Tax-Efficient Investing in India: Maximizing Returns While Minimizing Liabilities

Introduction:

Investing wisely is not just about picking the right stocks or funds; it’s also about optimizing your returns by minimizing tax liabilities. In the Indian context, understanding and implementing tax-efficient investment strategies can significantly impact your overall financial success. In this blog, we’ll explore the key principles of tax-efficient investing in India and provide actionable tips for maximizing your returns while keeping your tax liabilities at bay.

Understanding the Tax Landscape in India:

India has a complex tax system with various components such as income tax, capital gains tax, and dividend distribution tax. To navigate this landscape successfully, investors need to be aware of the tax implications associated with different investment instruments. For instance, income from salary, business profits, and capital gains are all taxed differently.

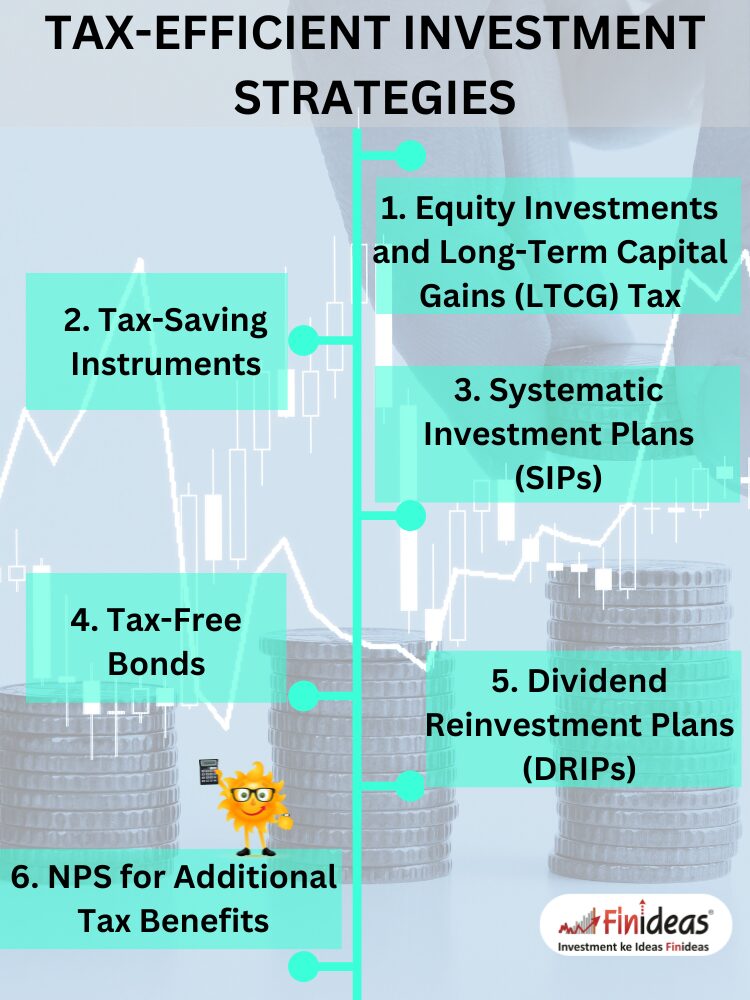

Tax-Efficient Investment Strategies:

Equity Investments and Long-Term Capital Gains (LTCG) Tax:

In India, long-term capital gains from equity investments are taxed at a lower rate compared to short-term gains. Holding your equity investments for more than one year can help you qualify for the LTCG tax benefit.

Tax-Saving Instruments:

Take advantage of tax-saving investment options such as Equity-Linked Saving Schemes (ELSS), Public Provident Fund (PPF), and National Pension System (NPS). These investments not only provide tax benefits under Section 80C but also contribute to your long-term financial goals.

Systematic Investment Plans (SIPs):

Investing through SIPs in mutual funds allows you to benefit from rupee cost averaging. This strategy reduces the impact of market volatility and can be tax-efficient, especially when considering capital gains taxation.

Tax-Free Bonds:

Consider including tax-free bonds in your portfolio. Interest earned from these bonds is tax-free, providing a steady income stream without the burden of additional taxes.

Dividend Reinvestment Plans (DRIPs):

Instead of receiving dividends in cash, opt for DRIPs offered by mutual funds. This way, you can reinvest dividends automatically, potentially saving on dividend distribution tax.

NPS for Additional Tax Benefits:

The National Pension System not only helps in retirement planning but also provides additional tax benefits under Section 80CCD(1B) for voluntary contributions up to ₹50,000.

If you are looking for Long Term Investment then you must know about Index Long Term Strategy.

Before we conclude, we want to hear from you! What tax-efficient investment strategies have you implemented in your portfolio? Share your insights and experiences in the comments below.

Conclusion:

Tax-efficient investing in India requires a strategic approach that aligns with your financial goals. By understanding the nuances of the Indian tax system and adopting the right investment strategies, you can maximize your returns while minimizing tax liabilities. Remember to regularly review your portfolio and adjust your investments based on changes in tax laws or your financial situation. A well-thought-out tax-efficient investment plan can go a long way in securing your financial future.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.