The Crucial Role of Risk Management in Investment Strategies

Introduction:

Investing in the financial markets can be both exhilarating and nerve-wracking. While the allure of potential high returns is undeniable, the risk of losing your hard-earned money is equally real. As a prudent investor, understanding and implementing effective risk management strategies is vital to safeguard your investments and achieve long-term success. In this blog, we will explore the role of risk management in investment strategies and why it is essential for every investor.

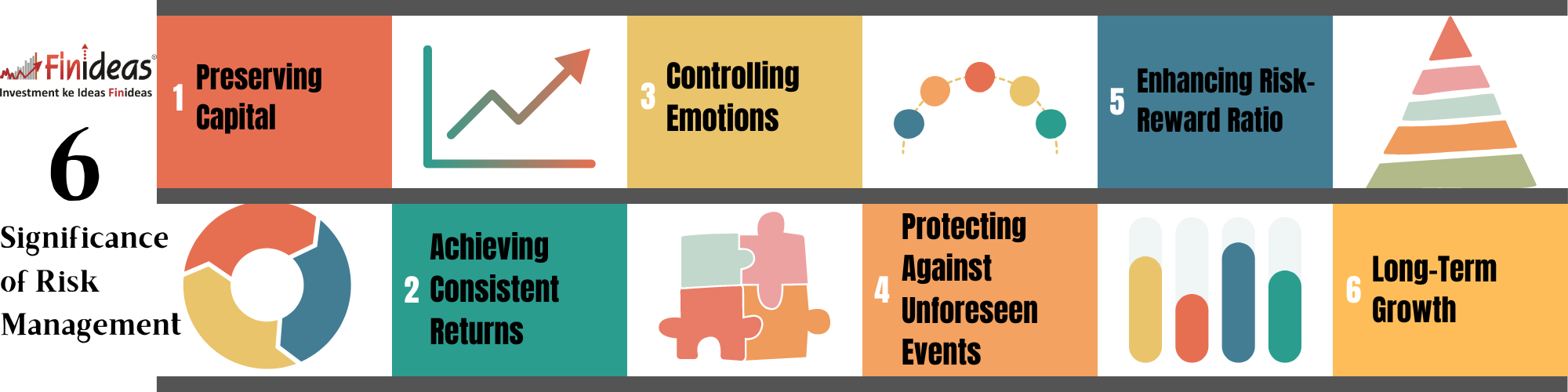

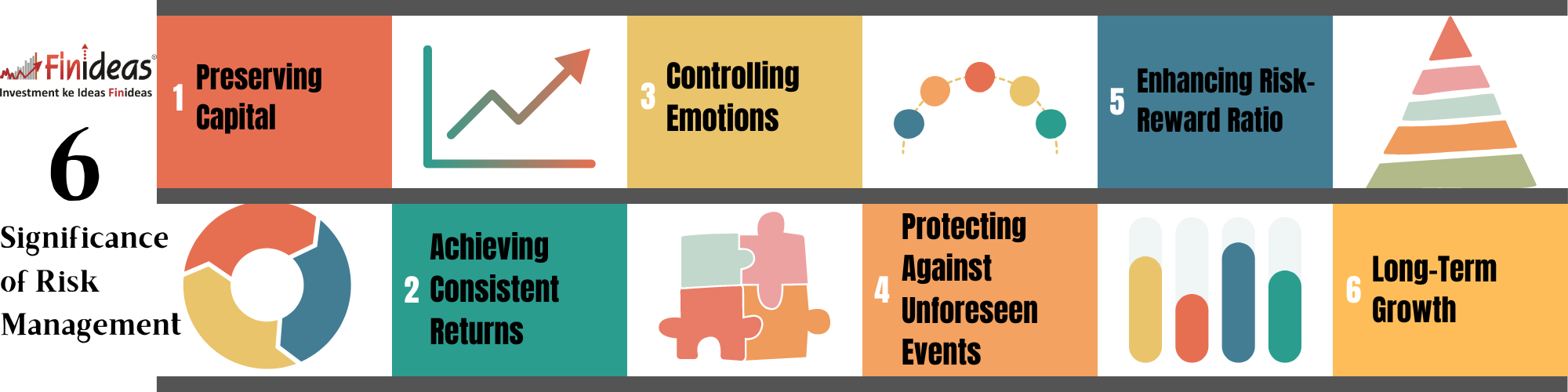

The Significance of Risk Management in Investments:

- Preserving Capital: One of the primary objectives of risk management is to preserve capital. By diversifying your investments across different asset classes, sectors, and geographical regions, you can mitigate the impact of a single market downturn and reduce the overall risk in your portfolio.

- Achieving Consistent Returns: Consistency is key in the world of investing. Implementing risk management strategies helps smooth out the ups and downs in your portfolio, leading to more predictable returns over time.

- Controlling Emotions: Investment decisions driven by fear or greed can lead to costly mistakes. A well-thought-out risk management plan helps control emotions, ensuring that you stick to your investment strategy even during turbulent market conditions.

- Protecting Against Unforeseen Events: The financial markets are susceptible to unexpected events like economic crises, geopolitical tensions, or pandemics. Risk management helps you build resilience to such events by limiting exposure to vulnerable assets.

- Enhancing Risk-Reward Ratio: By analysing potential risks and rewards, investors can make informed decisions that offer an attractive risk-reward ratio. A balanced approach allows for capital growth while avoiding undue exposure to unnecessary risks.

- Long-Term Growth: Successful investors understand that investing is a marathon, not a sprint. Risk management fosters a disciplined approach to long-term growth, reducing the likelihood of impulsive decisions that could harm your portfolio. Know More about our products Index Long Term Strategy And Alternative Investment Fund you can visit our website or contact us.

Statistical Data:

To further emphasize the importance of risk management, here are some statistics:

- According to a study conducted by Dalbar Inc., the average investor consistently underperforms the overall market due to emotional decision-making, costing them potential returns.

- A research paper published by Morningstar found that funds with lower volatility and downside risk performed better than high-risk funds over the long term.

- In a survey by the CFA Institute, risk management was identified as one of the critical skills required for successful investment professionals.

Conclusion:

Investing in the financial markets inherently involves risks, but those risks can be managed and minimized through thoughtful risk management strategies. By prioritizing capital preservation, consistency, and long-term growth, investors can navigate the ever-changing landscape of finance with confidence. Implementing risk management techniques is not just a choice; it is a necessity for any serious investor aiming for sustainable success.

How do you currently manage risk in your investment portfolio? Are you satisfied with the results? Remember to comment below with your thoughts, experiences, and any questions you have about risk management in investments. Let’s continue the conversation and help each other become better investors!

Happy Investing