Role of family office in wealth creation

A family office plays a crucial role in wealth creation and management for affluent families. A family office is a private wealth management advisory firm that is established to manage the financial affairs of a wealthy family or multiple families. Its primary purpose is to preserve and grow the family’s wealth over generations.

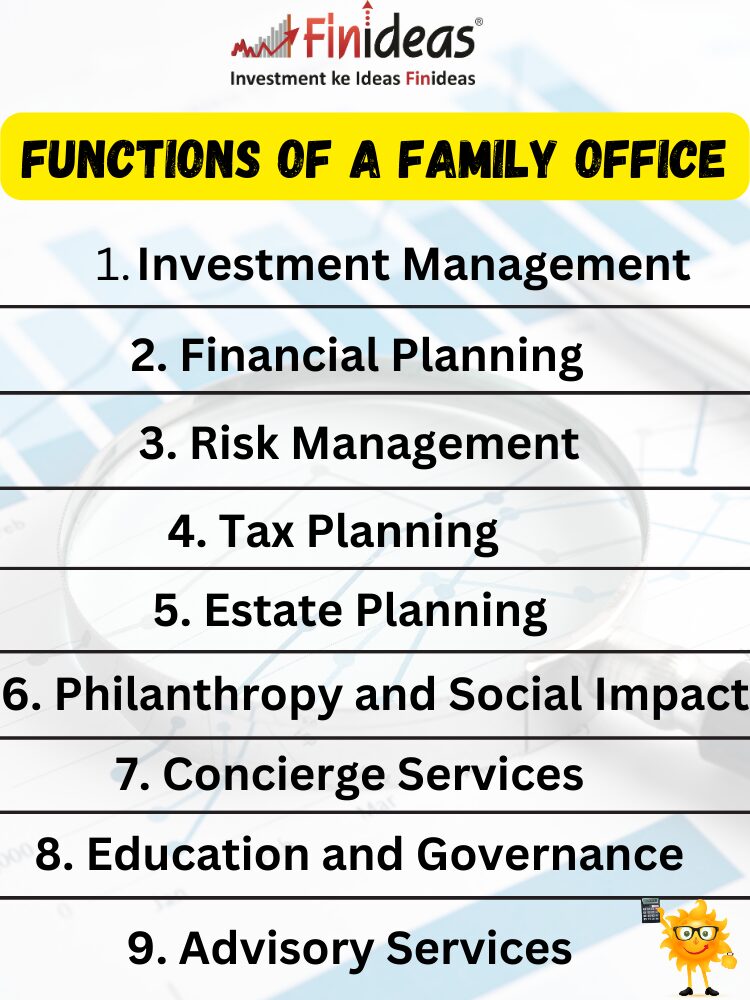

Here are some key roles and functions of a family office in wealth creation:

Investment Management:

Family offices are responsible for developing and implementing investment strategies to grow the family’s wealth. This includes asset allocation, portfolio management, and risk management.

Financial Planning:

Family offices assist in creating comprehensive financial plans that take into account the family’s financial goals, risk tolerance, and time horizon. This includes tax planning, estate planning, and philanthropic planning.

Risk Management:

Identifying and mitigating risks is crucial for wealth preservation. Family offices assess and manage various risks, including market volatility, economic fluctuations, and geopolitical risks.

Tax Planning:

Family offices work on optimizing the family’s tax situation, ensuring compliance with tax laws, and implementing strategies to minimize tax liabilities. This may involve coordination with tax specialists and legal advisors.

Estate Planning:

Planning for the orderly transfer of wealth to future generations is a key aspect. Family offices help in developing estate plans that address inheritance, succession, and the minimization of estate taxes.

Philanthropy and Social Impact:

Many affluent families are interested in giving back to society. Family offices help in structuring and managing philanthropic initiatives, ensuring that charitable goals align with the family’s values and priorities.

Concierge Services:

Family offices often provide concierge services to handle day-to-day administrative tasks, such as bill payment, property management, and coordination of family events. This allows family members to focus on their core interests and activities.

Education and Governance:

Family offices can play a role in educating family members about financial matters, wealth management strategies, and the family’s overall financial situation. They may also assist in establishing family governance structures to ensure effective decision-making.

Advisory Services:

Family offices act as trusted advisors, providing strategic guidance on financial decisions, investment opportunities, and overall wealth management. They work closely with the family to understand their unique needs and tailor solutions accordingly.

If you are interested in long term investment , then you must know about Index Long Term Strategy.

Conclusion

In summary, a family office is a comprehensive solution that goes beyond traditional wealth management. It addresses various aspects of a wealthy family’s financial life, aiming to preserve and enhance wealth across generations. The specific roles and services provided may vary depending on the family’s goals, values, and the complexity of their financial situation.

Among the various functions of a family office outlined, which do you believe requires the most careful navigation and expertise to execute effectively, particularly in today’s ever-changing financial landscape?

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.