Things to Take Care While Investing in a Power Booster Plan

Introduction

Investing in a Power Booster Plan can be an exciting opportunity to enhance your financial portfolio, especially when you have a substantial initial investment and a diversified portfolio. However, understanding the intricacies and potential risks involved is crucial to making informed decisions. Here, we will delve into the key elements of the Power Booster Plan and what you need to consider before investing.

To illustrate, let’s assume you have Rs. 1 Crore to invest and a portfolio worth Rs. 30 Lakhs available for pledging as F&O Margin. The Rs. 30 Lakhs portfolio will be pledged to obtain the margin needed in the F&O Segment. 10% of your initial investment will be reserved to cover the annual costs associated with the Index Long Term Strategy. This plan excludes the purchase of Index ETFs.

You will purchase synthetic futures of Nifty50, providing exposure equivalent to Rs. 1 Crore, using the margin obtained by pledging the Rs. 30 Lakhs portfolio. Additionally, you will acquire Put options in a quantity equivalent to the position of Nifty Futures. Investors can allocate the remaining 90% of the initial investment across various asset classes, their business, or for loan repayments, with an expectation to generate a return of 7 to 9% or more.

What are the Costs Associated?

The costs associated with this plan are logical and need careful consideration. The Hedging Cost is 5% of the total exposure value, translating to Rs. 5 Lakhs. Another 5% of the Futures’ exposure equates to Rs. 5 Lakhs (Rs. 1 Crore * 5%). The combined Hedging and Futures Forwarding Cost amounts to 10% of the total exposure value, which in this case is Rs. 10 Lakhs. Investors are expected to earn 7 to 9% interest from investments in debt funds and other asset classes, totaling Rs. 6.5 Lakhs. The net cost is the difference between the combined costs and interest earnings, calculated here as Rs. 3.5 Lakhs (Rs. 10 Lakhs – Rs. 6.5 Lakhs).

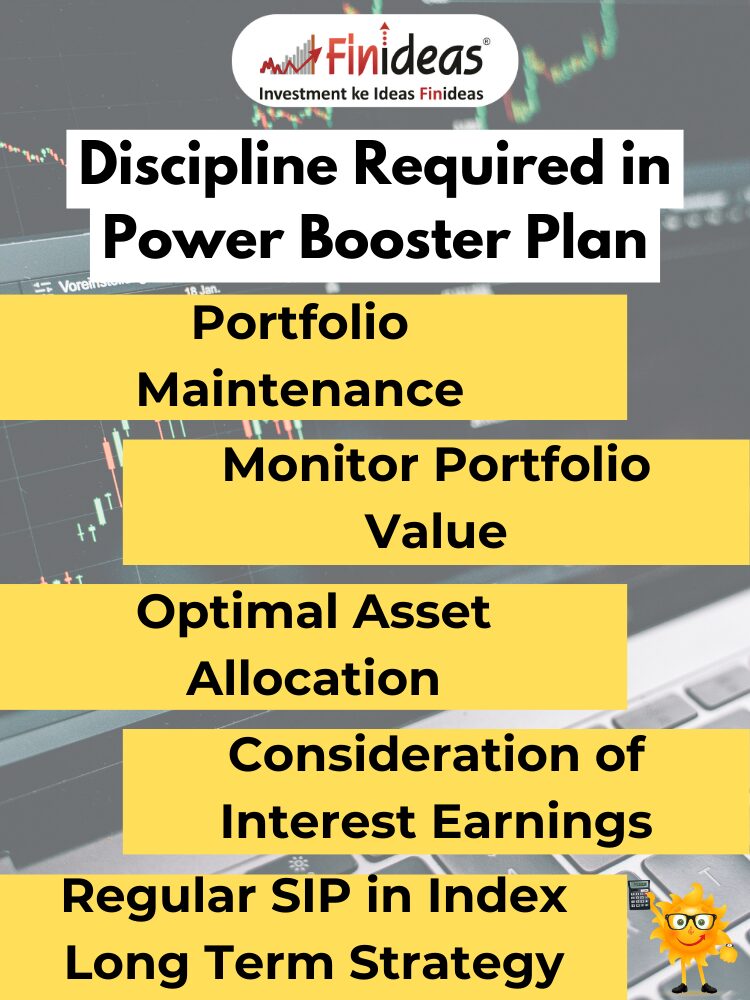

What Discipline Required in Power Booster Plan?

How is Portfolio Maintenance:

Maintain the pledged portfolio’s value at 30% of the total exposure in the Index Long Term Strategy.How to Monitor Portfolio Value:

If the portfolio value declines, prompt action is required. This may involve pledging additional assets or injecting the necessary funds.What is Optimal Asset Allocation:

Invest the remaining 90% of the initial amount in an asset class capable of yielding an annual interest rate higher than 7 to 9%.What should be the Consideration of Interest Earnings:

Factor in the interest earned from the investment when calculating the net Profit & Loss (P&L) in the Index Long Term Strategy.What is Regular SIP in Index Long Term Strategy:

Implement a systematic investment plan (SIP) from the first month onward. The monthly SIP amount should be the annual hedging and Financing cost divided by 12 months.

This plan is For Whom?

The Power Booster Plan of the Index Long Term Strategy is tailored for investors who meet the following criteria: possessing a substantial portfolio, the ability to generate higher returns from debt investments, and the financial capacity and discipline to commit to a regular monthly SIP. This plan is designed for those who already have a robust portfolio for pledging and obtaining F&O margin. Targeted investors should be capable of generating elevated returns from debt investments. The plan is suitable for individuals who can commit to a regular monthly SIP, an integral part of the plan.

In essence, this strategy caters to those with a strong financial standing, the ability to capitalize on debt instruments, and a commitment to regular monthly investments through SIP. It leverages the existing portfolio to enhance exposure in the Index Long Term Strategy, providing a pathway for potential growth and returns.

What do you think, is the Power Booster Plan right for you?

Do Comment Down Below We’d love to hear your thoughts and any experiences you have with similar investment strategies!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..