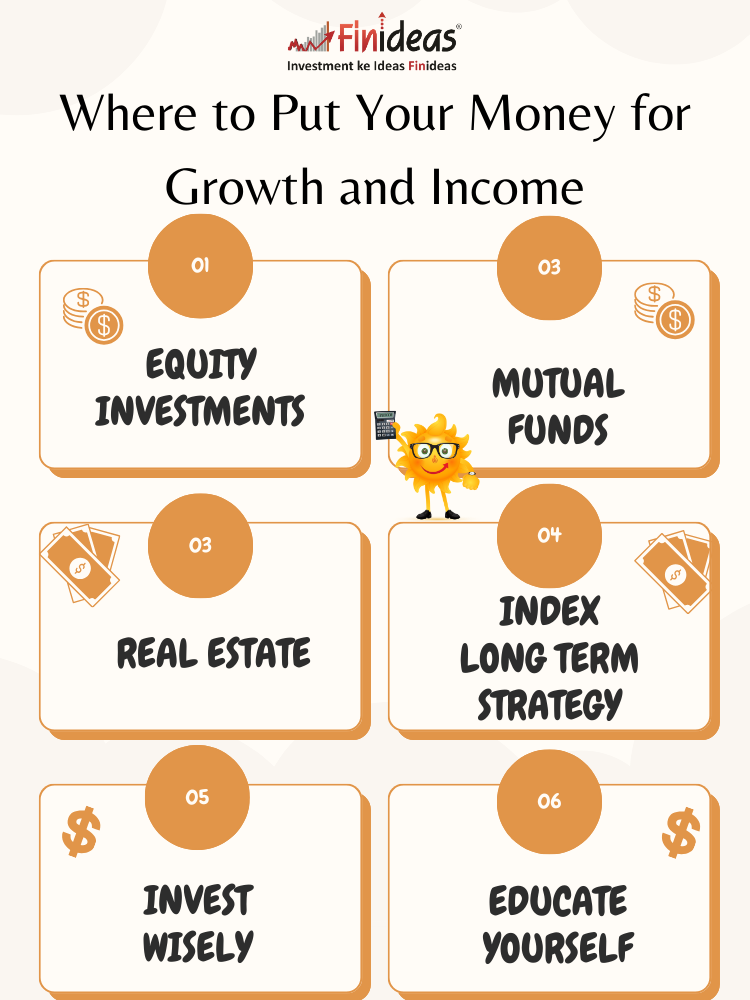

Top Investment Options: Where to Put Your Money for Growth and Income

Introduction:

Investing your money wisely is crucial for achieving financial growth and stability. With a plethora of investment options available in India, choosing the right ones can be a daunting task. In this blog, we will explore some of the top investment options that can help you achieve both growth and regular income.

Equity Investments:

– Investing in the stock market is one of the most popular ways to achieve high returns. Indian equity markets have shown consistent growth over the years. Consider investing in well-established companies or diversified mutual funds for a balanced approach.

Mutual Funds:

– Mutual funds pool money from various investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer professional management and are suitable for both beginners and experienced investors. SIPs (Systematic Investment Plans) provide a disciplined approach to investing.

Real Estate:

– Real estate has been a traditional favorite for Indian investors. Investing in residential or commercial properties can provide capital appreciation and rental income. However, it’s essential to research the location and market trends before making a decision.

Index Long Term Strategy:

- Rich Retirement: Have the funds to live the kind of life you want to live post retirement

- Beat Inflation: Inflation is the silent wealth killer – Stand the test of time

- No Stress. Just Growth: Times of stress are also times that are signals for growth

- Low Investment for Big Growth: Enable yourself to turn your dream of automating growth into a reality

- Invest now. Pay Later: Tide over the problem of fund crunch and secure your future

So you must know about Index Long Term Strategy.

Fixed Deposits:

– Fixed deposits (FDs) are a low-risk investment option offered by banks and financial institutions. They provide a fixed interest rate over a specified period. FDs are ideal for conservative investors looking for a steady income stream.

Government Savings Schemes:

– Schemes like Public Provident Fund (PPF), National Savings Certificate (NSC), and Senior Citizens Savings Scheme (SCSS) are backed by the government, making them safe investment options. They offer attractive interest rates and tax benefits.

Gold Investments:

– Gold has been a traditional store of value in India. Investors can consider physical gold, gold ETFs (Exchange Traded Funds), or sovereign gold bonds. Gold acts as a hedge against inflation and economic uncertainties.

“What are your preferred investment options, and what factors do you consider while making investment decisions? Share your experiences and insights in the comments below!”

Conclusion:

Diversifying your investment portfolio is key to managing risk and maximizing returns. The ideal investment strategy varies based on individual financial goals, risk tolerance, and time horizon. It’s crucial to stay informed about market trends, seek professional advice if needed, and regularly review and adjust your investment portfolio to align with your financial objectives. Remember, a well-thought-out investment plan can pave the way for a secure and prosperous financial future.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.