Unlocking Opportunities: 5 Advantages of Category 3 AIFs in India

In India’s dynamic investment landscape, Category III Alternative Investment Funds (AIFs) stand out as a compelling option for investors seeking diversification and potential higher returns.

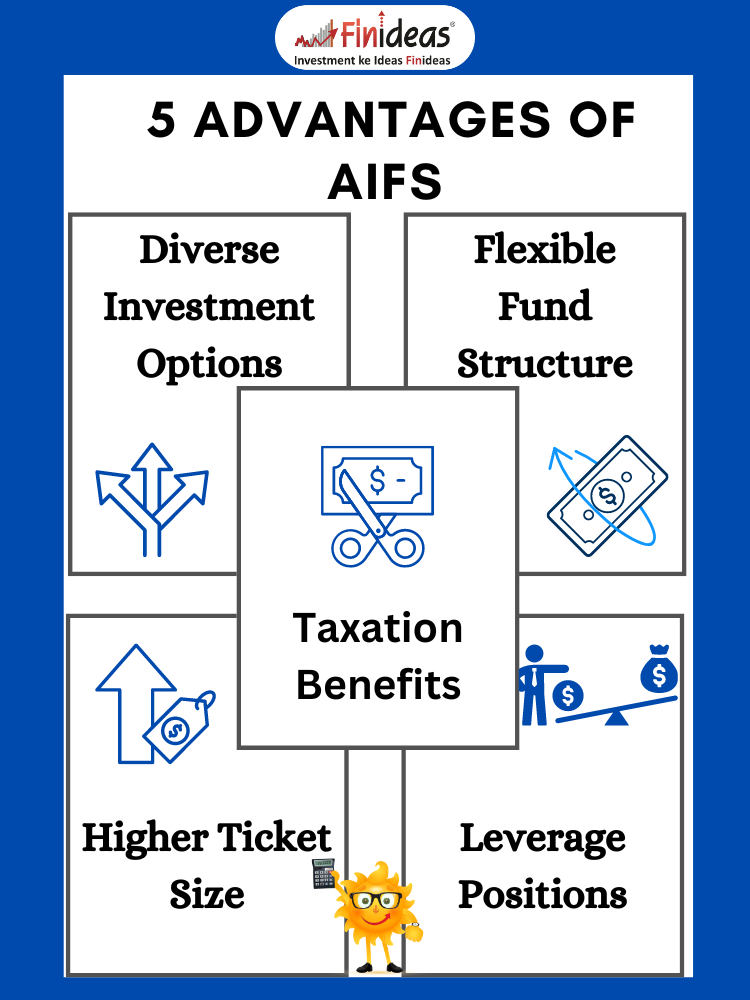

What are the five key advantages of Category III AIFs?

What are Diverse Investment Options?

Within Category III AIFs, investors gain access to a broad spectrum of investment avenues, spanning listed and unlisted companies, derivatives, structured products, and other AIF units. This diversity empowers investors to spread their risk across various asset classes, potentially enhancing portfolio resilience and returns.

What is Flexible Fund Structure?

Category III AIFs offer a flexible fund structure, accommodating both open-ended and closed-ended formats. Investors can choose between these structures based on their investment horizon and liquidity preferences, aligning their capital deployment with their financial goals.

How much Higher Ticket Size?

With a minimum ticket size of Rs 1 crore, Category III AIFs cater to investors with substantial capital, fostering a community of high-net-worth individuals and institutional players. This exclusivity not only ensures a conducive investment environment but also opens doors to potentially lucrative opportunities typically inaccessible to retail investors.

What are the Leverage Positions?

One of the distinguishing features of Category III AIFs is their ability to leverage positions, with leverage of up to two times the total fund corpus. Leveraging enables fund managers to amplify returns by strategically utilizing borrowed funds, potentially magnifying gains in favorable market conditions.

Which Taxation Benefits are there?

Category III AIFs offer tax advantages, with income taxed at the AIF level. The tax treatment varies based on the fund’s structure, whether it operates as a trust, Limited Liability Partnership (LLP), or company. Optimal tax structuring can enhance after-tax returns for investors, contributing to overall portfolio performance.

If you are someone who wants to start at a smaller level , Index Long Term Strategy can be a great option for your investment, you can checkout it on our website and want to know about AIF to click here.

In conclusion, Category III AIFs present an enticing proposition for investors seeking sophistication and potential alpha generation in their portfolios. However, it’s crucial to conduct thorough due diligence and consult with a financial advisor before committing capital to ensure alignment with individual investment objectives and risk tolerance.

What factors do you consider most important when evaluating alternative investment opportunities like Category III AIFs? Share your thoughts in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.