Understanding Options Contracts for WTI Crude Oil Futures on NSE

NSE is going to introduce option on Crude Oil, it can create a good opportunities for Arbitrageur, Jobbers & Traders. In this blog post, we will introduce you to options contracts on the underlying WTI Crude Oil Futures in the Commodity Derivatives Segment on the NSE (National Stock Exchange) . Let Us Understrand it.

Options on WTI Crude Oil Futures

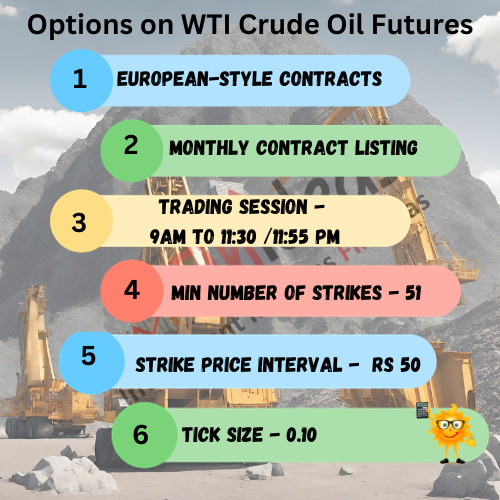

The NSE offers options contracts on the WTI Crude Oil Futures, widely traded commodities in the financial markets. Here are some key details about these options contracts:

- European-Style Contracts

The options contracts on WTI Crude Oil Futures on the NSE are European-styled, meaning they can only be exercised on the expiration date. That means the traders will be relaxed from the risk of sudden assignment in short options positions.

- Monthly Contract Listing

These options contracts will have monthly expiry. Currently, NSE is not going to launch the weekly options on WTI Crude Oil. It is important to note that the last trading day (contract expiry) of this contract is two business days prior to the expiry day of the underlying futures contract.

- Trading Period

Options on WTI Crude Oil Futures can be traded from Mondays through Fridays.

- Trading Session

The trading session for these options is from Monday to Friday, starting at 9:00 am and ending at 11:30/11:55 pm, depending on the US daylight saving time period.

- Underlying Quotation

The quotation for these options is based on the per-barrel price of WTI Crude Oil. The tick size is 0.10 (equivalent to 10 paise).

- Number of Strikes

There are a total of 25 in-the-money, 25 out-of-the-money, and 1 near-the-money strikes for both call (CE) and put (PE) options. The exchange may introduce additional strikes if needed.

- Strike Price Interval

The strike price interval is Rs 50.

- Base Price

The base price is determined by the option pricing model on the first day of the contract. On other days, it is based on the previous day’s daily settlement price of the contract.

- Initial Margin

The initial margin for these options is calculated using the SPAN (Standard Portfolio Analysis of Risk) software. It also includes factors like volatility scan range, short option minimum margin, margin period of risk, and extreme loss margin.

- Premium Blocking

The premium of the buyer is blocked upfront on a real-time basis.

Risks and Settlement

It’s essential to understand the risks associated with options contracts, especially when they devolve into futures on expiry. Here’s what you need to know:

- Margin Increases

During the initial phase, members are provided with a sensitivity report about impending margin increases at least two days in advance. The exchange may levy pre-expiry option margins if necessary.

- Penalty

The penalty for short collection or non-collection due to an increase in initial margins resulting from the devolvement of options into futures will not be levied for the first day.

Settlement of Premium

Premium settlement occurs on T+1 day, one day after the options contract’s expiry. The open positions devolve into underlying Futures positions as follows:

- Long call positions become long positions in the underlying futures contract.

- Long put positions become short positions in the underlying futures contract.

- Short call positions become short positions in the underlying futures contract.

- Short put positions become long positions in the underlying futures contract.

All these devolved futures positions are opened at the strike price of the exercised options.

Exercise Mechanism at Expiry

At expiry, all in-the-money (ITM) option contracts are automatically exercised unless long position holders provide “contrary instruction” not to do so. ITM option holders who haven’t submitted contrary instructions receive the difference between the settlement price and strike price in cash.

If contrary instructions are given by ITM option position holders, the positions expire worthless. All out-of-the-money (OTM) option contracts also expire worthless. Devolved futures positions are considered opened at the strike price of the exercised options, and exercised contracts within an option series are assigned to short positions in a fair and non-preferential manner.

In conclusion, options contracts on WTI Crude Oil Futures offer traders a versatile tool for managing risk and creating trading strategies in the world of commodities. Understanding the details and mechanics of these contracts is crucial for successful trading in this market. Always remember that trading options carry inherent risks, and it’s essential to have a solid understanding of the market and the instruments you’re using.

If you want to know more about WTI Crude Oil or have any queries then you can contact us or Visit Our Website.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.