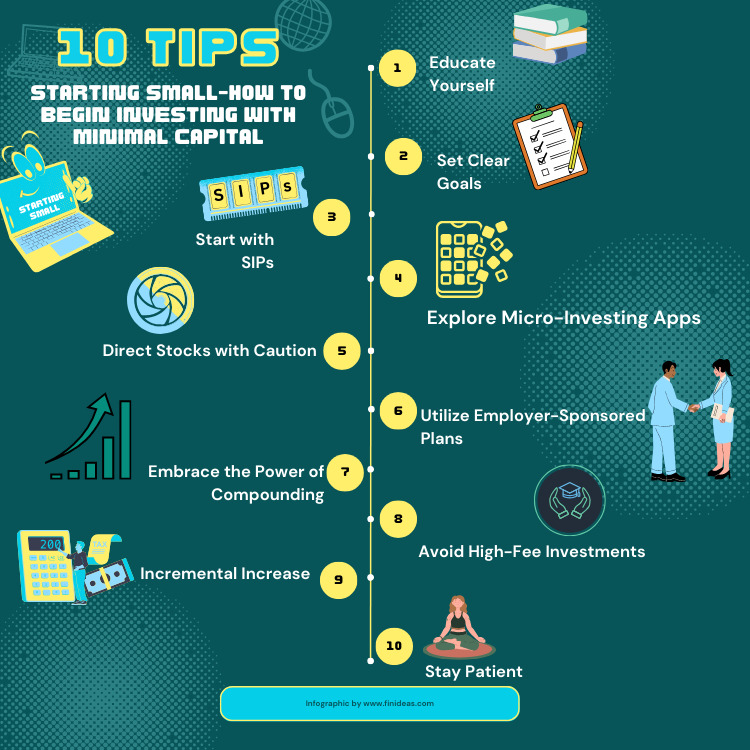

Starting Small: How to Begin Investing with Minimal Capital

In the world of finance and wealth-building, the notion that you need a substantial amount of money to start investing is gradually fading away. Thanks to technological advancements, changing attitudes towards personal finance, and a plethora of accessible investment options, anyone can dip their toes into the world of investing with minimal capital. For the Indian audience, this is particularly relevant, as more and more individuals seek avenues to grow their money wisely. Let’s delve into some practical strategies for beginning your investment journey, even if you’re starting small.

- Educate Yourself: Before you embark on any investment journey, take the time to educate yourself about the various investment options available in India. From stocks and mutual funds to bonds and real estate, each avenue comes with its own set of risks and rewards. Websites, online courses, and financial blogs can provide valuable insights to help you make informed decisions.

- Set Clear Goals: Define your investment goals early on. Are you saving for a short-term goal like a vacation or a long-term goal like retirement? Your goals will influence the type of investments you choose and the level of risk you’re willing to take.

- Start with SIPs: Systematic Investment Plans (SIPs) offered by mutual funds are a popular choice for individuals with limited capital. SIPs allow you to invest small amounts of money at regular intervals, reducing the impact of market volatility. Over time, these small investments can grow into a significant sum. Also we are using SIPs in our product Index Long Term Strategy.

- Explore Micro-Investing Apps: Several micro-investing apps have emerged in India, catering to those who want to start investing with as little as ₹100. These apps often offer curated portfolios, making it easier for beginners to navigate the complex world of investments.

- Direct Stocks with Caution: While investing directly in stocks can yield substantial returns, it also carries higher risks, especially for newcomers. If you decide to invest in individual stocks, diversify your portfolio and conduct thorough research before making any decisions.

- Utilize Employer-Sponsored Plans: If your employer offers a Provident Fund (PF) or Employee Provident Fund (EPF), take advantage of it. These are essentially forced savings that can grow over time, bolstering your financial stability.

- Embrace the Power of Compounding: Even small investments can benefit from the magic of compounding. Compounding allows your initial investment to earn interest, and then, the interest earns more interest. Over time, this can lead to substantial growth, making it an ideal strategy for those starting with minimal capital.

- Avoid High-Fee Investments: As a beginner, it’s essential to keep an eye on fees. High management fees can eat into your returns, especially if you’re investing a small amount. Opt for investment options with reasonable fees, such as low-cost index funds.

- Incremental Increase: As your financial situation improves, consider increasing your investment amounts gradually. This incremental approach allows you to adapt to market dynamics while maintaining a disciplined investment routine.

- Stay Patient: Investing is a long-term game. It’s crucial to remain patient and not be discouraged by short-term market fluctuations. Markets will have their ups and downs, but a well-thought-out investment strategy can weather the storms and lead to fruitful outcomes.

In conclusion, starting small doesn’t mean you’re limited in your investment potential. The key is to begin with a well-informed strategy, take advantage of accessible investment options, and remain patient as your investments grow over time. By embarking on this journey with a clear plan, even individuals with minimal capital can pave the way toward financial prosperity.

Do you agree with the the above Tips for Minimal Investing? If not Please let us know your thoughts

Happy Investing!