The Power of ILTS: Transforming Long-Term Investment Strategies

Investing can be a complex and often daunting endeavor, especially when balancing growth and security. The Index Long-Term Strategy (ILTS) emerges as a powerful solution, seamlessly blending various asset classes such as Index ETFs, futures, options, and debt funds. This strategy is designed to offer prosperity by combining the growth potential of equities with the safety of options and debt funds. Let’s explore how the POWER of ILTS can help you achieve your financial goals.

What is an Index Long-Term Strategy?

The Index Long-Term Strategy is an innovative investment approach that integrates multiple asset classes to provide diversification, consistency, and the power of compounding. By strategically combining index ETFs and futures with options and debt funds, ILTS aims to build wealth over time while offering protection against market downturns and enabling profit from market fluctuations.

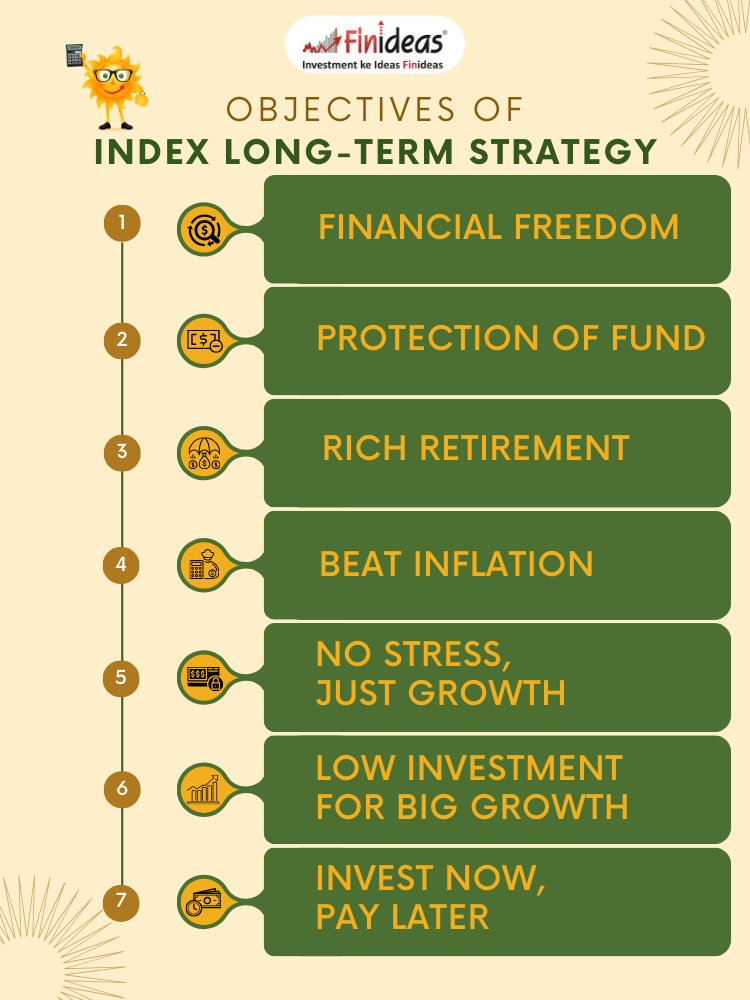

What are the Objectives of Index Long-Term Strategy?

What is Financial Freedom?

ILTS is crafted to help you achieve financial independence through consistent and sustainable wealth growth.

How to Protect of Fund?

Through strategic hedging, ILTS safeguards your investments against severe market conditions, ensuring the safety of your funds.

How to achieve Rich Retirement?

The strategy is designed to accumulate substantial funds, allowing you to enjoy a comfortable and prosperous post-retirement life.

How to Beat Inflation?

ILTS is structured to outpace inflation, protecting your purchasing power and preserving your wealth over time.

How to achieve No Stress, Just Growth?

Focus on growing your investments without the stress and anxiety of market volatility.

What is Low Investment for Big Growth?

Start with a low initial investment and experience significant growth through the power of compounding.

What it’s like Invest Now, Pay Later?

Overcome financial constraints by investing now and securing your future, even if you face a fund crunch initially.

Developed by Finideas after extensive research, ILTS offers a powerful and risk-managed approach to long-term wealth creation.

How Does Index Long-Term Strategy Work?

ILTS employs a methodical and structured approach to long-term investing in the index. Here’s an overview of its working process:

Step-by-Step Process

Investment in Index ETFs + Index Futures:

Begin by investing in index ETFs and futures to tap into the equity market’s growth potential.

Purchase Protection of Investment:

Secure your investments against market downturns by purchasing protective options.

Invest Balanced Money in Debt Funds:

Allocate a portion of your investments to debt funds to ensure stability and balance.

Additionally, an amount equivalent to the exposure in futures is invested in debt funds to generate interest arbitrage and reduce strategy costs. The minimum exposure in ILTS typically equals the value of one lot of Nifty50, making it accessible to a broad range of investors.

Investment Plans

Relax Plan:

Invest 100% of the exposure value upfront.

Basic Plan:

Start with 30% of the exposure value and continue with a 1% monthly SIP of the exposure value.

Power Booster Plan:

Pledge an existing portfolio of 30% of the exposure value, invest 10% initially, and cover the remaining 90% through a monthly SIP of 1%.

ILTS is designed to capture the full bullish trend of Nifty while protecting your wealth during bearish trends, ensuring a balanced approach to long-term investment.

Who Should Consider an Index Long-Term Strategy?

ILTS is ideal for investors seeking long-term growth with added protection. It is perfect for those looking to benefit from the overall market growth and generate steady returns over time. Whether you are planning for retirement or aiming for financial freedom, ILTS provides a strategic pathway to smart wealth creation.

The Power of Index Long Term Strategy (ILTS) lies in its comprehensive approach to investing, combining growth, safety, and flexibility. By leveraging various asset classes and strategic investments, ILTS helps you achieve your financial goals with minimal risk.

How do you currently manage risk in your investment portfolio, and could the Power of ILTS provide a better approach for your long-term financial goals?

We’d love to hear your thoughts and experiences! Share your insights in the comments below.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..