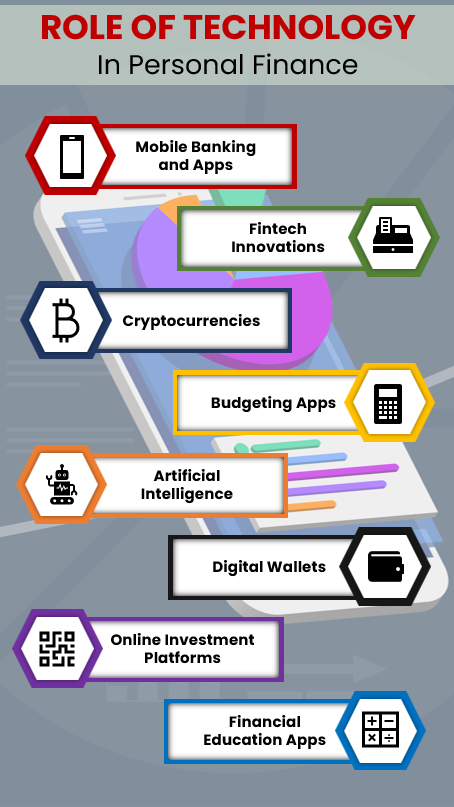

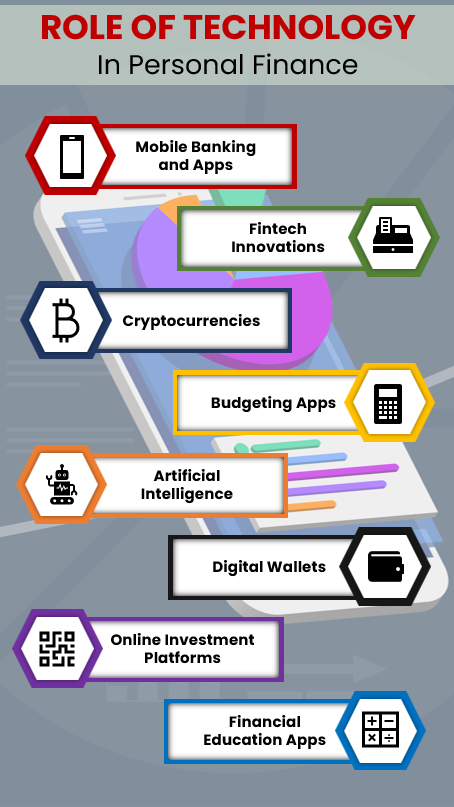

The Role of Technology in Personal Finance

In today’s dynamic realm of personal finance, technology silently transforms how we navigate our financial journeys. This revolution enhances convenience, fosters financial inclusivity, sparks innovation, and emphasizes financial literacy. Explore topics like mobile banking, fintech innovations, cryptocurrencies, budgeting apps, AI-driven advice, digital wallets, online investments, data security, automation, and the influence of technology on financial inclusion.

Mobile Banking and Apps: Revolutionizing Financial Management:

Mobile banking apps redefine financial interaction, offering unparalleled accessibility and control. From checking balances on the go to seamless fund transfers with a tap, these digital companions have become indispensable for modern personal finance, providing real-time transaction notifications.

Fintech innovation transforms finance, from robo-advisors providing algorithm-driven investment advice to peer-to-peer lending platforms connecting borrowers and lenders seamlessly. These advancements democratize finance, making it more accessible to a broader audience.

Cryptocurrencies and Personal Finance: Opportunities and Risks:

Cryptocurrencies, like Bitcoin and Ethereum, bring new opportunities and risks to personal finance. While individuals explore their portfolio potential, the volatile nature and regulatory uncertainties emphasize the need for caution in cryptocurrency investments.

Budgeting Apps: A Guide to Smart Money Management:

Budgeting apps, crucial for sound financial planning, are invaluable companions in the digital age. With user-friendly interfaces, insightful spending visualizations, and goal tracking features, they make navigating personal finance a gentle and empowering experience.

AI and Personalized Financial Advice:

Artificial intelligence brings a new era of personalized financial advice, tailoring recommendations to individual preferences and goals. AI-driven tools analyze data, offering actionable insights for informed decisions on investments, savings, and financial strategies. Highly Advisable to everyone to invest for Long term as it gives effect of compounding so you must know about Index Long Term Strategy.

Digital Wallets: The Future of Payments:

Digital wallets revolutionize payments, providing a secure and efficient alternative to cash. With contactless payments and integrated loyalty programs, they are integral to daily transactions, nudging us toward a cashless future.

Online Investment Platforms: Democratizing Investing:

Online investment platforms break entry barriers, democratizing investing for all. With features like fractional shares and user-friendly interfaces, these platforms empower both seasoned investors and beginners, fostering a culture of financial independence.

Data Security in Personal Finance Apps:

In the era of digital finance, ensuring data security is paramount. Personal finance apps must prioritize robust measures to protect sensitive information. Exploring companies’ efforts in ensuring privacy and security is essential for navigating the digital landscape responsibly.

Automation in Personal Finance: A Gentle Guide to Efficiency:

Automation is a guide to efficiency in personal finance, streamlining tasks like savings transfers and bill payments. Integrated technology enables individuals to effortlessly cultivate healthy financial habits. Financial education apps play a pivotal role in empowering users with knowledge, offering interactive lessons, simulations, and resources. They cater to individuals seeking to enhance their understanding of personal finance, promoting a culture of informed financial decision-making.

Financial Education Apps: Empowering Users with Knowledge:

Financial education apps play a pivotal role in empowering users with knowledge, offering interactive lessons, simulations, and resources. They cater to individuals seeking to enhance their understanding of personal finance, promoting a culture of informed financial decision-making.

The Impact of Technology on Financial Inclusion:

Technology drives financial inclusion, providing individuals, regardless of background, access to essential financial services. From mobile banking in remote areas to innovative solutions for the unbanked, technology bridges gaps, fostering a more inclusive financial landscape.

Smart Home Devices and Financial Management:

Technology extends beyond personal finance to smart home devices, promoting efficient energy use and cost savings. The intersection of technology and sustainable finance reminds us that our financial decisions can impact the environment and overall well-being.

Conclusion:

In this era of tech innovation, technology’s impact on personal finance is undeniable, from mobile banking to democratized investing. Embracing these changes responsibly is crucial, ensuring technology benefits financial well-being. How has technology transformed your approach to personal finance? Share your thoughts below.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.