Understanding the Role of ETFs in a Diversified Portfolio

What Are ETFs, and Why Are They Popular Among Indian Investors?

Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, much like individual stocks. ETFs are known for their low cost, diversification benefits, and ease of trading. In India, ETFs tracking indices like NIFTY 50 or Sensex are gaining traction as efficient tools for building a diversified portfolio.

How Do ETFs Contribute to Portfolio Diversification?

ETFs provide diversification by pooling money from multiple investors and investing it across a wide range of securities, such as stocks, bonds, or commodities. This minimizes the risk associated with holding individual securities. For example:

- Case Study: If you invest ₹50,000 in a NIFTY 50 ETF, your money is spread across the top 50 companies in India. Even if one stock underperforms, the impact on your portfolio is cushioned by the performance of other stocks.

What Are the Benefits of Including ETFs in a Portfolio?

- Cost-Effective: ETFs have lower expense ratios compared to actively managed funds.

- Liquidity: ETFs can be bought and sold on stock exchanges during market hours.

- Flexibility: You can invest in various sectors, commodities, or international markets with sectoral and thematic ETFs.

- Tax Efficiency: ETFs are more tax-efficient compared to mutual funds due to lower turnover.

How Does the Index Long Term Strategy (ILTS) of Finideas Fit Into ETF Investment?

The Index Long Term Strategy (ILTS) by Finideas is an excellent method for combining the benefits of ETFs with a long-term growth approach.

- ILTS focuses on building wealth steadily by leveraging index ETFs like NIFTY 50 or Sensex.

- By holding these ETFs long-term, investors benefit from compounding and reduced transaction costs.

- Example: If you invest ₹1,00,000 in a NIFTY 50 ETF and earn an average annual return of 12%, your investment could grow to ₹6.4 lakhs in 15 years through the power of compounding.

What Are the Risks Associated with ETFs, and How Can You Mitigate Them?

- Market Risk: ETFs are subject to the volatility of the underlying index or sector.

- Tracking Error: Some ETFs may not perfectly mirror the index performance.

- Liquidity Risk: Low-traded ETFs might have wider bid-ask spreads.

Mitigation: Choose ETFs with high trading volumes and lower expense ratios, and diversify across asset classes.

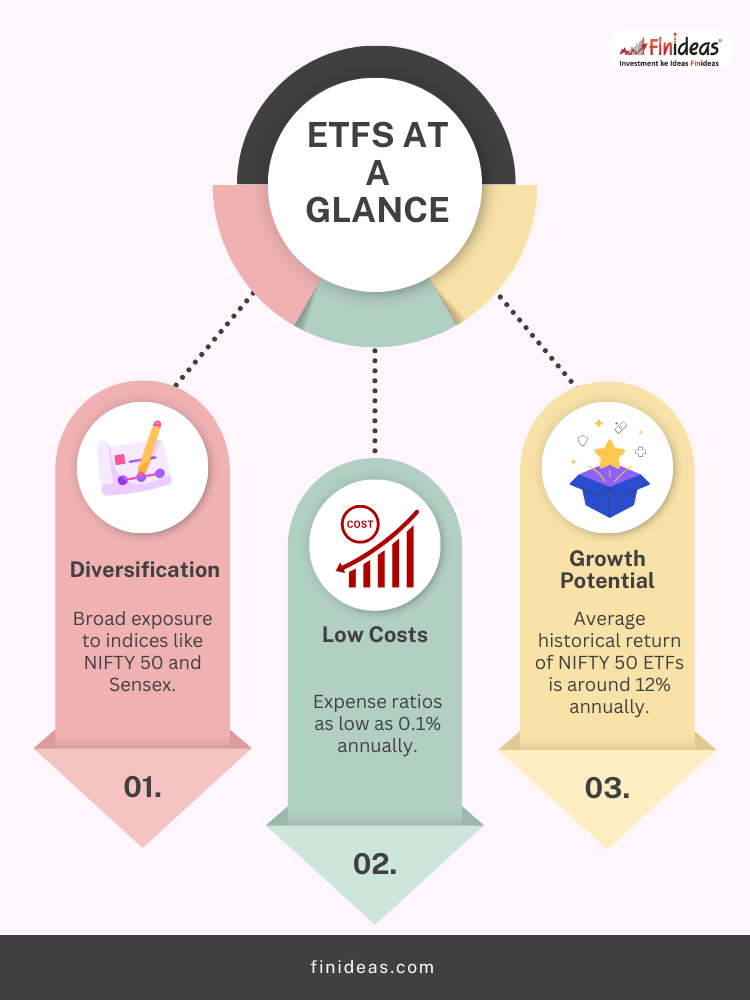

ETFs at a Glance:

- Diversification: Broad exposure to indices like NIFTY 50 and Sensex.

- Low Costs: Expense ratios as low as 0.1% annually.

- Growth Potential: Average historical return of NIFTY 50 ETFs is around 12% annually.

Conclusion: Why Should Indian Investors Consider ETFs?

ETFs are ideal for Indian investors looking for a simple, cost-effective way to diversify their portfolios. Combined with strategies like Finideas’ Index Long Term Strategy, ETFs provide a reliable path to wealth creation over the long term. What’s your preferred ETF for long-term investments, and why? Share your thoughts in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.