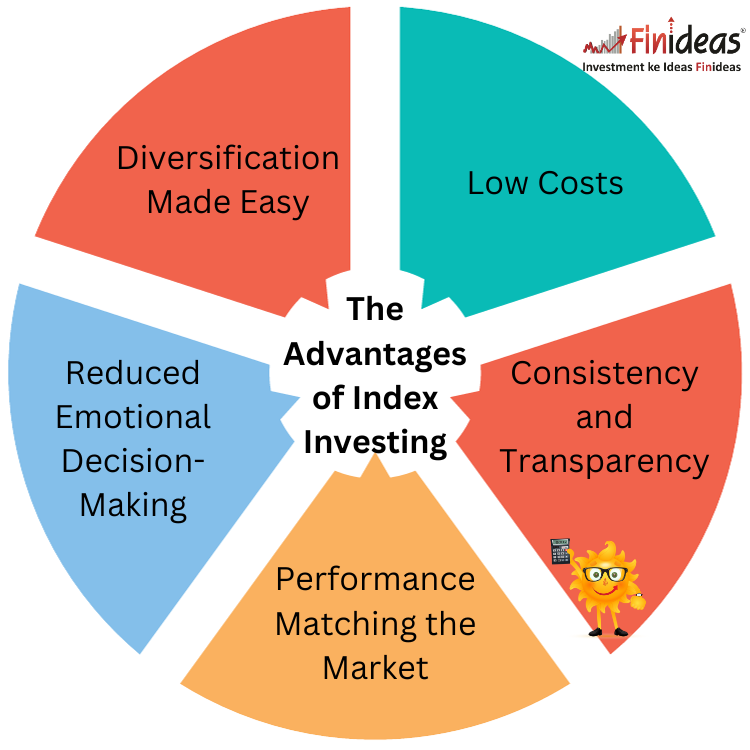

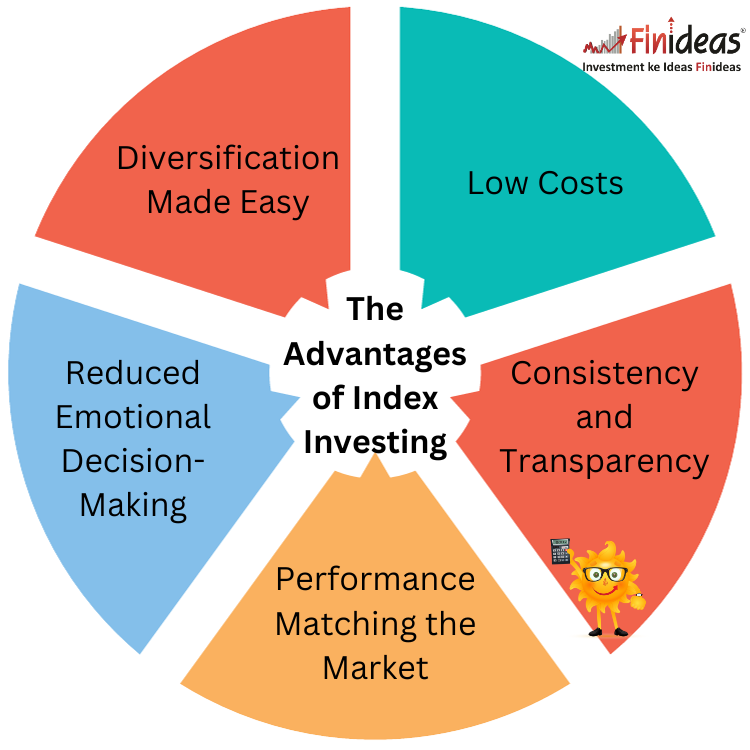

The Advantages of Index Investing

Introduction

Investing is an essential component of achieving financial goals and securing a comfortable future. In recent years, index investing has gained significant popularity among investors of all backgrounds. But what makes index investing such a popular choice? In this blog, we’ll delve into the advantages of index investing and explore why it has become a preferred strategy for many.

Diversification Made Easy

Diversification is a fundamental principle in investing. It involves spreading your investments across various assets to reduce risk. Index investing, through exchange-traded funds (ETFs) or index mutual funds, provides a simple and effective way to achieve diversification. When you invest in an index fund, you essentially own a slice of the entire index, which typically includes a broad range of stocks or bonds. This diversification can help cushion the impact of poor-performing individual assets, reducing the overall risk in your portfolio. Diversification is always helpful in any kind of investment Strategies as it helps into dividing risk for your investment amount as matter of fact You must Checkout Finideas’s Index Long Term Strategy.

Low Costs

One of the most significant advantages of index investing is its cost-effectiveness. Actively managed funds often come with higher management fees and expenses, which can eat into your returns over time. Index funds, on the other hand, aim to replicate the performance of a specific index, and their management is typically automated and passive. This results in lower fees, making index funds an attractive option for cost-conscious investors.

Consistency and Transparency

Index investing is known for its consistency. The rules governing an index are typically well-defined, and the components are publicly disclosed. This transparency allows investors to track the performance of their investments easily. As a result, you have a clear understanding of what you’re investing in and how it’s performing.

Performance Matching the Market

While actively managed funds aim to outperform the market, they often struggle to do so consistently. Index funds, on the other hand, aim to match the performance of a specific market index, which can be a more predictable approach. By investing in an index fund, you’re essentially betting on the long-term growth of the market, and historical data shows that market indexes tend to appreciate over time.

Reduced Emotional Decision-Making

Emotions can lead to impulsive investment decisions, often driven by fear and greed. Index investing takes the emotional element out of the equation. Since index funds are designed to mirror the market, you don’t need to make constant trading decisions. This can help investors stay committed to their long-term financial goals without getting sidetracked by market volatility.

Conclusion

Index investing has become a popular choice for many investors because of its ability to offer diversification, low costs, consistency, transparency, market-matching performance, reduced emotional decision-making. Whether you’re a novice or a seasoned investor, index investing provides an excellent way to build a diversified, low-cost portfolio that can help you work towards your financial goals. So, if you’re considering your investment options, don’t overlook the advantages of index investing – it may be the perfect strategy for you.

What are some specific financial goals you have in mind that you’d like to achieve through investing? Are you saving for retirement, planning to buy a home, or something else? Share your thoughts in the comments below, and let’s discuss how index investing might align with your goals.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.