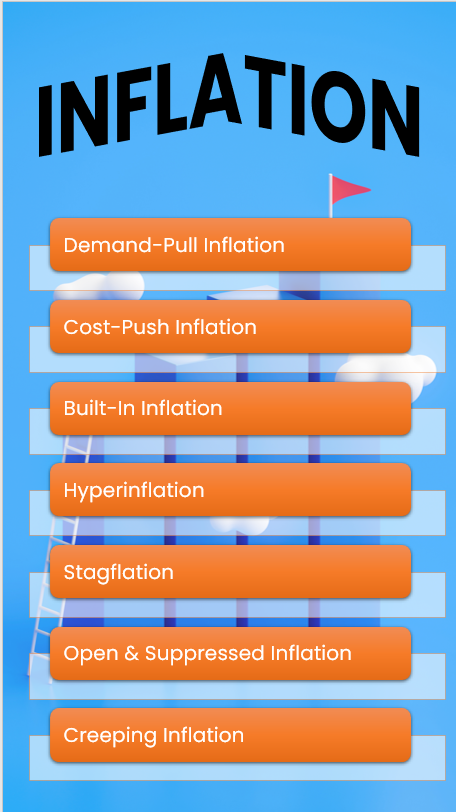

Understanding of Inflation: A Gentle Exploration of Various Types

Introduction:

In the intricate world of economics, inflation plays a pivotal role, influencing a nation’s purchasing power and economic stability. This article offers a brief exploration of various inflation types, uncovering their intricacies and implications.

- Demand-Pull Inflation: Results from demand surpassing supply, causing rising prices.

- Cost-Push Inflation: Occurs when increased production costs lead to higher consumer prices.

- Built-In Inflation: Reflects the cyclical dance between rising wages and prices.

- Hyperinflation: Characterized by a rapid and excessive increase in prices.

- Stagflation: Presents a challenge as inflation coexists with economic stagnation.

- Open and Suppressed Inflation: Political dimensions impact inflation acknowledgment or manipulation.

- Creeping Inflation: Gradual price increases quietly erode purchasing power over time.

To beat Inflation you must know about Index Long Term Strategy.

Measuring Inflation:

Instruments like the Consumer Price Index (CPI) and Producer Price Index (PPI) act as economic barometers.

Effects of Inflation:

Inflation influences consumers, businesses, and governments differently, impacting interest rates, borrowing, and the delicate balance between growth and stability.

Controlling Inflation:

Policymakers use monetary and fiscal policies to choreograph a balance between economic growth and price stability.

Global Perspectives:

International comparisons reveal how global factors contribute to diverse inflationary trends.

Future Trends:

Emerging trends influenced by technology and environmental factors shape the future of inflation management.

Elegance of Index Long Term Strategy:

Within the inflation dance, the Index Long Term Strategy shines:

- Index-Based Investment: Aligning portfolios with economic indices safeguards against inflation’s impact.

- Index = GDP + Inflation: A powerful formula capturing both growth and inflation for investor guidance.

- Combining Index with Hedging: Strategic pairing enhances resilience to uncertainties.

- Inflation in India and CAGR of Index Long Term Strategy: In India, with inflation oscillating between 6% to 8%, the CAGR of the Index Long Term Strategy stands at around 18%.

Conclusion:

In this brief exploration, we’ve touched on diverse inflation types and highlighted the strategic elegance of the Index Long Term Strategy. From hyperinflation to creeping inflation, each type leaves its mark on the economic stage. The strategy emerges as a star performer, not just preserving but beating the rhythm of inflation in the long run. As we delve into this economic dance, here’s a question for you: How do you think technological advancements will shape the future landscape of inflation and economic strategies? Comment Down Below

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.