Why Your Put Option Isn't Matching the Market's Drop (And Why It's Still Working)

Introduction:

One question we consistently hear from our customers is, “Why isn’t my put option increasing in value as much as the market is falling?” It’s a valid concern, especially when you see the market plummet and expect your protective put to mirror that decline. Today, let’s break down why this happens and explain why your put option is still providing the protection you need.

The Puzzle: Spot Price vs. Option Price

Let’s take a concrete example. The current spot price of the index is 22,450. You hold a December 2025 put option with a strike price of 24,000, currently priced at ₹1,200.

Logically, you might think: “If the index is at 22,450, and my put is at 24,000, the intrinsic value should be 24,000 – 22,450 = ₹1,550.” So why is it only ₹1,200?

Understanding the Time Difference: Spot vs. Future

The key lies in the fact that we’re comparing two different timeframes:

- Spot Price: The current, real-time price of the index (22,450).

- Put Option: A contract expiring in December 2025 (9.5 months away).

Option prices, especially those with longer expirations, are heavily influenced by the future price of the underlying asset, not just the current spot price.

The Role of Futures and Interest

Futures prices are calculated using the formula:

- Future’s Price = Spot Price + Interest (Carrying Cost)

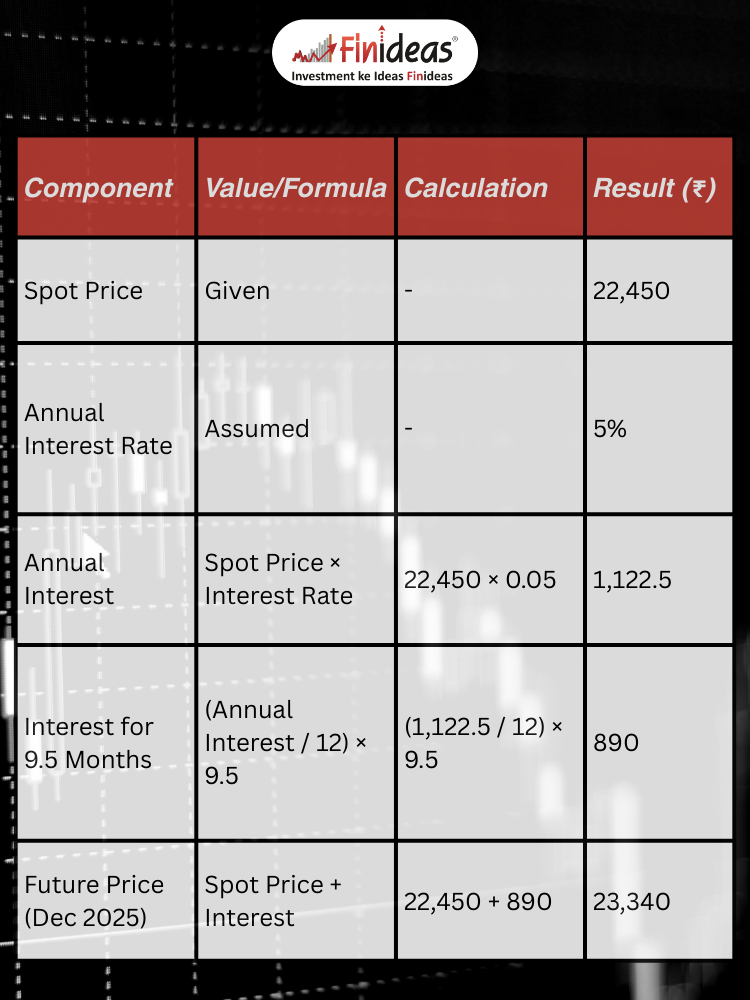

Let’s break down the interest component:

- Assume an approximate annual interest rate of 5%.

- For a spot price of 22,450, the annual interest is 22,450 * 0.05 = ₹1,122.5.

- For 9.5 months, the interest is approximately (1122.5/12) * 9.5 = ₹890.

- Therefore the future price for December 2025 is 22450+890 = 23340.

So, the December 2025 futures price is approximately 23,340.

Calculating the Put Option’s True Value

Now, let’s calculate the intrinsic value of your 24,000 put option based on the futures price:

- Intrinsic Value = Strike Price – Futures Price

- Intrinsic Value = 24,000 – 23,340 = ₹660

This means the minimum premium for your put option should be ₹660. The current price of ₹1,200 is therefore perfectly reasonable, as it also includes time value.

Why Your Put Is Still Providing Protection

The key takeaway is: “The market’s drop is being reflected in your put option, but you need to compare it to the appropriate futures price.”

- If, on the December 2025 maturity date, the spot price is 22,450, the futures price will also be 22,450, and your 24,000 put will indeed have an intrinsic value of ₹1,550.

- The difference now is due to the “forwarding cost” included in the futures price.

Your put option is still providing the intended protection, and your risk management calculations remain accurate.

Beyond the tactical use of put options for market protection, Finideas strongly advocates for a long-term index investing strategy as a foundational element of sound financial planning known as Index Long Term Strategy. This approach, characterized by diversification, low costs, and historical long-term growth, provides a robust framework for building wealth. By consistently contributing to index funds, strategically allocating assets, and maintaining a focus on long-term goals, investors can leverage the power of market growth while minimizing the complexities and risks associated with active trading, making it a cornerstone for achieving lasting financial security.

Conclusion:

Understanding the relationship between spot prices, futures prices, and option premiums is crucial for effective trading. Don’t be alarmed if your put option’s value doesn’t perfectly mirror the market’s immediate fluctuations. It’s working as intended, accounting for the time value and futures pricing.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.