The Emotional Aspect of Investing: How Investment Advisors Can Provide Stability

Introduction:

Investing in the stock market is akin to riding a rollercoaster – full of ups and downs, twists and turns. While the financial landscape is inherently volatile, what often goes overlooked is the emotional toll it can take on investors. In this blog, we’ll delve into the emotional aspect of investing and discuss how investment advisors can play a pivotal role in providing stability for the Indian audience.

Understanding the Emotional Rollercoaster:

Investing triggers a myriad of emotions, ranging from excitement and euphoria during bull markets to fear and anxiety in times of a market downturn. The emotional rollercoaster can lead investors to make impulsive decisions that may not align with their long-term financial goals. Recognizing and understanding these emotional responses is crucial for both investors and their advisors.

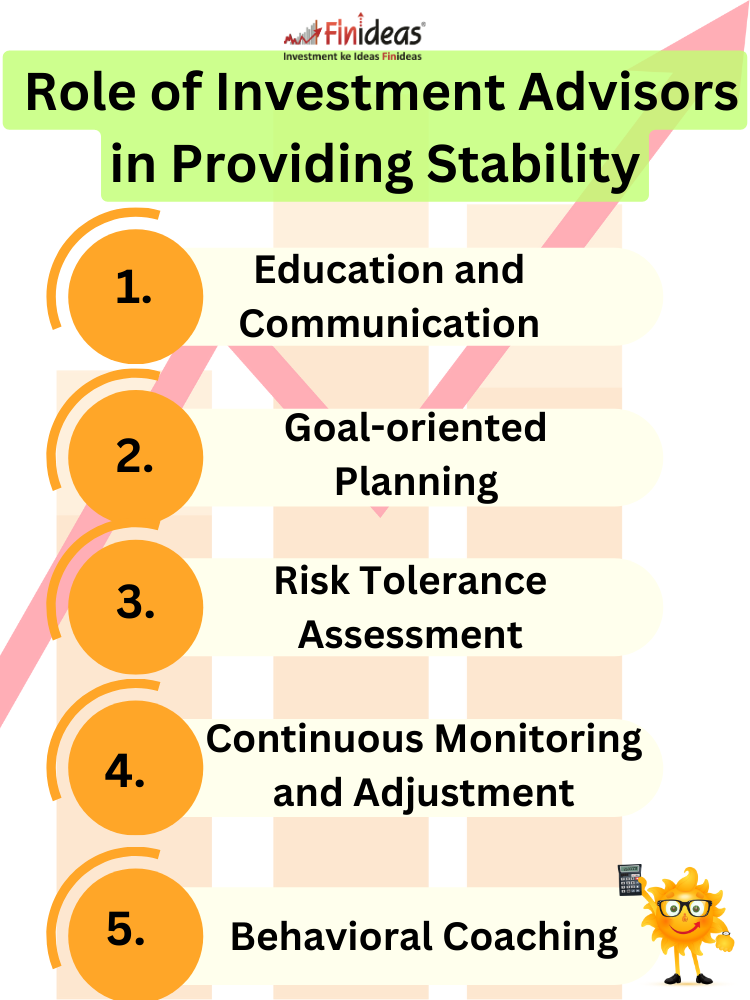

The Role of Investment Advisors in Providing Stability:

Education and Communication:

Investment advisors play a crucial role in educating their clients about market dynamics, risk, and the importance of a long-term perspective. Regular communication helps manage expectations and provides reassurance during turbulent times.

Goal-oriented Planning:

Advisors should work closely with investors to define clear financial goals. Establishing a roadmap tailored to individual objectives helps investors stay focused on the bigger picture, minimizing the impact of short-term market fluctuations.

Risk Tolerance Assessment:

Understanding an investor’s risk tolerance is paramount. Advisors should conduct thorough risk assessments to align investment strategies with the client’s comfort level, ensuring a balanced approach that considers both potential returns and volatility.

Continuous Monitoring and Adjustment:

Markets evolve, and so should investment strategies. Advisors must regularly monitor portfolios, reassess risk tolerance, and make necessary adjustments. This proactive approach helps in adapting to changing market conditions.

Behavioral Coaching:

Investment advisors should serve as behavioral coaches, guiding investors to make rational decisions rather than succumbing to emotional impulses. Encouraging discipline and a focus on long-term goals is essential for sustained success.

When discussing a financial product for long-term investment, one hopes to find all the above-mentioned points within that product. Enter the Index Long-Term Strategy—a product designed to balance both stability and risk. Familiarizing yourself with it is crucial.

As we explore the emotional side of investing, we invite you to reflect on your own experiences. What emotions do you associate with investing, and how do you manage them to stay on course with your financial goals? Comment Down Below

Conclusion:

In the dynamic world of investing, emotions can be both a friend and a foe. Investment advisors, armed with knowledge, empathy, and strategic planning, can provide the stability needed to navigate the emotional rollercoaster. By fostering a collaborative relationship with clients, advisors contribute not only to financial success but also to the emotional well-being of investors in the Indian market.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.