time to assess your current financial situation and establish clear goals for the future. Consider factors such as budgeting, saving, and investing to align your newfound wealth with your long-term objectives.

Understanding the Nature of the Windfall:

Not all windfalls are created equal, and understanding the nature of the windfall is crucial. Whether it’s an inheritance laden with sentimental value or a lottery win bringing unforeseen wealth, each type comes with its own set of considerations. Delve into the tax implications and legal aspects to ensure that you navigate this windfall smoothly.

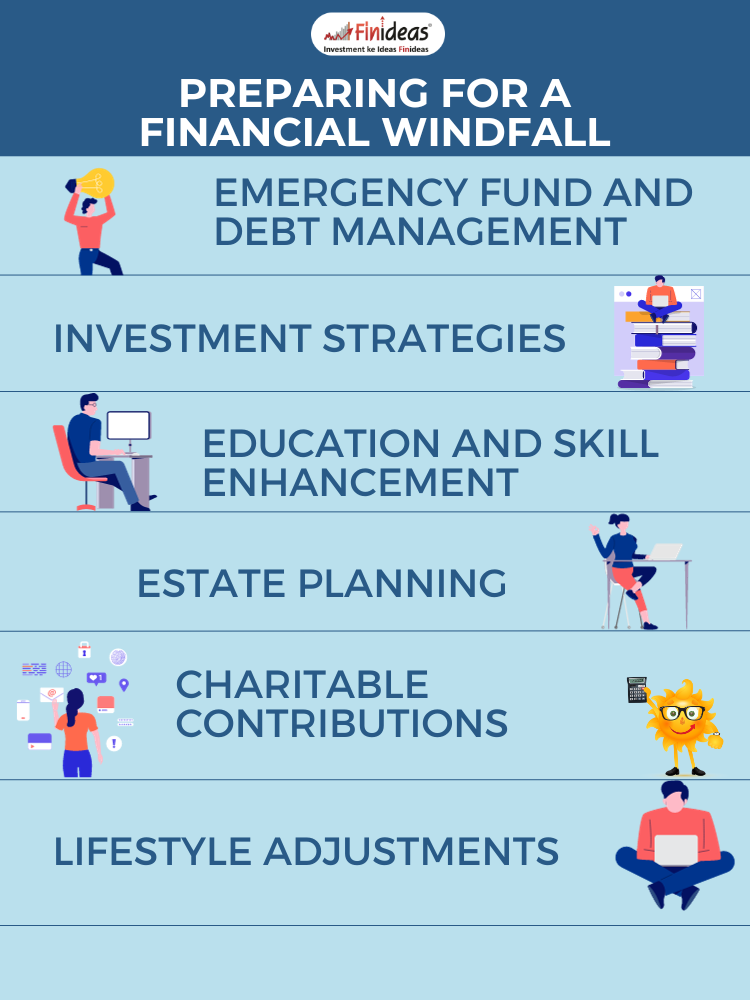

Emergency Fund and Debt Management:

Before embarking on grand financial endeavors, fortify your financial foundation. Consider using a portion of the windfall to establish or bolster an emergency fund, providing a safety net for unforeseen circumstances. Additionally, evaluate existing debts and formulate a strategy to manage and reduce them responsibly.

Investment Strategies:

Diversification is the key to sustainable financial growth. Explore various investment options to ensure a balanced portfolio that aligns with your risk tolerance and financial goals. Seeking professional financial advice can provide valuable insights and help you make informed decisions about your investments.

Education and Skill Enhancement:

Investing in yourself is one of the wisest decisions you can make with a financial windfall. Consider allocating funds for education or skill development that can enhance your future earning potential. Strike a balance between short-term gains and long-term benefits to ensure a holistic approach to personal growth.

Estate Planning:

While the prospect of estate planning may seem daunting, it is a critical aspect of managing a financial windfall responsibly. Update or create a will to reflect your current circumstances and consider the use of trusts and other estate planning tools to safeguard your assets and provide for your loved ones.

Charitable Contributions:

The joy of sharing newfound prosperity can be immensely rewarding. Explore opportunities for philanthropy and consider making charitable contributions. Not only does this contribute to the greater good, but it may also offer tax advantages, aligning your philanthropic efforts with your financial goals.

Lifestyle Adjustments:

As the saying goes, “With great power comes great responsibility.” Assess your current lifestyle and consider making adjustments that align with your long-term financial goals. Avoid unnecessary splurges and lifestyle inflation to ensure that your newfound wealth contributes to lasting financial security.

Legal and Financial Consultation:

In the intricate landscape of finance, seeking professional advice is akin to having a trusted guide on a challenging journey. Consult with financial advisors, accountants, and lawyers to ensure compliance with legal requirements and make well-informed decisions that stand the test of time.

Building Financial Literacy:

Financial literacy is the cornerstone of sound money management. Take the time to educate yourself on financial matters, empowering you to make informed decisions about investments and money management. A well-informed individual is better equipped to navigate the complexities of wealth.

Family and Relationship Considerations:

The impact of a financial windfall extends beyond individual finances. Open communication with family members is essential to navigate this new chapter together. Discuss your financial goals, set boundaries, and manage expectations to foster a supportive and harmonious environment.

Risk Management:

While a financial windfall opens doors to new possibilities, it also introduces potential risks and uncertainties. Identify and assess these risks, and formulate strategies to mitigate them effectively. A well-thought-out risk management plan ensures the longevity and sustainability of your newfound wealth.

Tax Planning:

Taxes are an inevitable part of financial windfalls, but strategic planning can help optimize your tax situation. Understand the tax implications of your windfall and explore tax-efficient investment options to minimize your tax burden while maximizing the benefits of your newfound prosperity.

Long-Term Sustainability:

Amid the excitement of a financial windfall, it’s crucial to keep an eye on the long-term horizon. Craft a financial strategy that balances short-term needs with long-term goals, ensuring that your newfound wealth contributes to sustained financial well-being for years to come.

Psychological and Emotional Preparedness:

The emotional impact of sudden wealth should not be underestimated. Take the time to address the psychological aspects of this transition. Whether it’s seeking the support of loved ones or engaging with professionals, maintaining emotional well-being is a vital component of preparing for a financial windfall.

Conclusion:

Preparing for a financial windfall is not just about managing money; it’s about crafting a roadmap for a prosperous and fulfilling future. By approaching this windfall with a gentle and thoughtful mindset, you can ensure that your newfound wealth becomes a source of joy, security, and positive change. Embrace the opportunities it brings, make informed decisions, and let your financial windfall be a beacon guiding you towards a brighter and more secure financial future.

Also you must know about Index Long Term Strategy if you are preparing for a financial windfall.

What aspect of long-term financial planning do you find most challenging or intriguing? Share your thoughts and experiences in the comments below.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.