Weathering Economic Storms Strategies for Financial Resilience

Economic storms are inevitable. Whether it’s a global recession, an industry downturn, or unexpected financial challenges, having strategies to weather these economic storms is crucial. This blog will explore various approaches to ensure financial resilience, helping individuals and businesses in India navigate through tough economic times with confidence.

What is Financial Resilience?

Financial resilience refers to the ability to withstand and recover from financial setbacks. It’s about having strategies and plans in place to manage your finances effectively, ensuring stability and growth even during economic challenges.

Why is Financial Resilience Important?

Financial resilience is important because it provides stability during economic downturns. It allows for continued growth and investment opportunities, and it reduces stress and anxiety by giving you the peace of mind that comes with being prepared for financial challenges.

How to Build an Emergency Fund?

An emergency fund is your first line of defense against financial storms. To build one:

- Set a Goal: Aim for 3-6 months of living expenses.

- Start Small: Begin by saving a small percentage of your income.

- Automate Savings: Set up automatic transfers to your savings account.

For example, if your monthly expenses are ₹50,000, aim to save ₹1,50,000 to ₹3,00,000 in your emergency fund.

How to Diversify Your Income Streams?

Relying on a single income source is risky. Diversifying your income can provide financial stability. Consider taking on side hustles like freelancing, tutoring, or selling products online. Invest in stocks, mutual funds, or real estate, and explore passive income options like rental income or dividend-paying stocks. For instance, if your main job provides ₹1,00,000 per month, aim to earn an additional ₹25,000 from side hustles and investments.

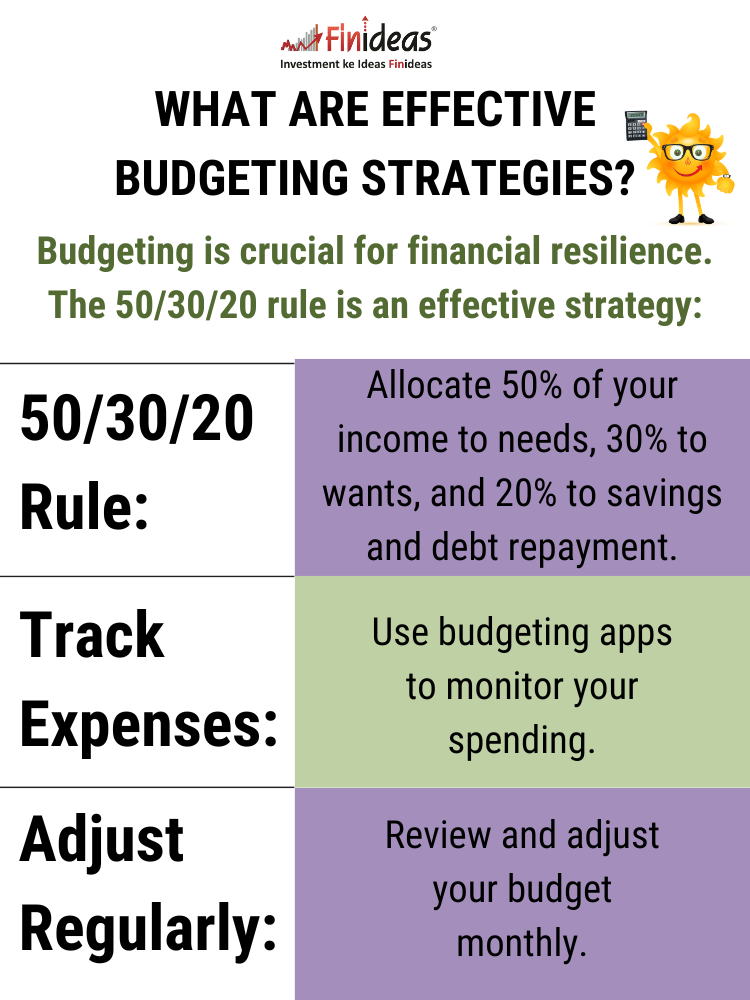

What Are Effective Budgeting Strategies?

Budgeting is crucial for financial resilience. The 50/30/20 rule is an effective strategy:

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Track Expenses: Use budgeting apps to monitor your spending.

- Adjust Regularly: Review and adjust your budget monthly.

For example, with a monthly income of ₹1,00,000, allocate ₹50,000 to needs, ₹30,000 to wants, and ₹20,000 to savings and debt.

How to Manage Debt Effectively?

Managing debt is essential to maintain financial health. Prioritize paying off debts with the highest interest rates first, consider debt consolidation to lower interest rates, and contact creditors to negotiate lower interest rates or payment plans. For example, if you have a credit card debt of ₹2,00,000 at 18% interest, focus on paying it off before lower-interest debts.

What Role Does Insurance Play in Financial Resilience?

Insurance provides a safety net during unforeseen events. Key insurance types include health insurance, which covers medical expenses; home insurance, which protects against property damage; and life insurance, which provides for your dependents in case of your death.

How to Invest for the Long Term?

Investing for the long term helps grow your wealth and build financial resilience. Start early to benefit from compound interest, diversify your investments across different asset classes, and stay informed about market trends to adjust your portfolio as needed. For example, investing ₹10,000 monthly in a mutual fund with a 12% annual return can grow to approximately ₹23,00,000 in 10 years. You can also start investing in Index Long Term Strategy by 1 Lot minimum.

What Are Some Cost-Cutting Strategies?

Reducing expenses can help you save more and improve financial resilience. Cut non-essential spending, limit dining out, subscriptions, and impulse purchases. Negotiate bills by contacting service providers to lower them or switch to cheaper plans. Use energy-efficient appliances to reduce utility bills. For example, cutting ₹5,000 in monthly non-essential spending can save you ₹60,000 annually.

How to Plan for Retirement During Economic Uncertainty?

Retirement planning is crucial, even during economic uncertainty. Contribute regularly to retirement accounts, balance your portfolio based on your risk tolerance and time horizon, and consult a financial advisor for personalized advice. For instance, if you save ₹30,000 monthly in a retirement account with a 10% annual return, you can accumulate approximately ₹1,14,00,000 in 20 years.

How Can You Stay Financially Educated?

Financial education is key to resilience. Stay informed by reading financial books and blogs, enrolling in financial planning courses, and participating in financial forums and groups. For example, reading one financial book per month can significantly enhance your financial knowledge over time.

What is your biggest challenge in achieving financial resilience, and what strategies have you found helpful in overcoming it? Share your thoughts in the comments below!

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment..