The Future of Index Funds: Trends to Watch in 2025

Index funds have gained massive popularity in India as a low-cost, efficient investment option. With 2025 around the corner, investors need to track key trends shaping the future of index investing. Let’s explore what’s ahead and how you can leverage NIFTY 50 index funds for tax-saving benefits before March 31.

What Are the Top Trends for Index Funds in 2025?

📌 Passive Investing to Dominate the Market

Passive investing through index funds is growing as investors prefer low-cost, diversified options over actively managed funds. In 2024, passive funds saw inflows of ₹1.2 lakh crore in India, and this trend will continue as active funds have higher expense ratios (1.5%-2%) compared to index funds (~0.2%-0.5%).

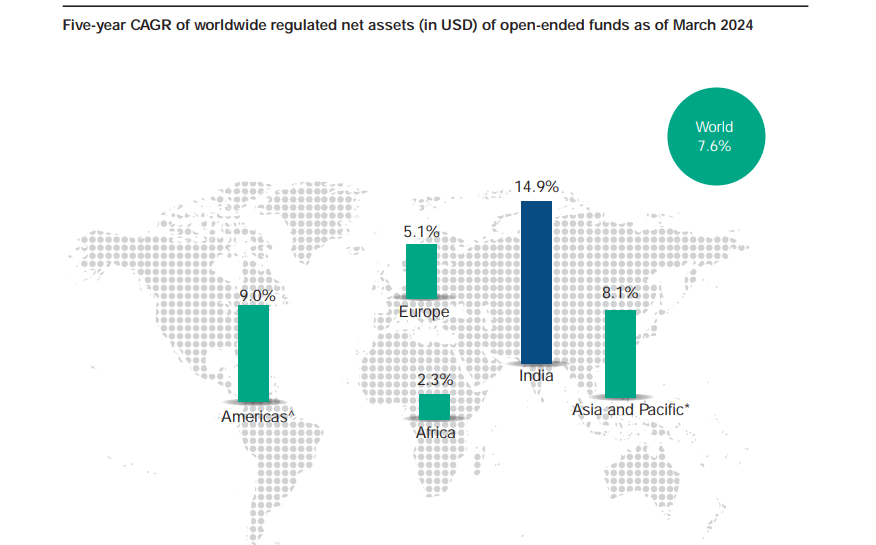

📌 Increased Focus on NIFTY 50 & Sensex Index Funds

More investors are choosing NIFTY 50 and Sensex-based index funds for their historical stability and strong returns. A ₹1 lakh investment in NIFTY 50 five years ago would have grown to ₹2.2 lakh today (assuming a 15% CAGR).

📌 Rise of Smart Beta Index Funds

Smart Beta funds, which track custom-built indices, are gaining traction. These funds aim to outperform standard index funds by selecting stocks based on value, momentum, and volatility factors.

📌 Tax Efficiency Driving Investor Interest

With capital gains tax advantages, index funds will continue to be a tax-efficient investment choice. Investors can leverage index funds before March 31 to maximize tax benefits.

How to Leverage NIFTY 50 Index Funds for Tax-Saving Investments Before March 31?

📌 Tax Benefits Under Section 80C & LTCG

- Investing in ELSS funds that track NIFTY 50 qualifies for a ₹1.5 lakh deduction under Section 80C.

- Long-term capital gains (LTCG) up to ₹1 lakh per year are tax-free, making index funds a smart tax-saving choice.

📌 Capital Gains Harvesting Strategy

To optimize tax savings, investors can sell and rebuy index funds to keep LTCG below ₹1 lakh and avoid excessive tax liability.

For instance, if you invest ₹10 lakh and earn ₹1.8 lakh in gains, you can sell ₹1 lakh worth to keep your taxable LTCG at ₹80,000 (below the exemption limit).

Why is the Index Long Term Strategy of Finideas a Top Investment Strategy?

The Index Long Term Strategy (ILTS) by Finideas is one of the best ways to maximize index fund returns with a structured, disciplined investment approach.

How Does ILTS Work?

✅ Invest consistently in NIFTY 50 index funds using a systematic investment approach.

✅ Rebalance based on market conditions to reduce risk and enhance returns.

✅ Benefit from compounding and long-term tax advantages.

Example of Wealth Creation Through Index Funds

If an investor invests ₹25,000 per month in NIFTY 50 index funds, assuming a 12% annual return, they can accumulate:

- ₹1.76 crore in 20 years

- ₹6.93 crore in 30 years

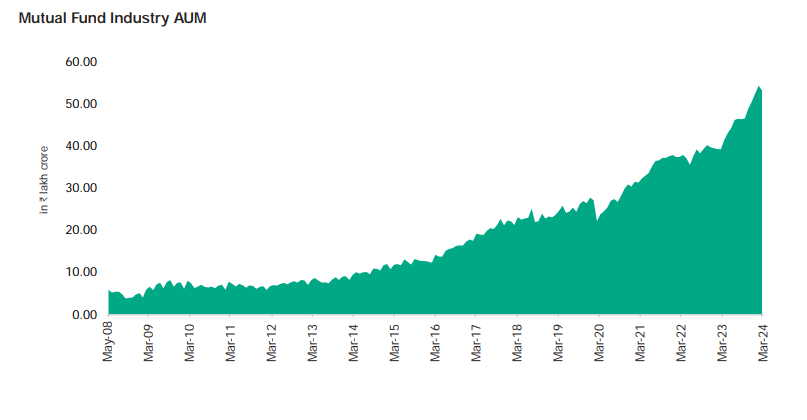

Source : amfiindia.com

Key Trends for Index Funds in 2025

- Passive Investing Growth: ₹1.2 lakh crore inflows in 2024

- Tax Efficiency: LTCG below ₹1 lakh = 0% tax

- Smart Beta Funds: New strategy-driven index funds

- NIFTY 50 Dominance: Preferred index for long-term wealth

Conclusion

Index funds are the future of smart investing in India. With passive investing on the rise, tax-efficient strategies, and new trends like Smart Beta, 2025 will be an exciting year for investors. Make sure to leverage NIFTY 50 index funds before March 31 to maximize tax benefits.

💬 What’s Your Take?

Which trend do you think will have the biggest impact on index investing in India? Comment below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.