The Role of NIFTY 50 in Wealth Preservation During Market Volatility

The Role of NIFTY 50 in Wealth Preservation During Market Volatility

Market volatility can be a major concern for investors. Sudden price fluctuations and economic uncertainties often lead to panic selling, causing significant losses. However, NIFTY 50, India’s leading stock market index, plays a crucial role in wealth preservation during these uncertain times.

But how does NIFTY 50 help protect your investments? Let’s explore.

What Makes NIFTY 50 a Reliable Index During Market Volatility?

NIFTY 50 represents India’s top 50 companies across various sectors. These companies have strong financials, diversified business models, and a history of resilience. During market downturns, weaker stocks tend to fall more, while fundamentally strong stocks, like those in NIFTY 50, provide stability.

For example, during the 2008 financial crisis, NIFTY 50 fell sharply but recovered within a few years. Similarly, in the 2020 COVID-19 crash, NIFTY 50 dropped to nearly 7,500 points in March 2020 but bounced back to above 15,000 points by early 2021, rewarding long-term investors.

How Does NIFTY 50 Perform Compared to Individual Stocks?

Investing in individual stocks can be risky, as some may collapse completely during downturns. However, NIFTY 50 diversifies risk by including 50 well-established companies. Even if a few companies perform poorly, the overall index remains strong due to better-performing stocks.

For instance, in 2022, IT and tech stocks faced declines, but banking and FMCG sectors within NIFTY 50 balanced the impact, preventing a major crash.

Why Is NIFTY 50 a Safe Option for Long-Term Investors?

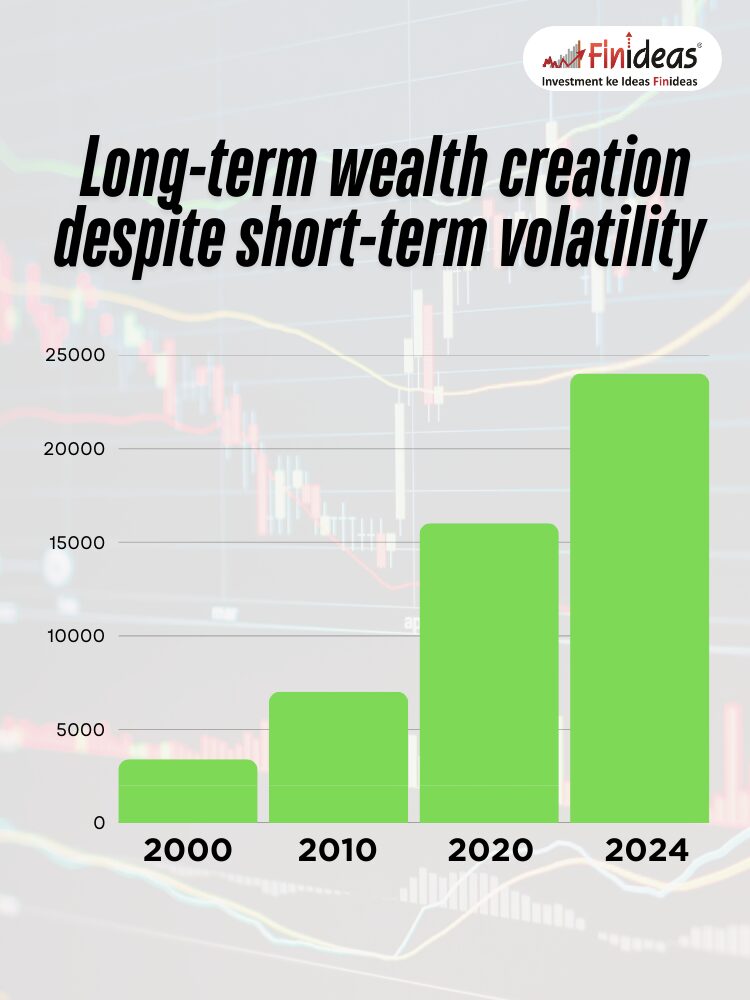

NIFTY 50 has consistently grown over the years. Even after market downturns, it has shown strong recovery and long-term growth.

📌 Numerical Example:

This long-term growth proves that staying invested in NIFTY 50 can help preserve and grow wealth over time.

How Can You Use Index Long Term Strategy (ILTS) of Finideas for Wealth Preservation?

One of the best ways to invest in NIFTY 50 is through the Index Long Term Strategy (ILTS) of Finideas. This strategy focuses on:

✔ Consistent investment in NIFTY 50 to reduce risk and enhance returns

✔ Compounding wealth over the long term

✔ Staying invested to ride out market volatility and benefit from India’s growth

ILTS ensures that you don’t panic during downturns but instead use volatility as an opportunity to invest more at lower prices, maximizing long-term gains.

Should You Invest in NIFTY 50 for Stability?

Market volatility is inevitable, but NIFTY 50 provides a stable and growth-oriented investment option. Instead of reacting to short-term fluctuations, investing in NIFTY 50 through a long-term strategy like ILTS of Finideas can help secure your wealth and generate consistent returns.

💬 What’s your experience with investing in NIFTY 50? Have you stayed invested during market volatility? Comment below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.