Secure Your Golden Years: The Role of Stocks and Bonds in Indian Retirement Investments

Retirement is often referred to as the “golden years” of one’s life, a period to savor the fruits of a life well-lived. However, ensuring financial security during retirement is a significant concern for many in India. The combination of stocks and bonds plays a pivotal role in crafting a stable and rewarding retirement strategy in the Indian context. Let’s delve into the specifics of how these financial instruments work together to provide financial stability during your golden years.

The Indian Retirement Landscape

In India, the retirement scenario is evolving. With the traditional joint family system becoming less prevalent and the government’s social security schemes limited, individuals are increasingly responsible for building their retirement corpus. This is where stocks and bonds come into play.

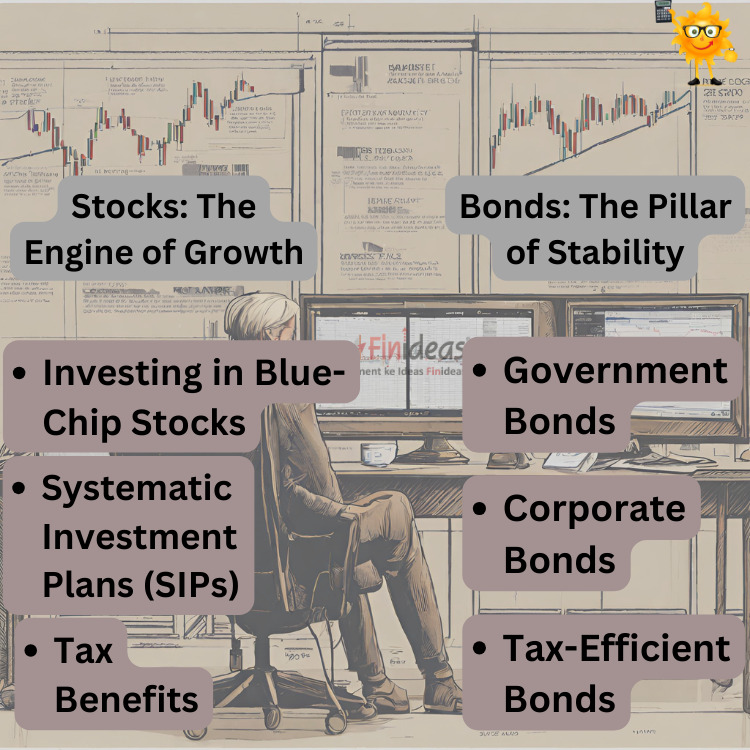

Stocks: The Engine of Growth

Stocks, also known as equities, represent ownership in a company. They have a reputation for their potential to generate substantial returns over the long term. In India, stocks can be a powerful tool for accumulating wealth and securing a comfortable retirement.

- Investing in Blue-Chip Stocks: Blue-chip stocks belong to large, well-established companies with a track record of financial stability. Investing in these firms can form the cornerstone of your retirement portfolio, as they often provide consistent returns over time.

- Systematic Investment Plans (SIPs): SIPs, a popular choice among Indian investors, allow you to invest small, regular amounts in a diversified portfolio of stocks. This disciplined approach can gradually build a substantial retirement nest egg.

- Tax Benefits: Long-term capital gains from Indian stocks enjoy favorable tax treatment, making stocks an attractive option for retirement savings.

If you want to know more about strategies for your golden years planning, you can read about Index Long Term Strategy.

Bonds: The Pillar of Stability

Bonds are debt securities that represent a loan to a corporation or government. They offer periodic interest payments and the return of principal upon maturity. In an Indian retirement portfolio, bonds are crucial for providing stability and a source of regular income.

- Government Bonds: Investments in government bonds, like the National Savings Certificate (NSC) and Public Provident Fund (PPF), provide low-risk options with fixed interest rates, ensuring a guaranteed source of income during retirement.

- Corporate Bonds: Although somewhat riskier than government bonds, corporate bonds often offer higher yields. Careful selection can minimize credit risk, making them an appealing choice for retirees.

- Tax-Efficient Bonds: Certain bonds, such as the Senior Citizens Savings Scheme (SCSS), offer tax benefits, enhancing their appeal for retirees.

Let’s test your knowledge on retirement investments in the Indian context with an interactive question:

Question: What type of investment is typically considered the “growth engine” in an Indian retirement portfolio?

- A) Government Bonds

- B) Corporate Bonds

- C) Stocks

- D) National Savings Certificate

Feel free to share your answer in the comments section below.

The Significance of Diversification

A well-structured retirement investment strategy combines stocks and bonds in a balanced manner, taking into consideration your risk tolerance, financial goals, and investment horizon. Diversification is key to spreading risk and ensuring a smoother retirement journey.

As we have explored, stocks offer growth potential but come with higher volatility, while bonds provide stability and regular income. By striking the right balance, you can create a retirement portfolio that blends growth and stability, aligning with your long-term financial objectives.

In conclusion, for individuals in India, stocks and bonds are pivotal in establishing a robust retirement nest egg. Begin your retirement planning early, guided by your financial goals, and stay adaptable to changing circumstances. With thoughtful consideration and a disciplined approach, you can look forward to a secure, comfortable, and financially stable retirement in the Indian scenario.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.