The Gig Economy and Your Finances

In recent years, India, much like the rest of the world, has witnessed a significant shift in how people earn their livelihoods. The emergence and proliferation of the gig economy have transformed traditional notions of employment, offering both opportunities and challenges for individuals seeking to navigate their financial futures. Whether you’re a freelancer, a part-time contractor, or an independent consultant, understanding how to manage your income effectively in this changing landscape is crucial for financial stability and growth.

What is the Gig Economy?

The gig economy, characterized by short-term contracts and freelance work, has disrupted the traditional nine-to-five model. Enabled by digital platforms and technology, it has opened up new avenues for earning potential and flexibility. In India, this shift is particularly pronounced, with a burgeoning population of freelancers and gig workers across various sectors, from IT and marketing to transportation and hospitality.

What are the Upsides of Flexibility and Autonomy?

One of the key attractions of the gig economy is the flexibility it offers. Gig workers have the freedom to set their own schedules, choose the projects they take on, and work from anywhere with an internet connection. This flexibility can be especially appealing for those looking to balance work with other commitments, such as family responsibilities or pursuing personal passions.

Moreover, the gig economy can provide a sense of autonomy and empowerment. Freelancers and independent contractors have greater control over their work, allowing them to align their professional pursuits with their values and interests. This autonomy can lead to increased job satisfaction and a greater sense of fulfillment in one’s career.

What are the Challenges of Income Volatility and Financial Planning?

However, the gig economy also presents unique challenges, particularly when it comes to managing income. Unlike traditional salaried positions, where income is steady and predictable, gig workers often face income volatility. Fluctuations in workload, project availability, and payment terms can make it challenging to maintain a consistent cash flow, leading to financial uncertainty.

Moreover, gig workers may lack access to benefits such as health insurance, retirement plans, and paid leave, which are typically provided by employers in traditional settings. This places the onus on individuals to proactively manage their finances and plan for the future, including setting aside funds for taxes, emergencies, and retirement.

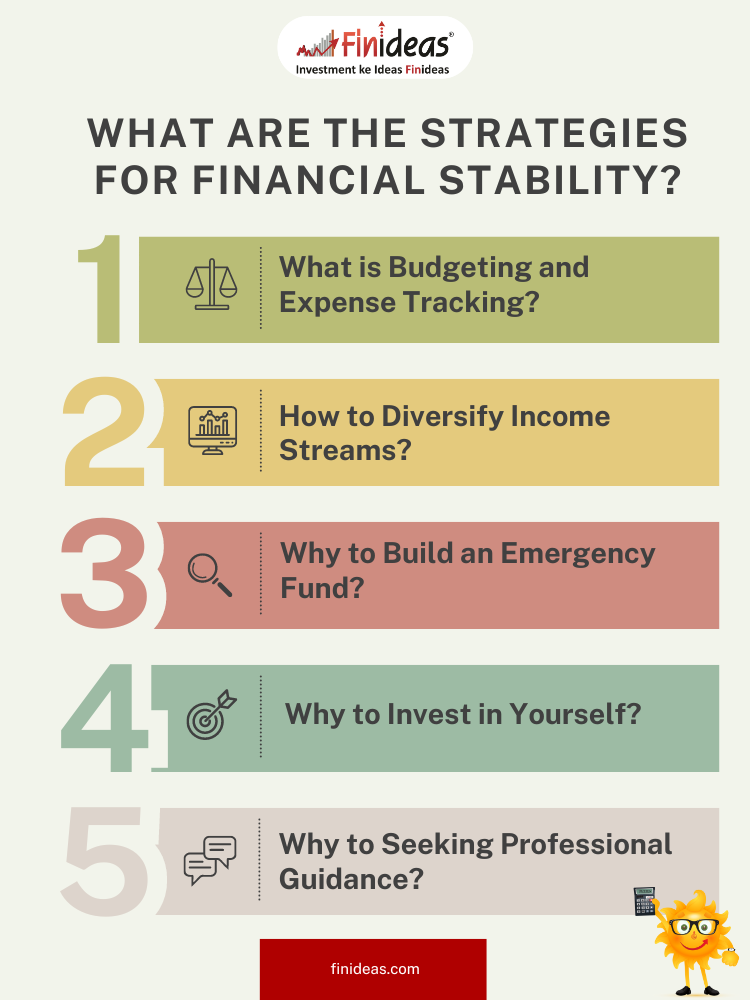

What are the Strategies for Financial Stability?

So, how can gig workers navigate these financial challenges and thrive in the gig economy? Here are some strategies to consider:

1. What is Budgeting and Expense Tracking?

Establish a budget to track your income and expenses, ensuring that you have a clear understanding of your financial situation. Use digital tools and apps to streamline this process and identify areas where you can save or cut back.

2. How to Diversify Income Streams?

Reduce reliance on any single source of income by diversifying your revenue streams. Explore opportunities for additional freelance work, side hustles, or passive income streams to supplement your primary source of income.

3. Why to Build an Emergency Fund?

Set aside savings to cover unexpected expenses or periods of low income. Aim to build an emergency fund equivalent to three to six months’ worth of living expenses to provide a financial safety net.

4. Why to Invest in Yourself?

Continuously invest in your skills and expertise to remain competitive in the gig economy. Consider pursuing further education, certifications, or training programs to enhance your marketability and command higher rates for your services.

5. Why to Seeking Professional Guidance?

Consult with financial advisors or professionals who specialize in working with gig workers. They can provide personalized advice and guidance tailored to your unique financial situation and goals.

How has participating in the gig economy impacted your financial outlook and planning? Share your experiences and strategies for managing income in this evolving landscape in the comments below!

If you are someone who is looking for a good investment product in the market, then you must know about Index Long Term Strategy.

In conclusion, while the gig economy offers unprecedented opportunities for flexibility and autonomy, it also requires careful financial management and planning. By adopting proactive strategies and leveraging available resources, gig workers can navigate the challenges of income volatility and achieve greater financial stability in an ever-changing landscape.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.